Accretion Incorporated presents itself as a modern asset management firm, promising high returns through diversified investment opportunities. However, a closer examination reveals several concerns that potential investors should consider.

Accretion Incorporated: Questionable Return on Investment Claims

Accretion Incorporated advertises a 20% weekly ROI through its copy trading platform and a 10% weekly ROI from commodity investments. Such high returns are atypical in the investment world and warrant skepticism. Historically, consistent weekly returns at this magnitude are unsustainable and often indicative of high-risk or fraudulent schemes.

Lack of Regulatory Oversight

Despite offering services in forex, cryptocurrency, stocks, and commodities, Accretion Incorporated does not provide clear information about regulatory compliance. There is no mention of oversight by financial authorities such as the SEC, FCA, or other reputable regulatory bodies. This absence raises concerns about the legitimacy and safety of investing with the firm.

Ambiguous Company Information

The company’s website lists an address at 24 Waverly Pl, New York, NY 10003, USA. However, there is no verifiable information confirming the presence of Accretion Incorporated at this location. Additionally, the website lacks details about the company’s leadership, history, and physical operations, making it difficult to assess its credibility.

Overemphasis on High Returns Without Transparency

Accretion Incorporated’s marketing heavily focuses on high ROI figures but provides limited information about the strategies and risks involved. The platform claims to offer “secure & transparent” services with “audited strategies,” yet there is no accessible evidence or third-party verification to support these assertions.

Potential Red Flags in Trading Accounts

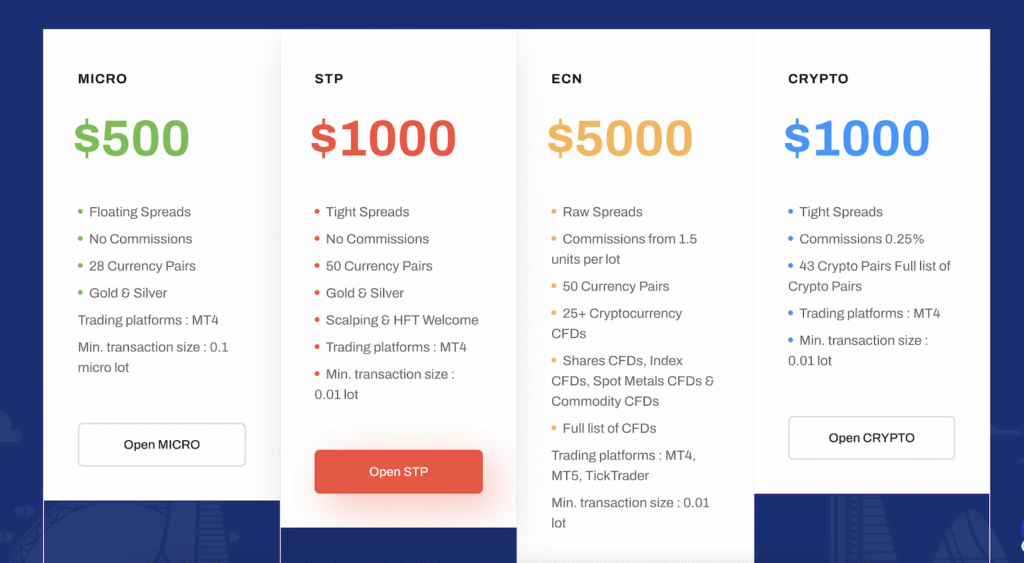

The company offers various trading accounts, including MICRO, STP, ECN, and CRYPTO, with minimum deposits ranging from $500 to $5,000. While these account types are common in the trading industry, the promised returns and lack of detailed information about trading conditions and risk management strategies are concerning.

Absence of Independent Reviews and Testimonials

A search for independent reviews or testimonials about Accretion Incorporated yields minimal results. The lack of customer feedback or third-party evaluations makes it challenging to gauge the experiences of actual investors and the company’s performance history.

Conclusion on Accretion Incorporated

While Accretion Incorporated presents an appealing investment opportunity with promises of high returns and diversified portfolios, several aspects raise red flags. The lack of regulatory oversight, ambiguous company information, and absence of transparent investment strategies suggest that potential investors should exercise caution. It’s crucial to conduct thorough due diligence and consult with financial professionals before engaging with such platforms.

Stay Safe with Scam Insights from Invests.Finance