Tyrion Capital presents itself as a cutting-edge broker offering access to global financial markets through platforms like MetaTrader 5. With promises of AI-powered automation, high leverage options, and multiple account tiers, it aims to attract traders seeking lucrative opportunities. However, a thorough examination uncovers several issues that potential investors should consider before engaging with this platform.

Tyrion Capital: Lack of Regulatory Oversight

One of the most pressing concerns about Tyrion Capital is its apparent lack of regulation by any recognized financial authority. Regulatory oversight is crucial for ensuring that brokers adhere to industry standards, protect client funds, and operate transparently. Without such oversight, investors are exposed to higher risks, including potential fraud and mismanagement.

Opaque Ownership and Operations

Transparency is a cornerstone of trust in the financial industry. Tyrion Capital’s website provides scant information about its ownership, management team, or physical headquarters. This opacity makes it challenging for investors to verify the legitimacy of the company and assess its credibility. The use of generic contact forms and lack of direct communication channels further exacerbate these concerns.

Questionable Marketing Practices

Tyrion Capital’s marketing materials emphasize high profitability and advanced trading technologies. However, these claims often lack substantiation. For instance, the website mentions “AI-powered automation” and “maximum trading opportunities” without providing detailed explanations or evidence of these features. Such vague assertions can be misleading and may not reflect the actual services provided.

High Leverage and Risk Exposure

The platform offers leverage options up to 1:1000, which, while potentially increasing profits, also significantly amplifies potential losses. High leverage is a double-edged sword and is often discouraged by financial regulators due to the increased risk it poses to retail investors. The absence of regulatory guidance on such offerings from Tyrion Capital raises further red flags.

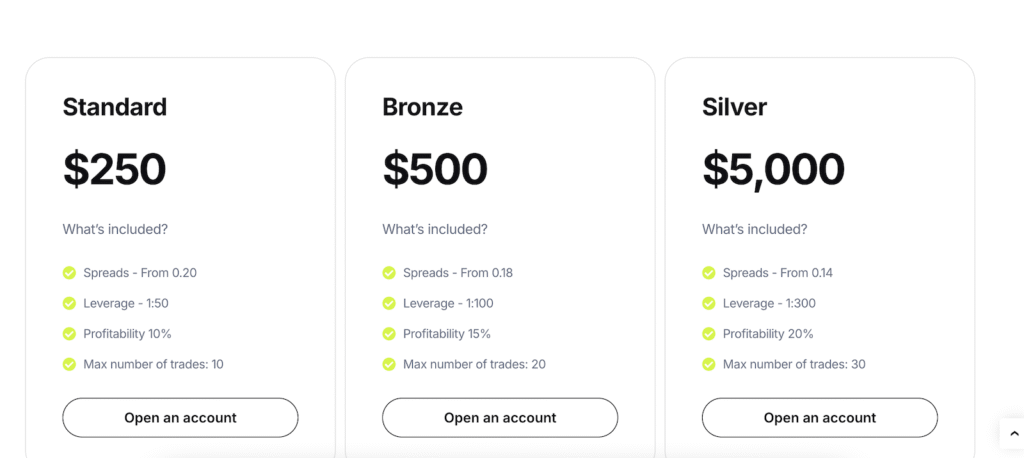

Dubious Account Tiers and Promises

Tyrion Capital’s account tiers range from “Standard” to “Diamond,” with minimum deposits starting at $250 and reaching up to $500,000. Each tier promises higher profitability percentages, with the “Diamond” account claiming up to 35% profitability. Such guaranteed returns are unrealistic and often indicative of potential scams, as legitimate investment platforms cannot assure fixed profits due to market volatility.

Tyrion Capital: Negative Online Reviews and Low Trust Scores

External reviews and trust assessments further cast doubt on Tyrion Capital’s legitimacy. Scam Detector assigns a low trust score of 4.6/100 to a related domain, tyrion.trade, citing concerns about phishing, spamming, and other high-risk activities. Similarly, Scamadviser reports a very low trust score for tyrion.io, highlighting issues like hidden ownership details and associations with high-risk cryptocurrency services.

Misleading Use of Names and Themes

The choice of the name “Tyrion Capital” may not be coincidental. There have been instances where fraudulent entities have adopted names reminiscent of popular culture to appear trustworthy. For example, a case was reported where an individual used names from the “Game of Thrones” series to create fake companies and defraud the government. While not directly linked, the use of such naming strategies can be a tactic to exploit familiarity and gain unwarranted trust.

Conclusion on Tyrion Capital

While Tyrion Capital markets itself as a reliable and innovative trading platform, several factors raise significant concerns:

- Lack of regulatory oversight

- Opaque ownership and operational details

- Unsubstantiated marketing claims

- High-risk leverage offerings

- Unrealistic promises of profitability

- Negative external reviews and low trust scores.

Investors are strongly advised to exercise caution and conduct thorough due diligence before engaging with Tyrion Capital. Opting for brokers with transparent operations, regulatory compliance, and positive reputations is essential to safeguard investments and ensure a secure trading experience.

Stay Safe with Scam Insights from Invests.Finance