Financial markets are full of opportunities, but behind the flashy slogans often lie traps. TradeSafeGlobal positions itself as a “reliable guide” in the world of Forex and cryptocurrencies, emphasizing “safety” and “transparency”. However, behind these words lies a reality that should alarm even experienced investors. Let’s break down why trusting this platform is a dangerous game.

- Legal Shadows: Where Is TradeSafeGlobal Hiding?

- The Myth of “Guaranteed Safety”: How They Mislead

- Phantom Returns: Why the Numbers Don’t Add Up

- Reviews: Between Rave and Rage

- The Scheme: How TradeSafeGlobal Drains Money

- 5 Reasons to Run from TradeSafeGlobal

- How to Avoid Becoming a Victim: A Survival Guide

- If you’ve already invested with TradeSafeGlobal:

- When choosing a broker:

Legal Shadows: Where Is TradeSafeGlobal Hiding?

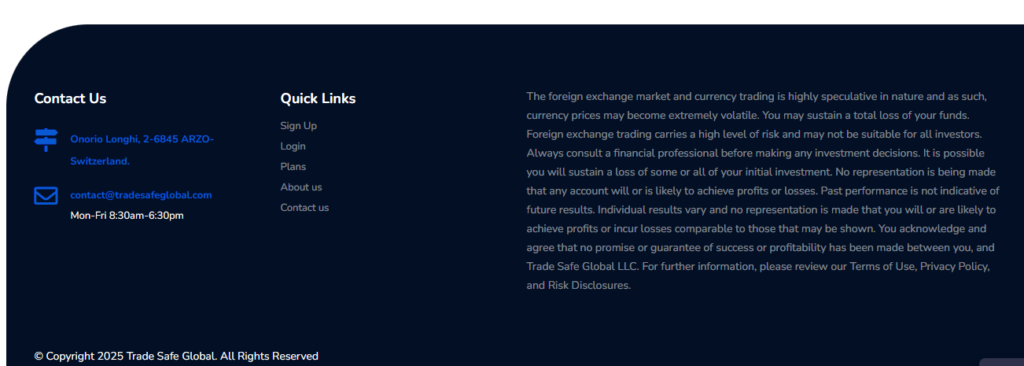

The first red flag is the lack of clear regulatory information. The company’s website is silent about its jurisdiction, but investigations reveal that TradeSafeGlobal is registered in Belize—an offshore zone where broker requirements are minimal. The local regulator, IFSC, does not monitor company activities, and a license here costs less than a month’s advertising budget.

For clients, this means: in case of account blockages, manipulations, or outright fraud, there’s nowhere to turn. An offshore status isn’t a “technical detail”—it’s a strategy to avoid accountability.

The Myth of “Guaranteed Safety”: How They Mislead

The name TradeSafeGlobal (“Global Safe Trading”) is part of a marketing gimmick. The company promises “capital protection” through “unique algorithms,” but the details are vague. Instead of concrete mechanisms, they use buzzwords like “premium risk management” or “artificial intelligence.”

Experienced traders know: real safety comes from licenses by reputable regulators (FCA, ASIC), deposit insurance, and transparent reporting. TradeSafeGlobal has none of this.

Phantom Returns: Why the Numbers Don’t Add Up

TradeSafeGlobal advertises “stable profits of 50% per month,” backed by stories of “successful clients.” But let’s use logic:

- Markets don’t follow templates. Even top hedge funds rarely achieve more than 20-30% annual returns.

- Algorithms aren’t infallible. Any automated strategy carries risks, especially in volatile conditions.

- Where’s the proof? The company doesn’t publish audited reports or verified trading results.

These “50% returns” are nothing more than bait for naive investors who believe in fairy tales about passive income.

Reviews: Between Rave and Rage

An analysis of client feedback reveals a double game:

- Fake praise. The website and social media are flooded with generic reviews: “Best platform ever!”, “Instant withdrawals!” The suspicious uniformity screams paid comments.

- Real complaints. On independent forums, users share a different story:

- “Stop-losses don’t work”—orders are ignored during market spikes.

- Hidden fees—percentages are deducted for “maintenance,” even on losing trades.

- Endless document checks—withdrawals are blocked under the guise of “additional verification.”

These facts paint a picture of systematic deception.

The Scheme: How TradeSafeGlobal Drains Money

The company operates using classic financial scam tactics:

- Creating an illusion of trust. A sleek website, mentions of “cutting-edge technology,” fake certificates.

- Aggressive client acquisition. Ads on TikTok and Instagram with slogans like “Start with $100 and get VIP signals!”

- Rigged gameplay. Client funds aren’t traded on real markets—trades are simulated in an internal system where quotes are adjusted in the company’s favor.

- Gradual disappearance. After the first complaints, support slows down, and the platform “temporarily suspends operations” for “technical updates.”

5 Reasons to Run from TradeSafeGlobal

- No regulation. No ties to FCA, CySEC, or other oversight bodies.

- Offshore accounts. Funds are held in ghost banks that don’t comply with international standards.

- Platform manipulation. “Random” glitches during profit withdrawals, tweaked quotes.

- Deposit pressure. Managers call with threats: “Your portfolio will lose value without a top-up!”

- Zero evidence. No audits, no real trading histories, no live representatives.

How to Avoid Becoming a Victim: A Survival Guide

If you’ve already invested with TradeSafeGlobal:

- Demand an immediate withdrawal—don’t fall for promises to “wait until the end of the month.”

- Document everything: correspondence, ticket numbers, balance screenshots.

- File a complaint with your country’s regulator (e.g., SEC or your local financial authority), even if chances are slim.

When choosing a broker:

- Verify licenses on official FCA, ASIC, or CySEC websites.

- Avoid platforms with aggressive ads and guaranteed returns.

- Test strategies on a demo account for at least 2-3 months.

- Read independent reviews on platforms like Trustpilot or Reddit.

TradeSafeGlobal is another wolf in sheep’s clothing. Pretty words about “safety” mask offshore schemes and manipulations. Remember: real capital protection starts with choosing a licensed broker, not a marketing gimmick. Don’t let scammers turn your investments into digital dust.