TradeXProp has emerged as a notable player in the proprietary trading industry, offering traders the opportunity to manage substantial funds across various financial instruments. However, a closer examination reveals several areas of concern that potential clients should consider before engaging with this firm.

TradeXProp – Safety and Legitimacy Concerns

One of the primary issues with TradeXProp is the lack of verifiable legitimacy indicators. The firm has no reviews on the Forex Peace Army (FPA), a respected platform for assessing trading companies. Additionally, the number of reviews on Trustpilot is minimal, raising questions about the firm’s credibility and the experiences of its users. This absence of substantial user feedback makes it challenging to gauge the reliability and trustworthiness of TradeXProp.

Furthermore, TradeXProp was established in 2023, making it a relatively new entrant in the proprietary trading sector. This limited operational history means the firm lacks a proven track record, which is crucial for assessing its stability and reliability. The absence of long-term performance data and client testimonials adds to the uncertainty surrounding the firm’s operations.

Account Types and Funding Limitations

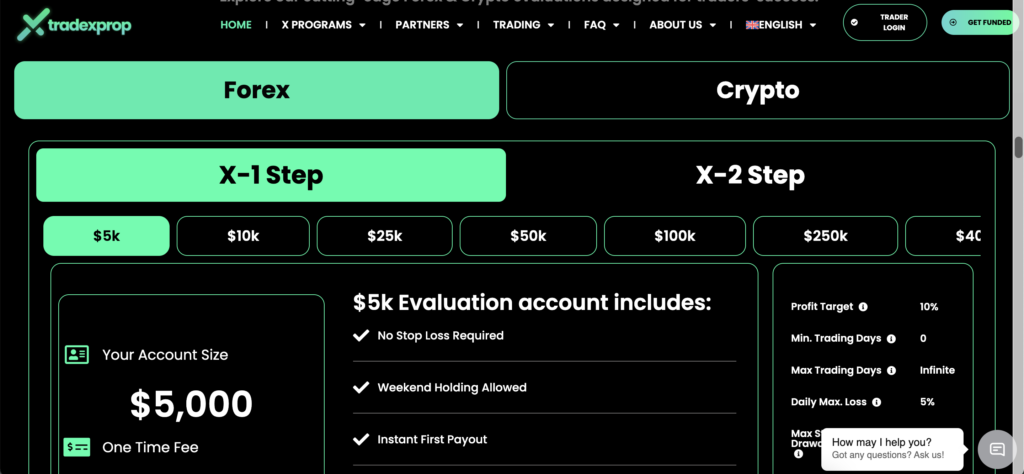

TradeXProp offers various funding programs, including Forex and crypto challenges, with account sizes ranging from $5,000 to $400,000. While these figures appear attractive, it’s important to note that all funded accounts are demo accounts. Traders do not gain access to live funded accounts with real capital, which may not align with the expectations of those seeking genuine trading opportunities. This setup raises concerns about the authenticity of the trading experience provided by TradeXProp.

Moreover, the firm does not offer a scaling plan. Scaling plans are essential for traders aiming to gradually increase their account sizes based on performance. The absence of such a feature limits the growth potential for both novice and experienced traders, making TradeXProp less appealing compared to competitors who provide scalable account options.

Strict Trading Rules and Limitations

TradeXProp imposes stringent rules, particularly for crypto challenges. For instance, the daily loss limit is set at a mere 3%, with a maximum drawdown of 6%. These tight restrictions can be challenging for traders to navigate, especially in the volatile cryptocurrency market. Such limitations may hinder traders’ ability to implement their strategies effectively and achieve consistent profitability.

Fee Structure and Withdrawal Constraints

While TradeXProp’s pricing starts at a competitive $35, there are notable drawbacks in its fee and withdrawal policies. The firm does not offer free trials or free repeats, which are commonly provided by other proprietary trading firms to allow potential clients to assess their services before committing financially. Additionally, traders are restricted to making withdrawals only once per month. This inflexibility can be inconvenient and may not suit traders who prefer more frequent access to their earnings.

Educational Resources and Customer Support Deficiencies

Another significant shortcoming of TradeXProp is the complete lack of educational resources. The firm does not provide webinars, trading courses, video guides, or a trading blog. This absence of educational support makes it difficult for beginners to learn and develop their trading skills within the TradeXProp environment. Competent educational materials are vital for trader development, and their absence is a notable disadvantage.

Customer support is also limited, with assistance available only through live chat and email. The lack of phone support may be a drawback for traders who prefer direct communication, especially when dealing with urgent issues. Effective and accessible customer service is crucial in the trading industry, and TradeXProp’s limited support channels may not meet the expectations of all clients.

Technical and Hosting Concerns

TradeXProp’s website is hosted in Malaysia, a country identified by the International Banking Federation as having a high level of fraud and corruption. While this does not directly implicate the firm, it does raise concerns about the potential risks associated with its operational base. Additionally, the website’s low Tranco rank indicates minimal traffic, suggesting limited reach and possibly reflecting a lack of widespread recognition or trust within the trading community.

Conclusion about TradeXProp

In summary, while TradeXProp presents itself as an innovative proprietary trading firm, several factors warrant caution. The lack of verifiable legitimacy indicators, restrictive account and trading conditions, absence of educational resources, limited customer support, and technical concerns collectively suggest that potential clients should conduct thorough due diligence before engaging with TradeXProp. Exploring alternative firms with established reputations and more favorable conditions may be advisable for traders seeking reliable and supportive trading environments.