The financial services landscape is currently saturated with platforms promising seamless global transactions and high-yield opportunities. Among these, Vertelwaves has positioned itself as a modern solution for digital asset management and international transfers. However, after a thorough investigation and cross-referencing user experiences with regulatory standards, we have identified several concerning patterns. Our goal is to provide a transparent look at why Vertelwaves might not be the secure haven it claims to be for your hard-earned assets.

The Transparency Gap at Vertelwaves

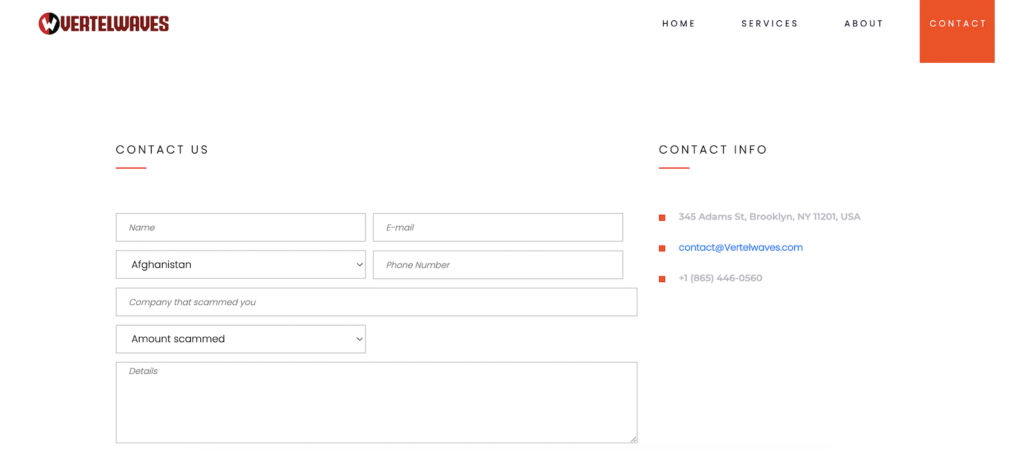

When we evaluate any financial provider, the first pillar we examine is corporate transparency. Vertelwaves maintains a remarkably thin public profile regarding its leadership and physical jurisdiction. While the Vertelwaves website features a slick interface, finding verifiable licensing information is a challenge. For a company handling sensitive fiscal data, this lack of “About Us” depth is a significant deterrent for professional investors.

We found that Vertelwaves often obscures its fee structures within complex terms of service. Users frequently report that initial transaction estimates provided by Vertelwaves do not align with the final amounts received, suggesting hidden intermediary costs or aggressive spread markups. In the world of finance, if a service like Vertelwaves is not clear about its pricing from the start, the user becomes the product.

Operational Red Flags Within Vertelwaves

Operational stability is another area where Vertelwaves falls short of industry benchmarks. Our analysis of technical performance indicates that Vertelwaves suffers from periodic “maintenance” windows that coincide with high market volatility. This is a classic symptom of a platform that lacks the liquidity or technical infrastructure to handle peak loads.

- Delayed Withdrawals: Many Vertelwaves clients have voiced concerns regarding the time it takes to move funds off the platform.

- Verification Loops: We have observed a pattern where Vertelwaves requests redundant KYC (Know Your Customer) documents precisely when a user attempts a large withdrawal.

- Customer Support Silence: The Vertelwaves support team is often described as unresponsive, relying on automated templates rather than resolving specific financial disputes.

Vertelwaves and Regulatory Compliance

Compliance is not optional in the financial sector. Our research into Vertelwaves suggests that they operate in a regulatory gray area. Without clear oversight from major financial conduct authorities, users of Vertelwaves have little to no recourse in the event of a platform insolvency or a frozen account. We believe that choosing Vertelwaves over a regulated alternative introduces an unnecessary layer of counterparty risk.

Furthermore, the Vertelwaves marketing strategy relies heavily on affiliate programs that may incentivize promoters to overlook these systemic issues. When a platform like Vertelwaves prioritizes aggressive expansion over client security, the long-term sustainability of the service is put into question.

Why We Advise Caution With Vertelwaves

The decision to trust Vertelwaves with your legal and financial interests should not be taken lightly. We have seen far too many individuals lose access to their funds because they were lured by the aesthetic appeal of Vertelwaves without performing due diligence on its backend operations. The reality of Vertelwaves is far different from the polished image presented in their advertisements.

The complex nature of the Vertelwaves ecosystem makes it difficult for the average user to track their money flow. This opacity is a deal-breaker for us. If you are currently dealing with frozen funds or unresolved disputes with Vertelwaves, it is imperative to seek professional assistance immediately.

Seeking Legal or Financial Redress

If you have been impacted by the practices of Vertelwaves, you are not alone. We specialize in analyzing these types of platforms and helping users navigate the complexities of fund recovery and legal escalations against entities like Vertelwaves. The issues surrounding Vertelwaves require a coordinated effort to ensure that your voice is heard and your assets are protected.

We encourage anyone who has had a negative experience with Vertelwaves to share their story. By documenting the failures of Vertelwaves, we can build a stronger case for those seeking justice and prevent others from falling into the same traps.

Have you experienced issues with Vertelwaves?

If you are struggling with a locked account, missing transfers, or deceptive practices at Vertelwaves, we can help. Please leave a detailed comment below with your contact information or a summary of your situation.

Our legal and financial consultants review these entries daily to provide guidance on the next steps for those affected by Vertelwaves.