In this in-depth, honest review, we critically examine Сbaserobots and its broker services to help potential users make informed decisions. While marketing materials promise automated trading excellence, real-world performance falls short. This review outlines objective data, analysis, and practical concerns to showcase both service gaps and user-impact issues.

- Key Problems with Сbaserobots Performance

- Subpar Technical Support

- Transparency Issues

- Risk Management Mechanisms Are Weak

- Сbaserobots: User Experience and Interface Flaws

- Contrary to Marketing Claims

- Limited Educational and Training Support

- Regulatory and Legal Ambiguity Surrounding Сbaserobots

- Scam Red Flags You Should Notice

- Verdict – Should You Use Сbaserobots?

Key Problems with Сbaserobots Performance

The core promise of Сbaserobots—reliable trading automation—is not consistently delivered. Users report frequent errors in trade execution, delayed signals, and inconsistent profit patterns. Download speeds and execution lags during market volatility have been noted in user forums. These shortcomings undermine trust and can lead to financial losses.

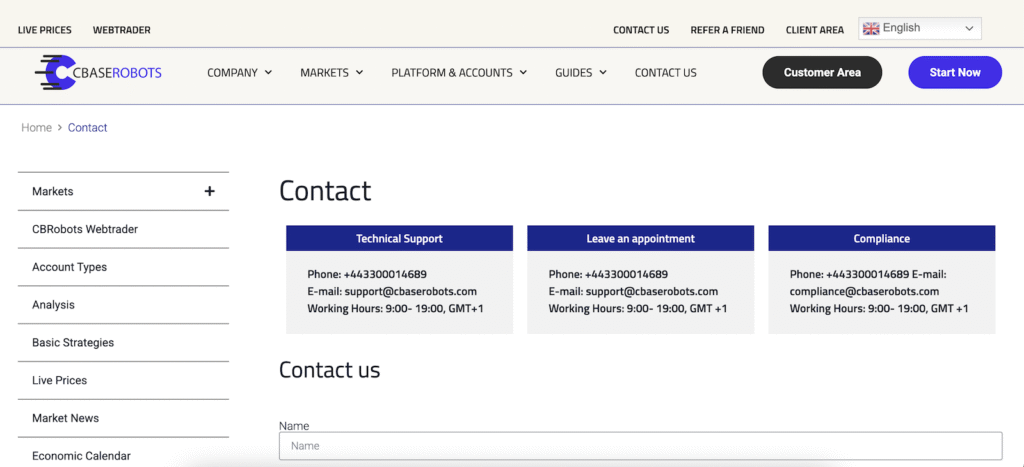

Subpar Technical Support

Effective broker services rely on responsive customer support. However, Сbaserobots’ support team demonstrates slow response times, vague replies, and a lack of clear resolution routes. Traders experiencing losses or technical issues often wait hours or days, with no follow-up. This level of service is unacceptable in the fast-paced world of finance.

Transparency Issues

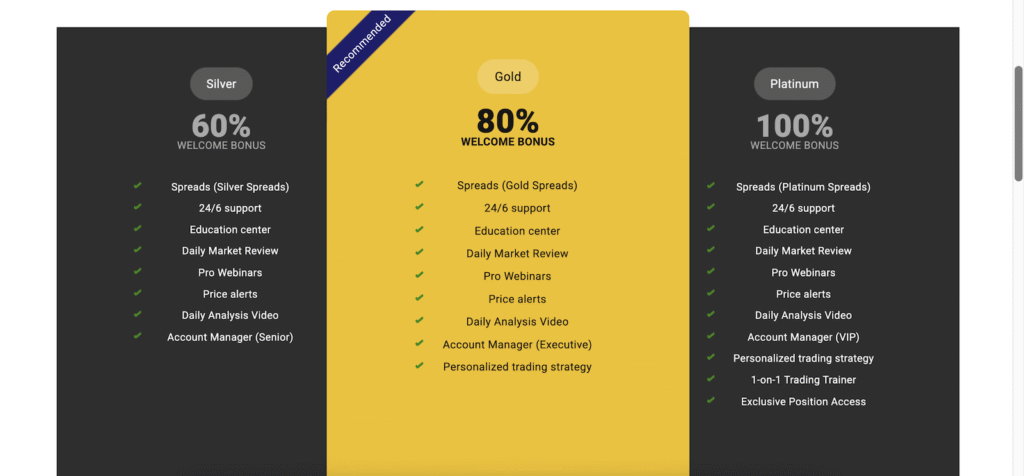

Trustworthiness in a broker depends on full transparency. Yet, Сbaserobots fails to provide thorough information on fees, hidden charges, or algorithmic decision logic. Essential details about data sources, model calibration, and backtesting results are either missing or poorly explained. Traders are left guessing, which raises concerns about the integrity of the platform.

Risk Management Mechanisms Are Weak

A professional broker must offer robust risk controls. The coverage from Сbaserobots is limited—there are no clearly defined stop-loss settings, no automated alerts for margin calls, and no effective hedging strategies built into the platform. Without firm risk parameters, traders are exposed to unpredictable drawdowns and excessive exposure.

Сbaserobots: User Experience and Interface Flaws

A smooth, intuitive UI is crucial for trader efficiency. Unfortunately, the Сbaserobots interface is clunky, displays outdated charts, and lacks customization. Features such as direct market depth visualization, fast order entries, and one-click modifications are absent. This results in inefficiency, frustration, and missed trading opportunities.

Contrary to Marketing Claims

Сbaserobots promotional materials claim “consistent profit,” “zero downtime,” and “guaranteed signal accuracy.” Independent users, however, report inconsistent profitability, improvement needed in uptime, and erratic signal performance. These discrepancies between claims and reality undermine credibility.

Limited Educational and Training Support

Traders often begin without advanced knowledge. Yet, Сbaserobots offers minimal training content—no robust webinars, tutorials, or live support. This results in novice users relying entirely on automated tools they don’t understand. The lack of self-development materials is a glaring omission.

Regulatory and Legal Ambiguity Surrounding Сbaserobots

There is no clear indication of proper licensing or regulatory compliance for Сbaserobots. Users should verify whether their funds are held in a regulated environment. Absence of visible audits or legal documentation introduces serious uncertainty and potential risk.

Scam Red Flags You Should Notice

Some red flags indicate shaky trustworthiness: unusually high promises of returns, pushy sales follow-ups, and evasive answers to direct questions. For responsible traders, these alarms are hard to ignore. Scam-like behavior contradicts the principles of ethical broker services.

Verdict – Should You Use Сbaserobots?

To sum up, Сbaserobots has valid issues in execution speed, support quality, risk mechanisms, transparency, and regulatory clarity. Until these are addressed, the platform remains at best a high-risk choice for serious traders.

Stay Safe with Scam Insights from Invests.Finance