We write as seasoned analysts and copywriters who care deeply about protecting scam victims. In this review, we examine Verida-afi (verida-afi.com) with a critical, fact-based eye. While their promise – to help fraud victims recover lost money – is attractive, our investigation finds serious concerns that any potential client should not ignore.

- Verida-afi – Questionable Trust and Transparency

- Risk Scores and Reputation Analysis

- Mixed Customer Feedback

- Licensing Claims vs. Reality

- Vague Cost Structure and Hidden Fees

- Dubious Claims About Experience and Partnerships

- Operating Model and Turnaround Time

- Verida-afi – Risk Around Personal Data

- Verida-afi: A Risky Bet for Vulnerable Victims

Verida-afi – Questionable Trust and Transparency

One of the first major warning signs about Verida-afi is its trustworthiness. According to ScamAdviser, the site’s trust score is very low. The owner’s identity is hidden via privacy protection, which makes it impossible to verify who is actually behind the service. A service offering legal or financial recovery should not operate under such anonymity.

Further, the domain was created on March 24, 2025, making the company extremely new. That contradicts their repeated claim of “20 years of experience.” This discrepancy suggests a constructed narrative rather than a genuine track record.

Risk Scores and Reputation Analysis

Independent security and trust-analysis platforms place Verida-afi in a high-risk zone:

- Scam Detector gives them a 38.3/100 trust score, flagging potential phishing, malware, and spam concerns.

- Gridinsoft ranks the site’s reputation as suspicious, at just 37/100, and warns users against submitting sensitive information.

- ScamDoc also signals a “Poor” trust score, noting the domain’s short lifespan and hidden registration data.

These unnervingly low marks across multiple platforms are not trivial: they point to structural and operational issues that any victim of fraud should weigh carefully.

Mixed Customer Feedback

On Trustpilot, reviews for Verida-afi are deeply polarized:

- Their UK TrustScore is 3.2/5 based on nine reviews.

- Around 45% of reviewers rate them 1-star, criticizing the business as a “scam” that demands money despite its “no win, no fee” promise.

- Other reviewers claim effective communication and recovery: for example, one user says their “account was frozen … and my money withheld till … I got in touch … they helped me get back everything.”

Such contradictory feedback raises huge red flags. Those who claim success are outnumbered by angry reports alleging deception. This makes it risky to rely on Verida-afi based on public opinion alone.

Licensing Claims vs. Reality

On its website, Verida-afi asserts it is “FCA Regulated.” However, a check of the UK Financial Conduct Authority’s register yields no matching company, according to financial-recovery researchers. If true, this is a major red flag: posing as a regulated claims management company without being regulated is misleading at best – and illegal at worst.

Vague Cost Structure and Hidden Fees

Verida-afi advertises a “no win, no fee” model, with fees ranging from 5% to 15% + VAT. But the website does not clearly explain how these percentages are calculated: whether they depend on the total recovered amount, the complexity of the case, or the type of fraud involved. That lack of transparency raises the risk that after committing to them, clients may face unexpected costs they did not clearly understand.

Moreover, some reviewers allege they were asked for additional money contradicting the “no win, no fee” policy. Without publicly available sample contracts or clear terms, it’s very difficult for a prospective customer to assess whether the fee structure is fair.

Dubious Claims About Experience and Partnerships

Verida-afi claims to have “10,000+ customers” and to have recovered “£70 million” in assets. Yet, these numbers are not substantiated with any report, audit, or independent verification. There is no publicly available breakdown of cases, no case studies, and no legal filings to confirm these claimed outcomes.

They also list well-known companies like Binance, Coinbase, and Revolut among their partners. But our investigation reveals no confirmation from these partners of any formal collaboration. In fact, no press release or public statement from these companies supports the partnership claim.

Operating Model and Turnaround Time

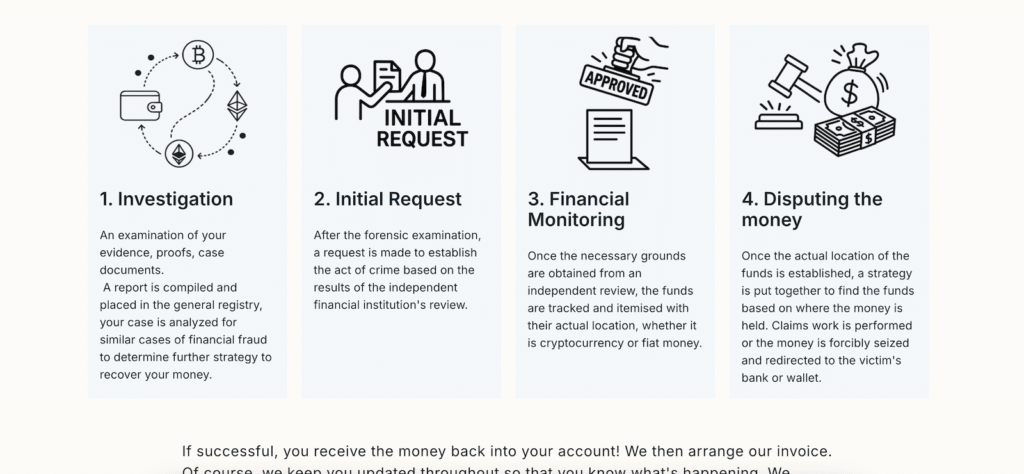

On their “How It Works” pages, Verida-afi promises a very aggressive timeline: case resolution in 1–2 weeks, and transaction tracking in as little as 3 days, according to their site. Real-world fund recovery especially when involving banks, crypto assets, and cross-border fraud rarely adheres to such tight timeframes. This kind of promise can mislead victims into believing in an unrealistic turnaround, increasing emotional pressure to sign on.

Verida-afi – Risk Around Personal Data

Recovering funds typically requires clients to share sensitive documents: transaction records, identity documents, communication logs. Entrusting such information to a company whose transparency is questionable, whose licensing is unverified, and whose trust ratings are low is inherently risky.

If Verida-afi fails to deliver or worse, misuses submitted data clients may not just lose money again, but expose themselves to identity theft or other forms of harm.

Verida-afi: A Risky Bet for Vulnerable Victims

While Verida-afi markets itself as a well-meaning fraud-recovery expert, the evidence suggests a number of serious concerns:

- Hidden ownership with no open verification.

- New domain (2025) despite claims of decades of experience.

- Very low trust scores on multiple independent platforms.

- Licensing claims that do not match public regulators’ databases.

- Unclear and potentially misleading fee structure.

- Bold recovery claims unsupported by independent proof.

- Unrealistic timelines for resolving complex financial cases.

Given all of this, we believe Verida-afi is a high-risk option, particularly for vulnerable victims desperate to retrieve lost funds. Rather than rush into a “no win, no fee” agreement, potential clients would be wise to explore alternative, more transparent recovery services ideally ones with verified regulation and a proven track record.