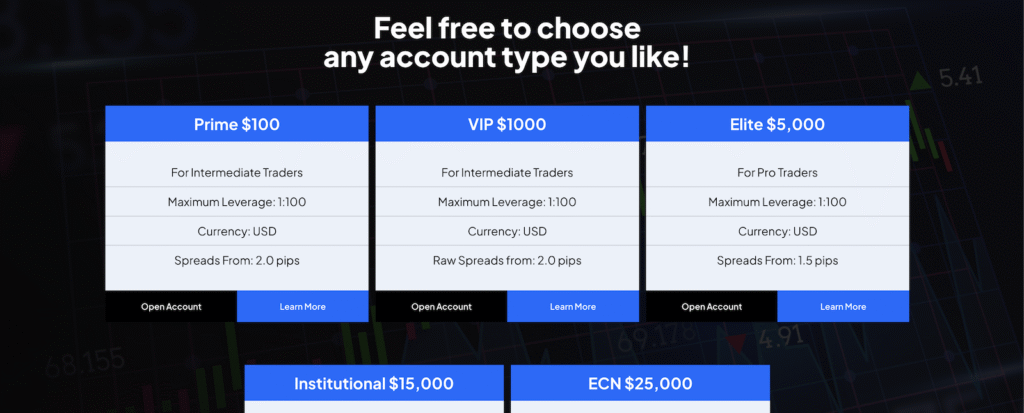

In the vast and volatile world of forex trading, selecting a reliable broker is paramount. Tejjara Forex Ltd positions itself as a “True ECN Broker” offering a range of account types, including Prime, VIP, Elite, and Institutional accounts. Their platform boasts features like tight spreads from 0.0 pips, leverage up to 1:500, and a cashback program. Additionally, they claim to provide client fund insurance up to $1,000,000, underwritten by Lloyd’s of London.

However, despite these appealing offerings, potential investors should approach with caution. A closer examination reveals several concerns that merit attention.

Tejjara Forex Ltd: Lack of Regulatory Oversight

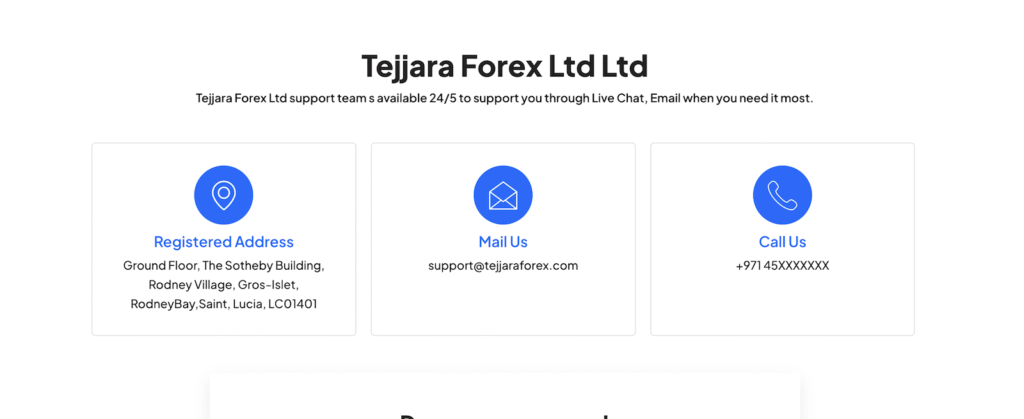

One of the most glaring issues with Tejjara Forex Ltd is the absence of regulatory oversight. The company does not appear to be registered with any reputable financial regulatory authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This lack of regulation raises significant concerns about the safety and security of client funds.

Regulatory bodies play a crucial role in ensuring that brokers operate transparently and fairly. Without such oversight, traders are left vulnerable to potential fraud and malpractice.

Transparency Issues

Tejjara Forex Ltd’s website provides limited information about the company’s operations, leadership, and physical address. Transparency is a fundamental aspect of trust in the financial industry. The absence of detailed company information makes it challenging for potential clients to assess the legitimacy and reliability of the broker.

Furthermore, the company’s promotional materials highlight features like tight spreads and high leverage without adequately addressing the associated risks. Such omissions can mislead inexperienced traders into underestimating the potential downsides of trading with high leverage.

Account Types

Tejjara Forex Ltd: Client Fund Insurance

Tejjara Forex Ltd claims to offer client fund insurance up to $1,000,000, underwritten by Lloyd’s of London. While this sounds reassuring, the details of this insurance policy are not readily available on the company’s website. Potential clients are left without clear information about the terms, conditions, and coverage limits of this insurance.

In the event of insolvency or other financial issues, the lack of transparency regarding insurance coverage could leave traders uncertain about the protection of their funds.

User Experiences and Reputation

Online forums and review platforms have reported mixed experiences from users of Tejjara Forex Ltd. Some traders have praised the platform’s user interface and range of trading instruments. However, others have expressed concerns about withdrawal processes and customer support responsiveness.

The inconsistency in user experiences highlights the importance of conducting thorough research before engaging with any forex broker. Potential clients should consider seeking feedback from multiple sources and exercising due diligence.

Conclusion on Tejjara Forex Ltd

While Tejjara Forex Ltd offers a range of attractive features, such as various account types and high leverage, the lack of regulatory oversight, transparency issues, and unclear client fund insurance raise significant concerns. Potential investors should exercise caution and consider these factors when evaluating whether to engage with this broker.

In the world of forex trading, the safety of your investments should be a top priority. It is essential to choose a broker that is regulated, transparent, and provides clear information about the protection of client funds.

Stay Safe with Scam Insights from Invests.Finance