SuisseEquity is a trading platform that offers access to forex, stocks, commodities, and indices. Marketed as user-friendly and efficient, it promises a seamless trading experience. However, upon closer inspection, there are several drawbacks that raise concerns for potential users. In this review, we’ll analyze the platform’s features, customer feedback, and overall performance to determine if SuisseEquity is worth your investment.

- SuisseEquity – User Experience: Cluttered and Unintuitive

- Limited Account Types and Trading Instruments

- SuisseEquity: Slow Customer Support

- Regulation and Security Concerns

- High Trading Costs

- Limited Educational Resources

- SuisseEquity: Security Features

- Final Verdict: Not Recommended for Serious Traders

- Final Thoughts about SuisseEquity

SuisseEquity – User Experience: Cluttered and Unintuitive

While SuisseEquity boasts a user-friendly interface, the reality is far from intuitive. The dashboard feels crowded, and many features are difficult to find, which can overwhelm both new and experienced traders. Other platforms offer a cleaner, more straightforward design, making the user experience here feel cumbersome and less efficient.

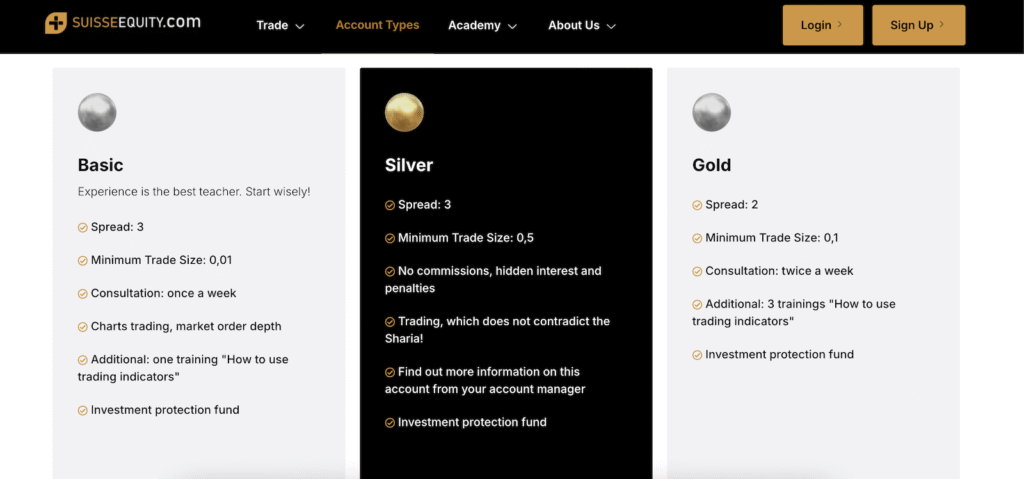

Limited Account Types and Trading Instruments

SuisseEquity offers basic account types (Standard and Premium), but the differences between them are minimal, mostly affecting spreads and commissions. In terms of trading instruments, the platform offers a standard selection of forex pairs, stocks, and commodities. However, it lacks more diverse options like cryptocurrencies or exotic forex pairs, limiting its appeal for traders seeking variety.

Account Types

SuisseEquity: Slow Customer Support

SuisseEquity’s customer support leaves much to be desired. While it claims 24/7 service, users often report slow response times and generic replies that don’t provide practical solutions. Fast and reliable support is crucial for traders, and this platform’s shortcomings in this area are a major drawback.

Regulation and Security Concerns

One of the biggest red flags is the platform’s lack of transparency regarding its regulatory status. Without clear information on licensing or regulatory oversight, traders are left uncertain about the safety of their funds and personal data. Trustworthy brokers should be upfront about their regulatory compliance, but SuisseEquity fails in this crucial area.

High Trading Costs

SuisseEquity’s trading fees are another downside. While the platform promotes low spreads, these can widen during volatile market conditions, and additional fees like commissions and overnight financing charges make trading more expensive, especially for active traders.

Limited Educational Resources

For beginner traders, the educational resources on SuisseEquity are limited. Basic tutorials and a glossary are available, but there’s little depth to help users advance their trading skills. Other brokers offer comprehensive courses, webinars, and market analysis tools that can better support traders looking to learn and grow.

SuisseEquity: Security Features

While SuisseEquity claims to implement standard security measures, such as encryption protocols, the lack of clarity around its regulatory status raises concerns about the platform’s overall security. Traders should always prioritize platforms with clear and transparent security features.

Final Verdict: Not Recommended for Serious Traders

While SuisseEquity offers basic trading services, its slow customer support, limited account types, and unclear regulatory standing make it a risky choice. The platform falls short in key areas such as user experience, educational resources, and transparency. For more experienced traders or those looking for a well-regulated platform, we suggest exploring alternative brokers.

Contacts

Final Thoughts about SuisseEquity

If you’re looking for a secure, intuitive, and comprehensive trading experience, SuisseEquity may not be the best option. Have you used the platform? Share your experience in the comments below to help others make a more informed decision!

Stay Safe with Scam Insights from Invests.Finance