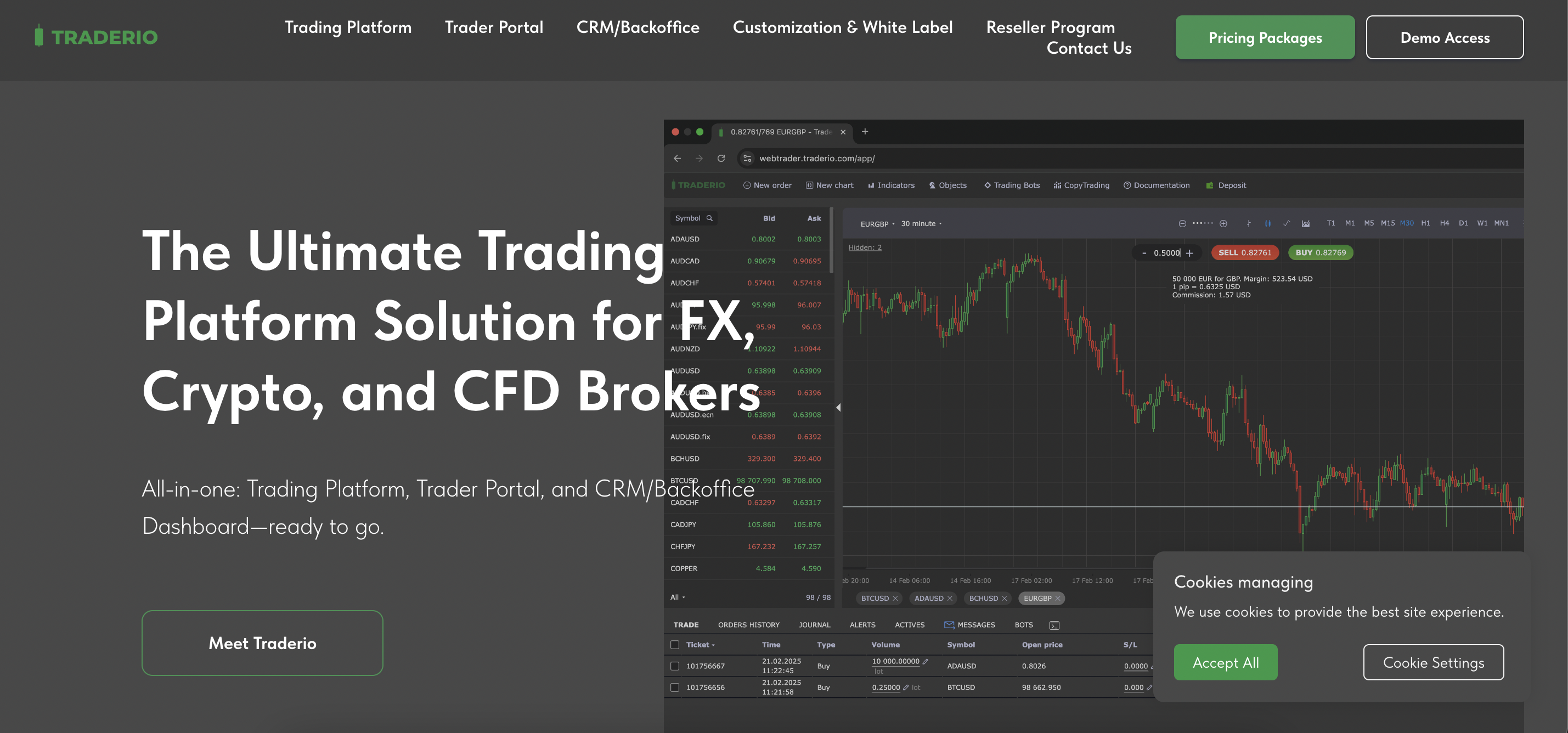

In the ever-evolving landscape of trading platforms, Traderio has emerged as a solution tailored for FX, crypto, and CFD brokers. Promising an all-in-one package encompassing a trading platform, trader portal, and CRM/backoffice dashboard, Traderio aims to streamline brokerage operations. However, as with any platform, it’s essential to delve deeper into its offerings to determine its suitability and reliability.

Traderio – Understanding Traderio’s Offerings

Traderio positions itself as a comprehensive solution for brokerage companies, highlighting several key features:

- Cost-Effective Solutions: Traderio emphasizes flexible pricing options, including monthly fees, lifetime licenses, and full source code ownership. Notably, it claims to have no volume-based charges and includes essential tools like the trader portal, CRM, and backoffice in every package.

- Customization Capabilities: The platform boasts a zero-code interface, allowing brokerages to modify layouts, colors, and branding without the need for developers. Additionally, it offers robust APIs for seamless integration with third-party tools.

- Cross-Platform Compatibility: Traderio supports multiple devices, including web, desktop (Windows, macOS, Linux), and mobile (iOS, Android). It also features an in-house proprietary crypto payment gateway and facilitates integration with external payment providers via API.

Potential Concerns and Considerations

While Traderio presents a suite of features designed to enhance brokerage operations, several aspects warrant a closer examination:

1. Lack of Independent Reviews

A thorough search reveals a scarcity of independent reviews or testimonials from brokerages that have implemented Traderio. This absence makes it challenging to gauge real-world performance, user satisfaction, and potential issues that may arise during integration or daily operations.

2. Limited Transparency on Security Measures

In the realm of trading platforms, robust security protocols are paramount. While Traderio mentions features like SSL encryption and authentication functions, there is limited information on comprehensive security measures, such as two-factor authentication, data encryption standards, or regular security audits. This lack of transparency may raise concerns for brokerages prioritizing data protection and compliance.

3. Absence of Regulatory Information

Traderio states that it is a technology provider and does not engage directly with individual traders or offer financial services. However, there is no mention of regulatory compliance or certifications that affirm its adherence to industry standards. For brokerages operating in regulated markets, this could pose challenges in meeting compliance requirements.

4. Potential Overemphasis on Cost Savings

While cost-effectiveness is a significant advantage, an overemphasis on affordability may lead to compromises in areas like customer support, platform stability, or feature richness. It’s essential to assess whether the cost savings align with the quality and reliability expected from a trading platform.

Comparative Analysis

When evaluating Traderio against other trading platforms, several factors come into play:

- User Experience: Platforms like MetaTrader 4/5 and cTrader have established reputations for user-friendly interfaces and extensive community support. Traderio’s user experience remains relatively untested in the broader market.

- Feature Set: While Traderio offers a range of features, it’s crucial to compare them against competitors to determine if any essential tools or functionalities are missing.

- Support and Community: Established platforms benefit from active user communities, forums, and extensive documentation. The lack of a visible user community for Traderio may impact the ease of troubleshooting and knowledge sharing.

Conclusion on Traderio

Traderio presents itself as a comprehensive, cost-effective solution for brokerages seeking an integrated trading platform. Its emphasis on customization, cross-platform compatibility, and bundled tools is commendable. However, the lack of independent reviews, limited transparency on security measures, and absence of regulatory information necessitate a cautious approach.

For brokerages considering Traderio, it’s advisable to conduct thorough due diligence, request detailed documentation, and possibly engage in a trial period to assess the platform’s suitability for their specific needs. Balancing cost savings with reliability, security, and compliance is essential to ensure long-term success and client trust.

Stay Safe with Scam Insights from Invests.Finance