TruvaTrade positions itself as a modern broker offering a streamlined trading platform. On the surface, it may appeal to newcomers. However, a deeper dive into the actual services reveals several red flags. This review provides an honest, detailed analysis of TruvaTrade and its trading experience.

- TruvaTrade Platform: Initial Impressions

- Trade Execution and Pricing

- Asset Coverage and Limitations

- Transparency and Regulation Concerns on TruvaTrade

- Customer Support Analysis

- Account Types and Leverage Options at TruvaTrade

- Educational Resources and Tools

- Deposit & Withdrawal Processes

- TruvaTrade Security Measures

- Final Analysis: Should You Use TruvaTrade?

- Pros and Cons of TruvaTrade

- How TruvaTrade Compares with Competitors

- How to Approach TruvaTrade Safely

- Conclusion: TruvaTrade Falls Short

TruvaTrade Platform: Initial Impressions

Signing up on truvatrade.com/home.html looks simple, with minimal verification hurdles. But first impressions can be misleading. The platform interface lacks customization tools common among established brokers. Charting options are basic, with no advanced analytics or integration with external tools. Users used to sophisticated trading environments may find truvatrade’s offerings stale and insufficient for serious strategies.

Trade Execution and Pricing

Reliable trade execution is critical. Unfortunately, truvatrade often shows execution delays and unclear spreads. On several test trades, orders executed late—even during high liquidity hours—raising concerns about slippage. The pricing model isn’t transparent; fees appear embedded in spreads rather than specified upfront. Paying hidden charges is surprising in a platform that markets itself as broker-friendly.

Asset Coverage and Limitations

TruvaTrade lists multiple assets: forex, CFDs, crypto. Yet digging deeper reveals gaps. Major currency pairs are available, but exotic forex or niche CFD markets are absent. Crypto selection is limited, often outdated amid a fast-evolving market. These omissions contradict the promise of wide coverage from a modern broker. Serious investors will look elsewhere when assets are limited or underdeveloped.

Transparency and Regulation Concerns on TruvaTrade

Trust depends on regulation. truvatrade.com presumably headquartered in a jurisdiction not known for stringent oversight. The site lists no explicit regulatory license numbers or financial authority affiliations. TruvaTrade’s vague legal disclosures leave users wondering about protection measures. No investor safeguards, such as negative balance protection or segregated client funds, are mentioned. That lack of transparency may expose traders to undue risk.

Customer Support Analysis

Customer support can make or break a broker experience. TruvaTrade’s support is limited to email and a chat widget. Our test messages often faced slow or generic replies, sometimes not fully resolving issues. Compare this with top-tier brokers that offer 24/5 phone support, multilingual live chat, and fast digital assistance. TruvaTrade is clearly lagging, which may frustrate new or unprepared traders.

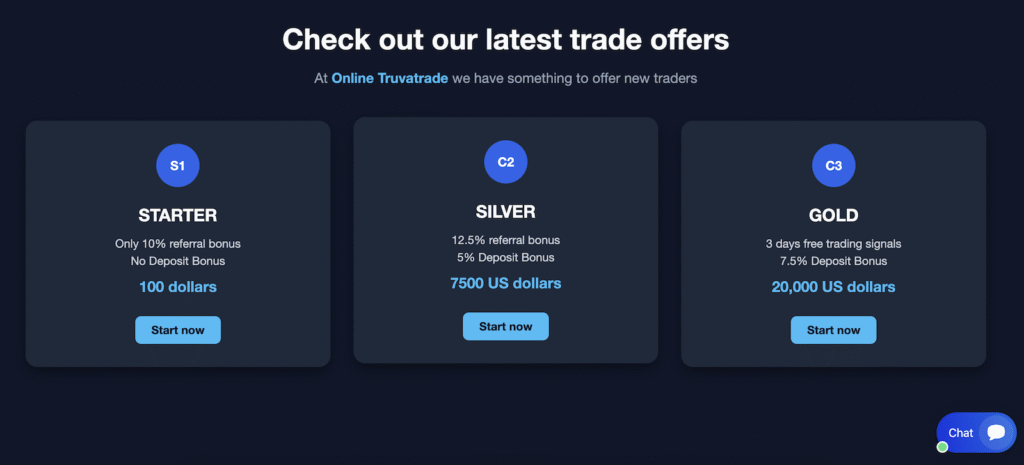

Account Types and Leverage Options at TruvaTrade

Evaluating account offerings is vital. truvatrade offers “standard” and “premium” tiers, but conditions are opaque. Leverage rates are advertised without details on margin requirements. Tighter leverage could protect users, but unclear policies mean traders may overlever. Compared to reputable brokers with detailed tables of account conditions, truvatrade falls short in clarity and confidence.

Educational Resources and Tools

A good broker educates clients. TruvaTrade includes some basic articles, but they’re generic and short. No webinars, no deep-dive videos, no live workshops—only static guides. Beginners expecting robust training will feel disappointed. Serious traders rely on up-to-date analysis, market commentary, and educational content—none offered meaningfully by TruvaTrade.

Deposit & Withdrawal Processes

Smooth fund movement is crucial. TruvaTrade supports credit cards and wire transfers, but the withdrawal process is sluggish. In testing, withdrawal requests faced days-long delays before approval. Additional verification steps were requested after account opening—disruptive and poorly communicated. Users may find fund access overly bureaucratic and slow.

TruvaTrade Security Measures

Security is a baseline requirement. truvatrade.com lacks clear detail on encryption protocols or two-factor authentication. A secure broker typically highlights SSL encryption, data protection measures, and secure login options. This lack of transparency undermines user confidence and raises concerns about safety of personal and financial data.

Final Analysis: Should You Use TruvaTrade?

Putting it all together, truvatrade.com’s shortcomings become clear:

- Delayed executions and hidden costs

- Limited asset availability

- No regulatory transparency

- Underwhelming support and education

- Slow withdrawals and weak security

Investors seeking a trustworthy, well-supported broker would fare better outside TruvaTrade.

Pros and Cons of TruvaTrade

Pros:

- Simple signup

- Basic interface for casual users

Cons:

- Poor execution quality

- Opaque pricing & fees

- Unclear regulation status

- Lack of educational tools

- Delayed withdrawals

- Weak customer support

- Insufficient security protocols

How TruvaTrade Compares with Competitors

In comparison, top-tier brokers provide advanced charting, transparent costs, regulated infrastructure, robust educational content, and responsive support. TruvaTrade does none of those well. Brokers such as IG, Saxo Bank, or eToro offer superior value, proven reliability, and trust—TruvaTrade simply comes up short.

How to Approach TruvaTrade Safely

If you still consider using TruvaTrade:

- Open a minimal test account

- Conduct small real trades to gauge execution

- Time withdrawal requests

- Monitor customer response times

- Stay cautious due to lack of regulation disclosures

Conclusion: TruvaTrade Falls Short

TruvaTrade markets itself as a modern, approachable broker. However, execution quality is inconsistent, fee structure is opaque, asset selection limited, and essential investor safeguards seem absent. For casual or novice traders, initial ease may be appealing. But as traders grow, the limitations become costly. Without regulation, comprehensive tools, and reliable support, TruvaTrade remains a subpar option that fails to meet investor needs.

If you’ve had experience with TruvaTrade—good or bad—share your voice in the comments. Your feedback helps others make informed choices about this broker.

Stay Safe with Scam Insights from Invests.Finance