In the crowded market of broker and affiliate services, Swift affiliate mining positions itself as an innovative way to generate affiliate income. However, as insiders and critical reviewers dig deeper into the service, serious concerns emerge. This article examines Swift affiliate mining objectively, unpacking its structure, potential flaws, and why it may not be the reliable income stream it claims to be.

- What Is Swift affiliate mining?

- Swift affiliate mining: Website Structure and Claims

- Lack of Regulatory Compliance

- Swift affiliate mining: Affiliate Experience

- Onboarding and Hidden Fees

- Withdrawal Delays

- Swift affiliate mining: Support and Communication

- Risk vs Reward: Is Swift affiliate mining Worth It?

- Risk Factors

- Why Some People Join

- Swift affiliate mining: Competitive Alternatives

- Swift affiliate mining: Final Verdict

- Should You Try It?

- Swift affiliate mining: Your Next Steps

- In Summary: Swift affiliate mining May Be More Flash Than Substance

What Is Swift affiliate mining?

Swift affiliate mining promotes itself as a dual-purpose service: a mining-like affiliate program that supposedly lets users earn from referrals and passive cryptocurrency-like rewards. They emphasize fast payouts, user-friendly dashboards, and high affiliate commissions. But a closer look uncovers gaps between marketing and reality.

Swift affiliate mining: Website Structure and Claims

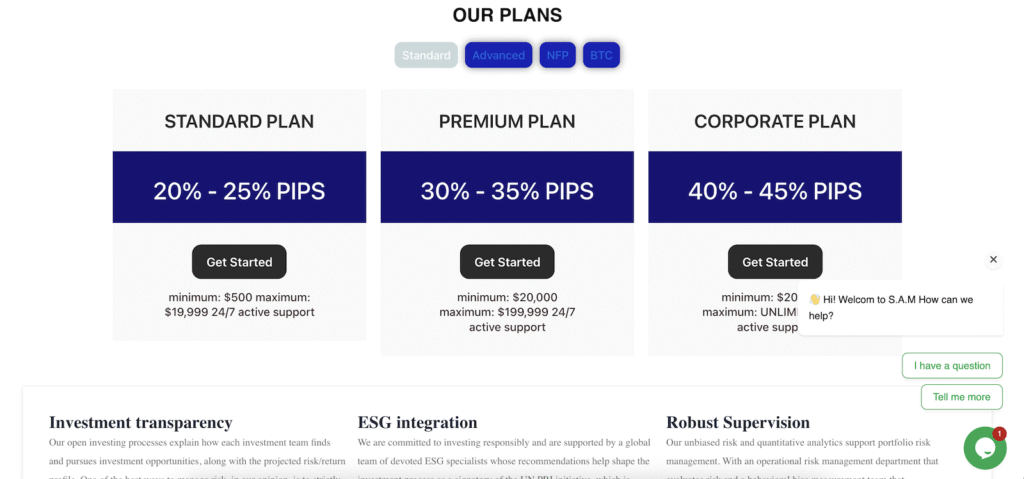

On the surface, the Swift affiliate mining website looks polished: slick fonts, promises of top-tier support, and claims of high daily returns on affiliate activity. They market:

- High yields: earning as much as 10–15% daily referral bonuses

- Automatic payouts: promised within 48 hours of withdrawal requests

- Tiered affiliate levels: escalating earnings for multi-level referrals

While these claims appeal to potential affiliates, the website offers virtually no independent verification, such as blockchain proof, third-party audits, or testimonials outside their own marketing materials. A key red flag in affiliate-mining models is the lack of transparency. Swift affiliate mining does not address this adequately.

Lack of Regulatory Compliance

A critical issue in this review is Swift affiliate mining’s refusal—or inability—to show registration with financial regulators. Legitimate affiliate brokers typically carry licenses and present them clearly. Swift affiliate mining, in contrast, hides behind vague statements about being “regulated offshore” or “operating under tertiary financial oversight.” These unsupported claims raise serious doubts and suggest a potential for future issues or sudden shutdowns.

Swift affiliate mining: Affiliate Experience

Onboarding and Hidden Fees

Many affiliate sign-ups describe an experience that starts smooth but deteriorates. After registration, users report unexpected conditions:

- Mandatory minimum withdrawal thresholds that climb unexpectedly

- Hidden commission caps that reduce earnings after initial payouts

- Fees unrelated to affiliate activity, like maintenance fees or account dormancy charges

These factors severely impact affiliate ROI and make the program appear deceptive.

Withdrawal Delays

Several users describe delays far exceeding the promised two-day window. Some report waiting weeks for pending withdrawals, only to be met with requests for additional documentation or alleged “compliance verifications.” Support often points to backend processes as the cause—though no real progress is observed. This directly contradicts Swift affiliate mining’s marketing promise of swift payouts.

Swift affiliate mining: Support and Communication

Transparency in customer service is a hallmark of trustworthy services. Unfortunately, Swift affiliate mining’s support system is problematic:

- Support email replies claim “high volume delays,” with responses taking up to 72 hours

- Live chat, when available, provides only scripted answers and non-specific reassurances

- Forums and third-party communities note misinformation or contradictory advice

These patterns suggest shallow support infrastructure and low prioritization of affiliate concerns.

Risk vs Reward: Is Swift affiliate mining Worth It?

Risk Factors

- Unverified structure: No audit or transparency in payouts

- Withdrawal obstacles: Sudden barriers and expansions of rules

- Regulatory uncertainty: No clear oversight or licensing

- Communications issues: Poor and inconsistent customer interaction

These risks are unacceptable for anyone relying on regular affiliate payouts, especially when comparing with more established competitor platforms.

Why Some People Join

Despite the concerns, some affiliates are initially drawn to Swift affiliate mining because:

- They advertise high commissions and fast returns

- Their affiliate tools appear well-designed and slick

- For novices, the promise of passive income feels achievable and attractive

But once they hit withdrawal or support problems, many become disillusioned.

Swift affiliate mining: Competitive Alternatives

If you’re considering affiliate income, vetted alternatives include:

- Regulated brokers offering transparent affiliate programs

- Crypto mining pools with verifiable blockchain payouts

- Affiliate networks with clear terms, reputable merchants, and track records

These options generally provide more reliable performance, transparent fee structures, and better customer support than Swift affiliate mining.

Swift affiliate mining: Final Verdict

In a marketplace rife with affiliate offers and investment opportunities, Swift affiliate mining falls short in key areas: transparency, reliability, and regulatory clarity. While affiliate commissions may appear generous initially, recurring withdrawal obstacles, confusing terms, and soaked‑up support indicate a risky environment. Unless they substantially overhaul operations—by obtaining licensing, publishing audits, and fixing support delays—Swift affiliate mining remains a questionable choice for serious affiliates.

Should You Try It?

- If you’re curious: proceed with tiny deposits, track withdrawal speeds carefully, and assess support responsiveness.

- If you’re serious: pursue alternative affiliate programs with third-party verification and clean reputations.

Swift affiliate mining: Your Next Steps

- Read all terms and withdrawal conditions carefully before signing up.

- Treat any “proof of earnings” on their site skeptically—always ask for verifiable documentation.

- Join independent forums or review platforms to see if real users are reporting issues.

- Diversify: don’t put all funds or effort into one service based on flashy marketing.

In Summary: Swift affiliate mining May Be More Flash Than Substance

Swift affiliate mining sells an appealing vision of easy affiliate income, but the marketing gloss hides a trove of concerns. Without proven transparency or regulatory safeguards, there’s little to distinguish it from other risky affiliate programs. If passive affiliate earnings are your goal, better-established alternatives exist. When your time, money, and reputation are on the line, caution and due diligence pay dividends far beyond the flashy promises of Swift affiliate mining.

Stay Safe with Scam Insights from Invests.Finance