Navigating the crowded broker market demands thorough research. In this detailed review of stockity web, we evaluate the service’s core features, pricing model, user experience, support responsiveness, and overall reliability. Our goal: an unbiased and honest analysis to help you decide if stockity web truly deserves your trust—or investment.

- What Is Stockity Web?

- Platform Usability and Interface Issues

- Limited Asset Range

- Fee Structure: Hidden Costs Revealed

- Stockity web: Customer Support Woes

- Educational Resources Are Sparse

- Security and Regulatory Ambiguity

- Mobile App Performance Is Inconsistent

- Account Types in Stockity web: Too Few Options

- Withdrawal and Deposit Constraints

- Transparency and Trust Concerns

- Pros and Cons at a Glance

- Who Might Suit Stockity Web?

- Final Verdict on Stockity Web

What Is Stockity Web?

Stockity web positions itself as a modern online broker with trading tools, analytics dashboards, and mobile access. The platform’s marketing highlights slick charts and fast execution. Yet beneath the polished interface, several concerning gaps emerge.

Platform Usability and Interface Issues

The dashboard of stockity web is clean but often confusing. Users report slow loading times during market peaks, undermining the promise of quick execution. Menu labels are inconsistent—“Trade” and “Orders” sometimes overlap in meaning, confusing newcomers. Despite frequent updates, essential features like customizable watchlists or advanced filtering remain lagging.

Limited Asset Range

The asset selection on stockity web is narrower than advertised. Although the site claims access to global markets, investors find that equities are primarily domestic, while forex and crypto options are limited. If you plan to trade lesser-known stocks or niche instruments, stockity web may fall short. Competing brokers offer broader options and deeper liquidity.

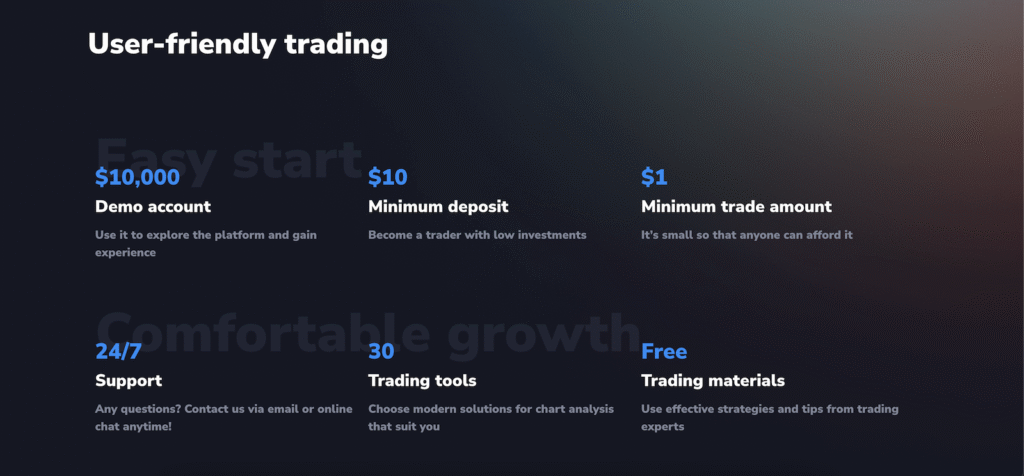

Fee Structure: Hidden Costs Revealed

Stockity web advertises low commission rates, but the real costs tell a different story. Spreads on forex pairs tend to spike during active hours. Withdrawal fees apply unless you meet monthly trading minimums—an important detail buried in the fine print. This opaque pricing structure clashes with the transparency investors deserve.

Stockity web: Customer Support Woes

Support is where stockity web truly falters. The platform offers live chat, email, and phone channels, yet user experiences vary wildly. Some clients waited days for responses. Phone support is limited to business hours in a single time zone—ignoring global traders. Resolution times exceed expectations, especially for urgent issues.

Educational Resources Are Sparse

A broker should educate its users. Unfortunately, stockity web falls behind. Their blog is inconsistent, with few in-depth tutorials or market analysis. Webinars are rare and often scheduled at inconvenient times. New traders searching for guided learning will find this lacking, and may turn to alternative platforms with richer content libraries.

Security and Regulatory Ambiguity

Stockity web claims regulatory compliance but provides scant details. There is no clear information about licensing authorities or data protection policies. For serious investors, the absence of visible regulatory oversight is a glaring red flag. Competitors prominently display registration with recognized financial regulators—stockity web does not.

Mobile App Performance Is Inconsistent

The mobile version of stockity web is functional but laggy. Users report crashes during live updates, missing order confirmations, and slow data refresh. When trading from the go, reliability is critical. Unfortunately, the mobile app’s current state undermines investor confidence, especially in fast-moving markets.

Account Types in Stockity web: Too Few Options

Account variety is limited. Stockity web offers only standard and premium tiers. There’s no mini, Islamic, or demo account, which means less flexibility for beginners, non-retail investors, or those with specific ethical requirements. The lack of a demo account is especially troubling. Many brokers allow risk-free practice trading—stockity web does not.

Withdrawal and Deposit Constraints

Deposits via common methods such as bank transfer and credit card are fine, but stockity web imposes limits on withdrawal frequency. Delays of up to three business days are standard, even for electronic transfers. If you need rapid access to funds in emergencies, this could present a problem.

Transparency and Trust Concerns

Trust in a broker comes from openness. Sadly, stockity web leaves many questions unanswered. The site lacks published audit reports, third-party reviews, or independent risk assessments. Instead, users rely on online forums for user feedback—an inconsistent and sometimes unreliable measure of credibility.

Pros and Cons at a Glance

Pros

- Clean interface with essential features

- Low headline commission rates

- Mobile trading available

Cons

- Narrow asset range on stockity web

- Hidden fees on withdrawals and spreads

- Support issues and limited availability

- Sparse educational content

- Regulatory uncertainty

- No demo or alternative account types

Who Might Suit Stockity Web?

Stockity web may appeal to traders who prioritize a simple interface and live in jurisdictions that don’t require advanced regulatory licensing. If you’re trading basic instruments and willing to accept occasional delays, it may work. However, for serious or international investors, the uncovered limitations should give serious pause.

Final Verdict on Stockity Web

After a close examination, stockity web falls short of expectations for a competitive brokerage. While it presents a sleek facade, its deficiencies in transparency, asset coverage, realistic cost structure, and user support reveal deeper issues. We recommend searching for well-regulated brokers with full feature sets, demo accounts, and clear pricing so you can avoid unforeseen surprises.

Have you tried stockity web? Share your experiences or questions in the comments below—your insights can help others navigate this broker landscape with greater awareness.

Stay Safe with Scam Insights from Invests.Finance