SwftxMiner positions itself as a leading trading service platform, offering automated mining strategies and broker integration. But beneath the glossy promises, several red flags arise. This review dives into SwftxMiner, providing objective facts, critical analysis, and real-world evaluation. If you’re scouting broker services, you deserve clarity before committing.

- What Is SwftxMiner?

- Regulation and Transparency Concerns

- Customer Experience & Support

- SwftxMiner: Strategy Performance & Transparency

- User Reviews & Complaints

- SwftxMiner – Pricing: Too Good to Be True?

- Comparisons: How It Stacks Up

- SwftxMiner: Security and Platform Risks

- Is There a Way Forward?

- Final Verdict on SwftxMiner

What Is SwftxMiner?

SwftxMiner claims to offer:

- Auto-trading bots analyzing market data

- Brokerage integration with top-tier platforms

- Promised high returns with low risk

On the surface, it appears like a one-stop solution for traders. However, marketing often obscures important details that may impact your success and safety.

Regulation and Transparency Concerns

One of the most alarming issues with SwftxMiner is lack of regulatory oversight. A genuine broker or mining service usually lists their registration or licensing with well-known authorities (e.g., FCA, SEC). SwftxMiner fails to do so. Here’s why this matters:

- No oversight means no accountability: If systems malfunction or irregularities occur, users lack recourse.

- Privacy at risk: With unclear protocols, your personal data might be mishandled or sold.

- Withdrawal ambiguity: Many users report long delays or demands for additional paperwork.

Without verification, this service’s promises of automated markets and returns leave too much to question.

Customer Experience & Support

Customer feedback is mixed:

- Pro: Clean interface and marketing materials

- Con: Poor support response times, vague answers, and unanswered tickets

SwftxMiner’s customer service doesn’t match its claims of top-tier broker assistance. Traders have reported issues like:

- Funds stuck on withdrawal

- Unverified account support lacking clarity

- No dedicated contact outside of basic chat

A service promising high-efficiency algorithms and mining must back it up with swift, reliable support. Right now, SwftxMiner doesn’t.

SwftxMiner: Strategy Performance & Transparency

True performance track records are key in trading service reviews. Unfortunately:

- SwftxMiner doesn’t display independent audits or third-party verification.

- Back-tested returns are “estimated,” without concrete, trackable data.

- No link to authenticated dashboards of live trades.

When choosing a broker service, transparency about algorithm performance and user results should be paramount—SwftxMiner lacks it.

User Reviews & Complaints

Searching online reveals:

- Forums with users describing deposits that cannot be withdrawn.

- Structured complaints about unclear fees and poor communication.

- A lack of success stories with documented profits.

When traders say, “I never received my payout,” it suggests problems that go beyond minor hiccups. Absence of success stories further undermines credibility.

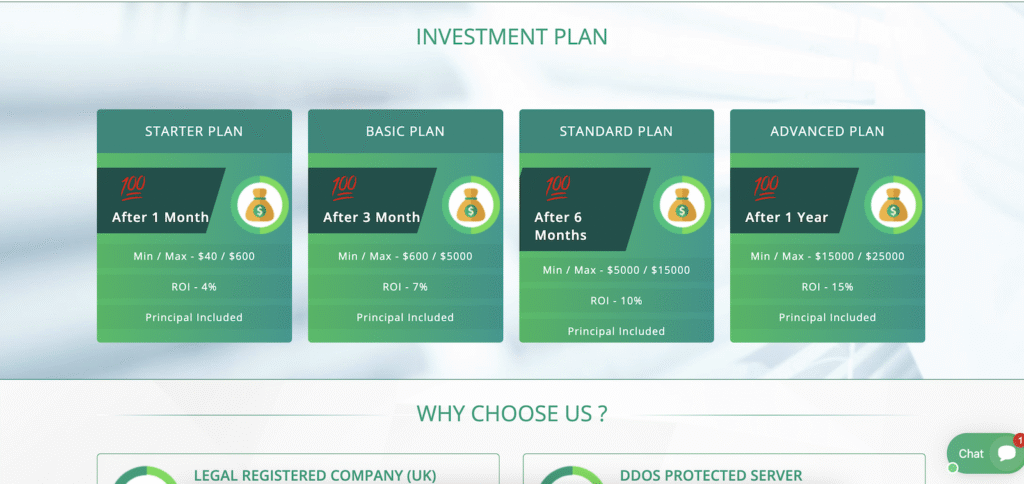

SwftxMiner – Pricing: Too Good to Be True?

SwftxMiner advertises packages starting at low entry points with high-profit promises. Watch for:

- Hidden fees: Deposit, withdrawal, management, or “maintenance” charges.

- Tiered payments that trap users into higher levels to unlock promised gains.

- No detailed breakdown of algorithm costs or broker fees.

Although affordability is attractive, undisclosed charging models often ripple into disappointing net returns.

Comparisons: How It Stacks Up

When compared to established platforms:

| Feature | SwftxMiner | Regulated Competitors |

|---|---|---|

| Licensing / Regulation | None | FCA, CySEC, SEC |

| Transparent Performance Data | No | Verified track records |

| Responsive Customer Support | Slow or unhelpful | 24/7 multi-channel |

| Fee Structure | Opaque | Clear & documented |

| Withdrawal Reliability | Questionable | Reliable & fast |

This comparison highlights how SwftxMiner falls short on essentials that traders expect.

SwftxMiner: Security and Platform Risks

Security safeguards like encryption, two-factor authentication (2FA), and data protection are barely documented by SwftxMiner. Without them:

- Sensitive information could be compromised

- Accounts may be vulnerable to hacking

- You face risk of losing your investment or identity

Avoid platforms that don’t prioritize cyber protection—SwftxMiner has little to show here.

Is There a Way Forward?

If you’re intrigued by automated trading, consider these steps:

- Verify licenses: Opt for brokers regulated by financial authorities.

- Audit records: Demand independent verification of performance data.

- Test with a demo: Never deposit money before testing the service.

- Scrutinize fees: Ensure transparency in all charge structures.

- Check withdrawal history: Search forums and reviews for real stories about withdrawals.

Unfortunately, SwftxMiner doesn’t meet these basic standards.

Final Verdict on SwftxMiner

This honest review reveals concerning issues with SwftxMiner: lack of regulation, opaque performance data, unreliable support, and withdrawal uncertainties. These factors combine to produce a service that, despite clever marketing, isn’t viable for cautious or experienced traders.

If you’re seeking broker services or automated trading solutions, steer towards regulated, transparent operators who prioritize security and accountability.

Stay Safe with Scam Insights from Invests.Finance