The online trading world is full of opportunities—and landmines. DPS Markets Limited claims to be a “licensed platform for professional trading” on Forex and commodity markets. But behind promises of “steady profits” and “personal manager support” lies a scheme designed to leave investors penniless. Let’s unpack why trusting this company is like betting against the house.

SHADY ADDRESS: Where Is DPS Markets Limited Hiding?

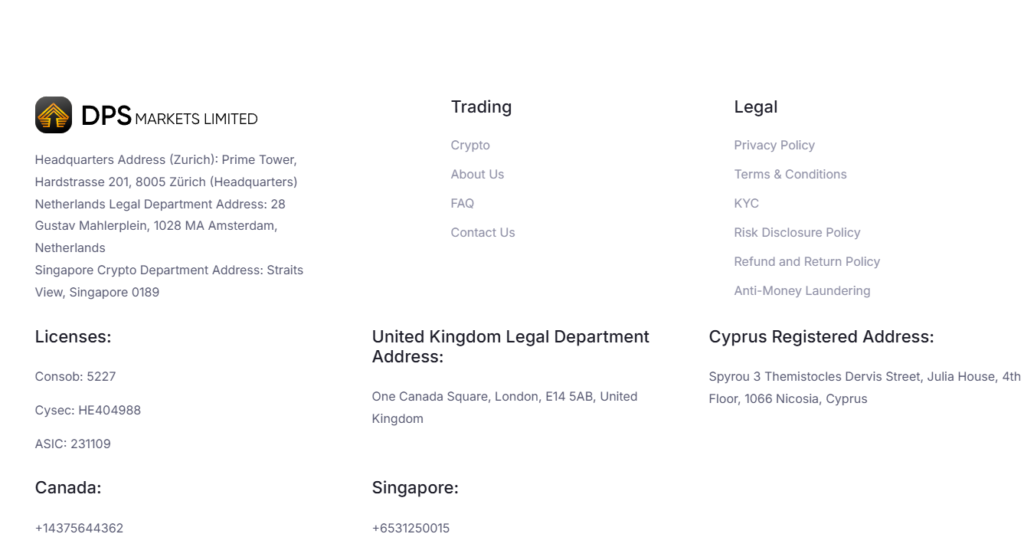

The first red flag? Its legal home base. DPS Markets Limited is registered in St. Vincent and the Grenadines—a notorious offshore zone where regulators don’t require brokers to hold licenses or investigate client complaints. Translation: if they freeze your account or manipulate prices, you’re on your own.

Dig deeper, and things get murkier. The website names founders like “James R.” and “Emily K.,” but their LinkedIn profiles are nonexistent. The “About Us” page is just a word salad of phrases like “global vision” and “client-centric values.” Real offices? Forget it.

PROMISES VS. REALITY: Smoke and Mirrors

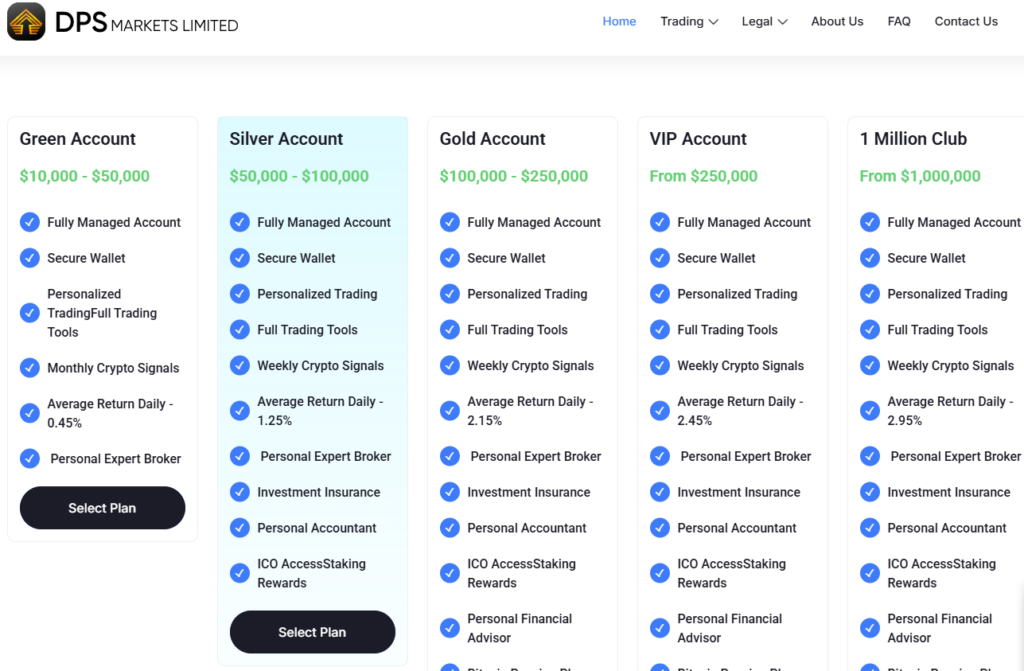

DPS Markets Limited advertises “up to 45% quarterly returns” and “low-risk strategies.” But here’s the truth:

– No verified track record. Their dashboard shows “live results” graphs that can’t be audited or exported.

– Price manipulation. Users report sudden “spikes” in asset prices the second they try to close a profitable trade.

– Emotional blackmail. Managers pressure clients to deposit more to “lock in gains,” then blame losses on “lack of trust in the strategy.”

Experts warn: even top brokers like Interactive Brokers avoid profit guarantees. “Risk-free” schemes? Always a scam.

REVIEWS: Glossy Lies vs. Raw Truth

DPS Markets Limited’s website features cookie-cutter testimonials about “withdrawing thousands.” But on Trustpilot and Forex Peace Army, the story flips:

– Account lockdowns. Clients lose access after requesting withdrawals, accused of “rule violations.”

– Hidden fees. Contracts bury monthly charges for “analytics” ($30) and “VIP manager access” ($50).

– Fake trade proofs. Managers send screenshots of “winning trades” with doctored dates and amounts.

THE PLAYBOOK: How They Steal Your Cash

DPS Markets Limited follows the classic “bucket shop” script:

1. Aggressive targeting. Facebook and Google ads push fake “trader success stories” claiming passive income.

2. Trust-building hustle. Managers spend weeks sweet-talking you into depositing $500+, dangling “free training webinars.”

3. Platform tricks. Their in-house software creates artificial slippage and delays order execution.

4. Withdrawal purgatory. Requests trigger endless “verification” loops demanding personal docs—delayed for months.

5 REASONS TO AVOID DPS MARKETS LIMITED

1. Zero regulation. No licenses from FCA, CySEC, ASIC, or credible authorities.

2. Offshore ghost. A P.O. box in St. Vincent isn’t a real address—it’s a scammer’s hideout.

3. Fantasy math. “45% in 3 months” ignores basic risk management principles.

4. Fake credibility. Phony certifications and stock-photo “teams.”

5. Rigged tech. Spreads widen mysteriously, and platforms “crash” during volatile news events.

HOW TO PROTECT YOUR MONEY

If you’ve already invested with DPS Markets Limited:

– Stop depositing. Now.

– Demand records. Under GDPR, they must provide full trade history and fee breakdowns.

– Report them. File complaints with FINRA or your local financial ombudsman—even offshore firms hate paper trails.

When vetting brokers:

– Check licenses. Use FCA Register or CySEC’s database to confirm legitimacy.

– Skip offshore traps. Avoid brokers based in St. Vincent, Vanuatu, or similar tax havens.

– Test drive first. Run a demo account for 2+ months, comparing prices to independent feeds like TradingView.

– Demand transparency. Legit brokers offer direct market access (DMA)—not manipulated quotes.

BOTTOM LINE: DPS Markets Limited Is a Bucket Shop

This company doesn’t trade—it gambles against you. Fake licenses, rigged platforms, and offshore loopholes scream scam. Remember: real brokers don’t hide their teams or trade histories. Don’t let slick charts and empty promises replace due diligence. Your greatest asset isn’t your deposit—it’s your skepticism.