In the ever-expanding world of online trading, choosing a reliable broker is paramount. SummitEdge Brokers presents itself as a promising platform for traders. However, a closer inspection reveals several areas of concern that potential users should be aware of.

SummitEdge: Regulatory Status and Oversight

A fundamental aspect of any brokerage’s credibility is its regulatory status. SummitEdge Brokers does not appear to be registered with any major financial regulatory authorities such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), or Australia’s Securities and Investments Commission (ASIC). This lack of oversight raises questions about the platform’s adherence to industry standards and the protection it offers to its clients.

Transparency and Company Information

Transparency is crucial in establishing trust with users. SummitEdge Brokers provides limited information about its corporate structure, leadership team, or physical office locations. The absence of verifiable details makes it challenging for users to assess the legitimacy of the company and its operations.

Website Analysis and User Experience

The official website of SummitEdge Brokers appears to be professionally designed at first glance. However, upon closer examination, several issues become apparent:

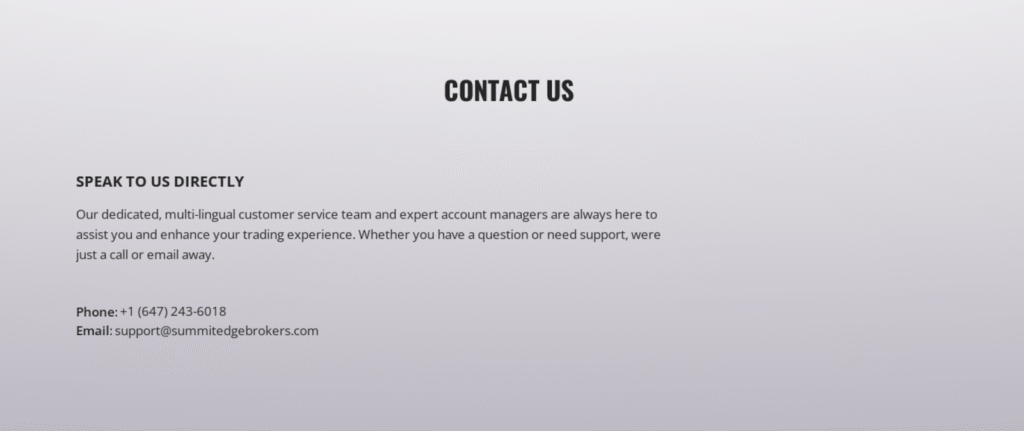

- Limited Contact Information: The website lacks comprehensive contact details, such as a physical address or direct phone numbers, making it difficult for users to reach out for support.

- Unverified Testimonials: The platform features user testimonials without providing verifiable sources or evidence of their authenticity.

- Generic Content: Much of the website’s content is generic and lacks specific information about the services offered, trading conditions, or educational resources.

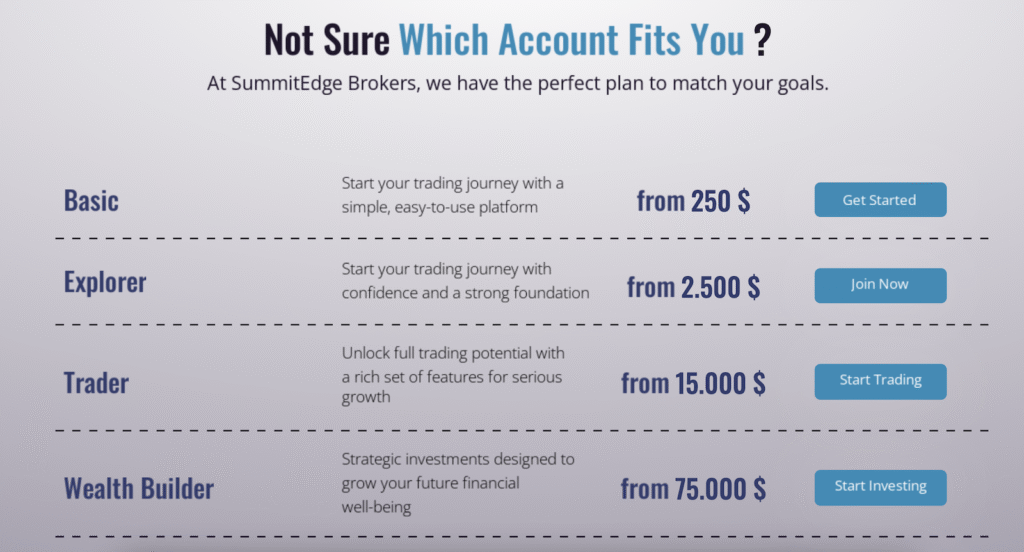

Account Types and Minimum Deposits

The platform offers various account types with differing minimum deposit requirements. However, the rationale behind the tiered structure is not clearly explained, and the benefits associated with each account level are vaguely described. This lack of clarity can lead to confusion and misinformed decisions by potential clients.

SummitEdge: Trading Platform and Tools

SummitEdge Brokers claims to offer a state-of-the-art trading platform. However, there is a lack of detailed information about the platform’s features, compatibility, and security measures. Additionally, there is no mention of demo accounts or educational tools for novice traders, which are standard offerings among reputable brokers.

Payment Methods and Withdrawal Policies

Information regarding accepted payment methods, processing times, and withdrawal policies is sparse. The absence of transparent guidelines on fund withdrawals and associated fees can be a red flag for potential users concerned about the security and accessibility of their funds.

Customer Support and Service

Effective customer support is essential for any online trading platform. SummitEdge Brokers provides limited avenues for customer service, with no clear information about support hours or response times. The lack of a dedicated support system can hinder users from resolving issues promptly.

Conclusion on SummitEdge

While SummitEdge Brokers presents itself as a viable option for traders, several aspects of its operations raise concerns. The lack of regulatory oversight, limited transparency, and insufficient customer support are significant factors that potential users should consider. It’s advisable for traders to conduct thorough research and consider more established and transparent brokers to ensure the safety and security of their investments.

Stay Safe with Scam Insights from Invests.Finance