The rise of online trading platforms has opened up opportunities for millions of investors around the world. Unfortunately, it has also created space for questionable brokers who overpromise and underdeliver. Vaults investment is one of the latest entrants in the digital finance space, claiming to offer everything from forex and crypto trading to wealth management services. But does it really live up to the hype? This detailed review of vaults investment examines the company’s operations, platform features, regulatory claims, and real user experiences to help you decide whether this is a broker worth trusting—or one to avoid altogether.

- Regulatory Ambiguity: Where Is Vaults Investment Licensed?

- Unclear Trading Conditions and Hidden Fees

- Dubious Promises and Unrealistic Returns

- Vaults Investment: Withdrawal Issues and Account Freezes

- Limited Educational Content and No Real Support

- Questionable Website Design and Copywriting

- Vaults Investment: No Clear Track Record or Executive Transparency

- Vaults Investment vs. Trusted Alternatives

- Final Verdict: Is Vaults Investment Legit?

Regulatory Ambiguity: Where Is Vaults Investment Licensed?

The first red flag when evaluating vaults investment is the lack of transparent regulatory oversight. Nowhere on their website do they clearly state which financial authority governs their operations. This is a serious issue, especially when handling client funds in volatile markets like forex and crypto.

A reputable broker must be registered with recognized regulatory bodies such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). Vaults investment offers no proof of regulation. Instead, it simply asserts legitimacy through generic terms like “trusted platform” and “secure transactions” without any licensing numbers or supporting documentation.

This leaves clients completely exposed in the event of disputes, fund freezes, or unauthorized activity. Without regulation, there is no guarantee your deposits are safe—or that vaults investment is operating legally in your jurisdiction.

Unclear Trading Conditions and Hidden Fees

A credible broker lays out all trading conditions in detail—spreads, commissions, margin requirements, overnight fees, and more. Vaults investment provides little clarity in this regard. The platform advertises competitive fees but fails to publish clear data on trading costs, which makes it nearly impossible to assess the true price of using the service.

Additionally, user reports suggest that vaults investment enforces hidden fees and withdrawal penalties not clearly disclosed at sign-up. These practices betray a lack of transparency and may mislead inexperienced traders who assume the platform is cheaper than it really is.

The absence of a clearly outlined fee structure on vaults investment’s site is both unprofessional and potentially deceptive.

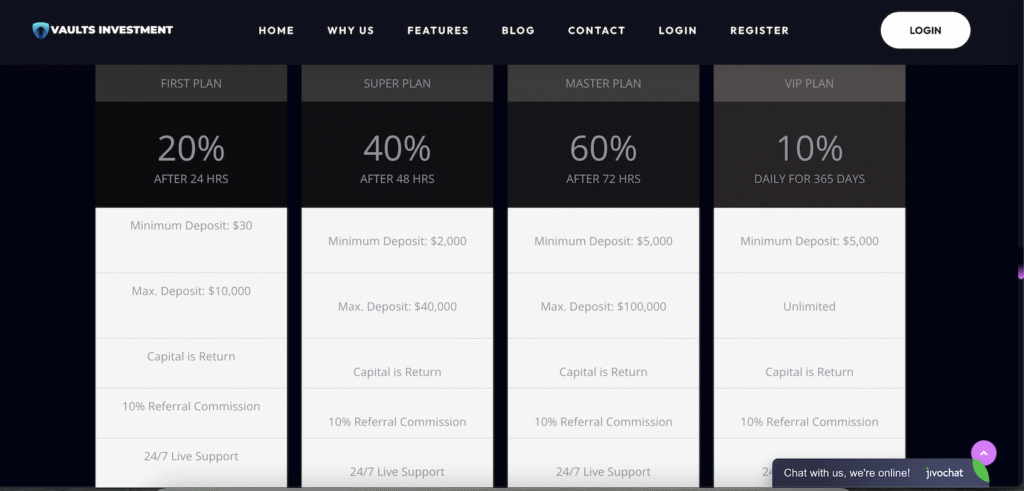

Dubious Promises and Unrealistic Returns

Vaults investment markets itself as a wealth management platform capable of delivering consistent returns. On their homepage, they highlight client testimonials and profit claims that raise serious doubts. Promises of guaranteed profits or high-yield returns are a classic warning sign in the world of online trading scams.

No legitimate broker can guarantee profits—especially in highly speculative markets like cryptocurrencies and foreign exchange. Yet vaults investment continues to make exaggerated statements that do not reflect the inherent risks of financial trading. For example, the use of phrases like “invest safely with us” and “grow your wealth risk-free” are dangerously misleading.

These marketing strategies are designed to lure beginners into depositing funds without fully understanding the market risks.

Vaults Investment: Withdrawal Issues and Account Freezes

Multiple user reviews and forum discussions point to serious issues regarding fund withdrawals on vaults investment. Clients have reported delayed responses to withdrawal requests, excessive documentation requirements, and in some cases, complete account freezes with no explanation.

This pattern is disturbingly common among unregulated brokers who rely on holding client funds as long as possible. Vaults investment appears to make depositing easy, but withdrawing funds is where many users encounter friction—an issue that undermines the broker’s credibility.

The Terms and Conditions also include vague clauses that allow vaults investment to withhold funds under various pretexts, which gives them unchecked control over your money.

Limited Educational Content and No Real Support

In contrast to reputable platforms that provide educational content to help clients improve their trading skills, vaults investment offers almost nothing. There are no webinars, no detailed trading guides, and no technical analysis tools.

Furthermore, their customer support is below industry standard. Clients who attempt to reach out for help are often met with automated responses, unqualified staff, or worse—no reply at all. The lack of real-time support is a major issue for traders who rely on swift action during market movements.

Vaults investment appears far more interested in acquiring deposits than providing long-term trading assistance or guidance.

Questionable Website Design and Copywriting

Though vaults investment’s website appears modern at first glance, a deeper inspection reveals inconsistencies. Several pages are poorly written, and some sections are duplicated or include generic placeholder content.

For example, the “About Us” page includes vague statements with no factual basis or verifiable company history. This kind of careless copywriting, combined with stock imagery and generic icons, signals that vaults investment may be more focused on optics than delivering genuine value.

Legitimate brokers invest in building credible, content-rich platforms—not just flashy templates.

Vaults Investment: No Clear Track Record or Executive Transparency

Another major concern is the complete anonymity of the people behind vaults investment. Unlike regulated brokers who disclose their board of directors, executive team, and business history, vaults investment offers zero background information.

There is no mention of company founders, no press releases, no business registrations—nothing that would allow a potential investor to confirm the organization’s credibility. This lack of accountability is unacceptable in an industry that deals directly with personal financial assets.

Vaults Investment vs. Trusted Alternatives

It’s important to compare vaults investment with more established and regulated brokers. Platforms like IG Group, eToro, and Interactive Brokers all offer full regulatory disclosure, transparent fee structures, educational tools, and real customer service.

Vaults investment lacks nearly all of these. Whether you’re a beginner or a professional trader, better and safer options exist that don’t involve the risks tied to an unregulated and opaque broker.

Final Verdict: Is Vaults Investment Legit?

After a full review of vaults investment, it’s difficult to recommend this platform to anyone serious about protecting their capital. From regulatory ambiguity and poor customer service to hidden fees and unverifiable claims, the risks are simply too high.

Until vaults investment can provide real proof of licensing, a transparent fee model, and improvements in client support, traders should proceed with extreme caution—or better yet, avoid the platform entirely.

Stay Safe with Scam Insights from Invests.Finance