The zen market positions itself as a multi-asset trading broker that promises user-friendly platforms, fast execution, and access to a wide range of financial instruments. With modern branding, sleek interfaces, and a global appeal, the zen market tries to lure both new and experienced traders with flashy promises. But does it live up to the marketing? A deep dive into the service reveals multiple red flags, questionable transparency, and operational weaknesses that traders should not ignore.

- The zen market platform: Looks can be deceiving

- Limited regulatory clarity from the zen market

- Account types and conditions: The fine print matters

- Funding and withdrawal issues at the zen market

- Customer support: Poor response times and canned replies

- Marketing over substance

- Risk disclosures are buried or incomplete

- Alternatives offer greater transparency and value

- Final thoughts on the zen market

The zen market platform: Looks can be deceiving

At first glance, the zen market trading platform seems well designed. The broker provides web-based access and claims compatibility with desktop and mobile trading. However, the reality is more complicated. Users have reported clunky interfaces, delayed price updates, and even freezing during high-volatility periods. This is particularly concerning for traders who rely on speed and precision.

Moreover, the charts offered by the zen market often lack essential indicators that are standard on other brokers. The platform’s technical analysis tools feel like an afterthought rather than a core feature. For a broker that claims to support serious trading, the platform does not inspire confidence.

Limited regulatory clarity from the zen market

One of the most serious concerns about the zen market is its regulatory standing—or rather, the lack of clarity around it. The broker’s website makes no clear mention of licensing from any well-known financial authority such as the FCA, ASIC, or CySEC. For a platform claiming to offer access to complex instruments like CFDs, forex, crypto, and commodities, this is alarming.

Lack of regulation means there’s no third-party oversight ensuring the broker acts fairly or protects client funds. Traders have no assurance their deposits are safe or that they can escalate complaints to an impartial regulator. In an industry where trust is everything, the zen market falls short in providing that basic layer of protection.

Account types and conditions: The fine print matters

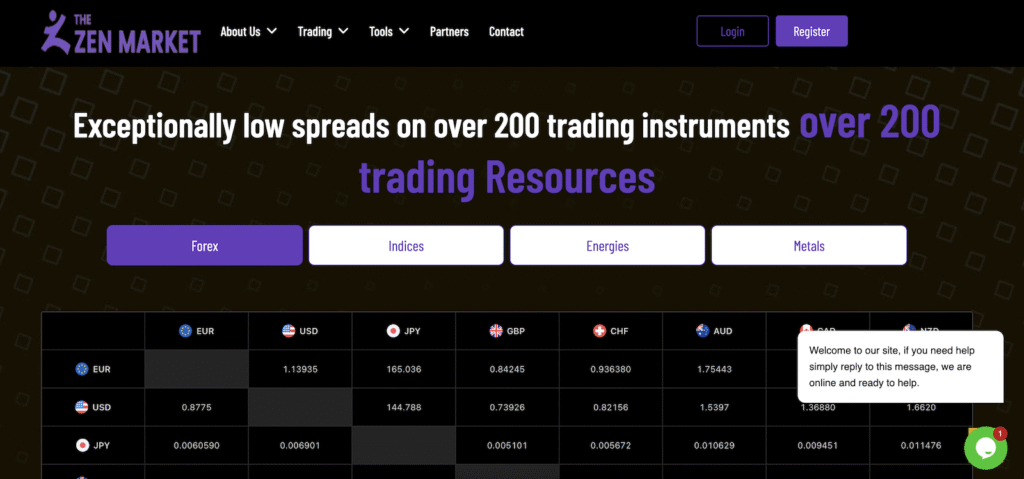

The zen market advertises a range of account types tailored to different levels of traders. However, on closer inspection, the differences are minimal and the benefits are unclear. There’s little transparency about spreads, commissions, or slippage—critical factors that experienced traders look for. Claims of tight spreads and low latency execution are not backed by independently verified data.

Even more troubling is the broker’s vague approach to margin requirements. There are no clear guidelines on leverage limits or margin calls. In volatile markets, this lack of clarity can lead to significant losses and even liquidation without warning.

Funding and withdrawal issues at the zen market

One of the key red flags with the zen market is the inconsistency in deposits and withdrawals. While the broker boasts of supporting multiple funding methods—credit card, bank transfer, e-wallets—the process is not as smooth as advertised.

Users have complained about delays in fund processing, both when depositing and withdrawing. Some report waiting over a week to receive withdrawals, despite the broker promising 24–48 hour processing times. There are also hidden withdrawal fees that are not clearly communicated upfront, making the experience both confusing and costly.

Additionally, the platform appears to require unnecessary verification steps at the time of withdrawal, often holding funds until extensive documentation is provided. While KYC compliance is normal in the industry, the zen market’s process seems designed more to stall withdrawals than to protect the user.

Customer support: Poor response times and canned replies

Customer support is another area where the zen market falters. Despite advertising 24/7 support, live chat is not always available, and response times via email are sluggish. Traders dealing with time-sensitive issues often receive generic responses or are redirected to vague FAQ pages rather than being given actionable help.

This lack of reliable support can become critical when facing technical issues, withdrawal problems, or trade disputes. In many cases, users feel abandoned when they need assistance the most.

Marketing over substance

It’s clear that the zen market invests heavily in marketing, with a polished website, aggressive SEO tactics, and enticing claims about its award-winning status. But beyond the surface-level polish, the substance is lacking. There is little in the way of transparent performance metrics, verified user testimonials, or meaningful client protections.

The broker’s emphasis on style over substance becomes particularly problematic when real money is on the line. Trading requires trust—and right now, the zen market is not doing enough to earn it.

Risk disclosures are buried or incomplete

Another area of concern is the broker’s approach to risk warnings. Most reputable brokers are required to prominently disclose the high-risk nature of leveraged trading. However, on the zen market website, these warnings are vague or tucked away in footnotes. This can mislead new traders into thinking trading is less risky than it actually is.

The lack of educational content or trader resources further suggests that the zen market is more interested in attracting deposits than building informed, sustainable trading relationships.

Alternatives offer greater transparency and value

In comparison to better-known and regulated brokers, the zen market falls significantly short. Platforms like IG, IC Markets, and Pepperstone offer full regulatory compliance, clearer fee structures, better customer service, and robust platforms. These brokers also provide rich educational resources and active communities—features that the zen market entirely lacks.

For a trader deciding where to invest time and capital, it’s difficult to recommend the zen market when more transparent, responsive, and secure options exist.

Final thoughts on the zen market

Despite its slick design and marketing efforts, the zen market does not deliver a trustworthy or reliable trading experience. Its lack of regulatory clarity, vague fee structures, poor customer support, and technical limitations all combine to make it a high-risk choice—especially for beginners.

Those considering using the zen market should exercise extreme caution. Without transparency, third-party oversight, or consistently positive user feedback, it’s hard to see how this broker adds value in a crowded marketplace. Until it addresses these core issues, the zen market remains more of a gamble than a gateway to successful trading.

Stay Safe with Scam Insights from Invests.Finance