When choosing a brokerage or financial service provider in Switzerland, understanding the regulatory environment is crucial. This review offers an in-depth, honest look at the Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/), detailing its role, strengths, limitations, and why it matters to both brokers and investors. Through objective facts, real-world examples, and clear insights, this article empowers you to make confident choices—while encouraging engagement and inquiries in the comments below.

- What is the Swiss Financial Market Supervisory Authority – FINMA?

- FINMA’s Regulatory Framework: Rules You Can Trust

- 1. Licensing and Supervision

- 2. Investor Protection

- 3. Anti‑Money‑Laundering (AML) and Compliance

- Why FINMA Matters to Brokers and Investors

- Reliable Oversight

- Market Integrity

- Reputation and Trust

- Key Services Swiss Financial Market Supervisory Authority Provides

- Real‑World Example: SecureBrokers AG

- Pros and Cons of Swiss Financial Market Supervisory Authority Regulation

- How to Check Broker Status with FINMA

- Final Thoughts about Swiss Financial Market Supervisory Authority

What is the Swiss Financial Market Supervisory Authority – FINMA?

Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/) is the independent regulator for Switzerland’s financial markets. Established in 2009, FINMA oversees banks, insurance companies, securities firms, collective investment schemes, and intermediaries.

- It ensures compliance with banking laws, anti-money‑laundering regulations, and consumer protection standards.

- FINMA’s decisions are publicly available, emphasizing transparency and accountability.

This authority’s mandate consolidates oversight formerly handled by multiple organizations, creating a unified supervision model. For brokers and financial institutions, registration with Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/) is mandatory to operate legally within Switzerland.

FINMA’s Regulatory Framework: Rules You Can Trust

1. Licensing and Supervision

FINMA requires brokers to hold a license. This ensures:

- Rigorous capital adequacy standards

- Background checks on management and owners

- Ongoing reporting to FINMA about financial health and client dealings

2. Investor Protection

Under the oversight of Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/), brokers must:

- Keep client funds segregated from the broker’s assets

- Provide transparent information on fees and terms

- Offer dispute resolution mechanisms and complaint support

3. Anti‑Money‑Laundering (AML) and Compliance

FINMA enforces strict AML regulations. Brokers must:

- Monitor client identities and behaviors (KYC procedures)

- Report suspicious transactions to authorities

- Maintain compliance programs, updated according to evolving standards

As a result, investing through a FINMA-regulated broker significantly reduces risks related to fraud, misappropriation, and weak compliance.

Why FINMA Matters to Brokers and Investors

Reliable Oversight

- The presence of Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/) allows brokers to operate under a recognized, trusted regulatory regime.

- Investors benefit from certainty that brokers meet high standards and can be held accountable.

Market Integrity

- Maintaining client fund segregation and enforcing transparency protects users from insolvency of financial institutions.

- Dispute resolution measures foster confidence in brokerage services.

Reputation and Trust

- Swiss regulation garners international respect.

- Brokers regulated by Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/) often attract global clientele seeking stable, regulated markets.

Key Services Swiss Financial Market Supervisory Authority Provides

- Registration and Licensing: Providing official approval for brokers to operate.

- Continuous Monitoring: Reviewing financial statements, risk profiles, and operational compliance.

- Enforcement Actions: Imposing fines, suspending licenses, or banning non‑compliant firms.

- Consumer Guidance: Publishing bulletins, FAQs, and updates for investor awareness.

Recent cases (2023–2025) include sanctions on firms violating AML rules, demonstrating FINMA’s active enforcement.

Real‑World Example: SecureBrokers AG

SecureBrokers AG, a mid-sized Swiss broker, received supervision from FINMA in 2024. Highlights include:

- Regular audits affirming fund segregation and capital reserves

- Quick remediation of administrative deficiencies

- No major client complaints or regulatory breaches

This real-world oversight reinforces FINMA’s role in maintaining service quality and trust in financial services.

Pros and Cons of Swiss Financial Market Supervisory Authority Regulation

| ✅ Pros of FINMA | ⚠️ Cons of FINMA |

|---|---|

| High regulatory standards | Potential delays in license approval |

| Robust investor protection | Possible cost implications for small brokers |

| Stable, transparent oversight | Strict compliance adds administrative workload |

| Strong AML enforcement | Brokers might pass compliance costs to clients |

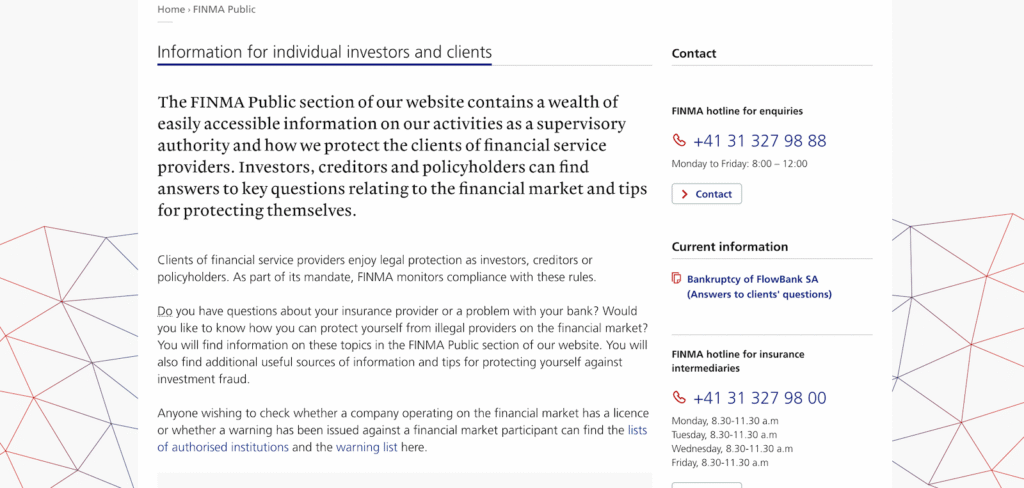

How to Check Broker Status with FINMA

- Visit Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/).

- Access the ‘Registers’ section.

- Search for the broker’s name to confirm valid registration and licensing.

- Review any regulatory measures or warnings issued.

This process is freely available and regularly updated, promoting transparency and protecting investors.

Final Thoughts about Swiss Financial Market Supervisory Authority

- Choosing a **Swiss Financial Market Supervisory Authority – FINMA – (https://www.finma.ch/)**-regulated broker means operating under a thorough, respected regulatory framework.

- Investors benefit from enhanced protection, transparency, and dispute resolution mechanisms.

- Brokers must adhere to high standards—offering a stable environment for clients.

If you’re exploring Swiss brokers, FINMA registration is among the first and most important factors to check. Have questions about specific brokers, compliance, or FINMA’s services? Please leave a request or comment below—we’re here to help!