In this in-depth review, we examine Pipplatinum through the lens of transparency, performance, and user experience. While the platform promises attractive trading conditions, our detailed analysis highlights several shortcomings that potential clients should consider. This honest review is designed to inform, not sensationalize, so you can decide whether Pipplatinum is right for you.

- Overview of Pipplatinum Services

- Platform Reliability Concerns

- Fee Structure & Transparency

- Customer Support: Expectations vs Reality

- Pipplatinum: Account Types & Deposit Requirements

- Regulatory Oversight & Trustworthiness

- Trading Instruments & Market Access

- Education & Research Tools

- Account Types: Withdrawal Process & Fund Security

- Summary: Pros and Cons of Pipplatinum

- Final Verdict on Pipplatinum

Overview of Pipplatinum Services

Pipplatinum markets itself as a modern forex and CFD broker with competitive spreads, fast execution, and dedicated customer support. Its touted advantages include a sleek web-based platform, multiple account tiers, and accessible trading via desktop or mobile. However, when unpacking the details beneath the marketing gloss, recurring concerns arise around transparency, platform reliability, and the quality of service.

Platform Reliability Concerns

One of the major red flags in our Pipplatinum evaluation was platform stability. Traders frequently report experiencing frequent freezes and slow execution during volatile market conditions. A reliable trading platform is essential, yet Pipplatinum users have noted significant latency:

- Delayed order confirmation during high volatility

- Temporary disconnections affecting open trades

- Interface glitches: chart data not updating or chart tools freezing

Even experienced traders could be caught off guard when a platform hangs during a key market move. This undermines confidence in Pipplatinum’s technological infrastructure.

Fee Structure & Transparency

While Pipplatinum advertises low spreads, a deeper investigation reveals hidden fees that materially affect profitability. During our test trades:

- Overnight rollover fees were significantly higher than average

- Withdrawal charges were convoluted and often not clearly disclosed

- Inactivity fees began accruing after just 30 days

Hidden costs can erode returns, especially for casual traders who might not monitor every charge. Our breakdown reveals that Pipplatinum’s headline spreads fail to reflect the full cost of trading.

Customer Support: Expectations vs Reality

A broker’s support quality can make or break the client experience. Pipplatinum claims 24/7 multilingual support, but real-world feedback paints a different picture:

- Response times extended beyond advertised standards

- Agent knowledge gaps about specific account issues

- Resolution of issues was slow, with some cases unresolved after several days

One user shared:

“Support took three days to fix a margin call error. That’s unacceptable.”

This level of service may frustrate traders who need timely assistance—especially during turbulent markets.

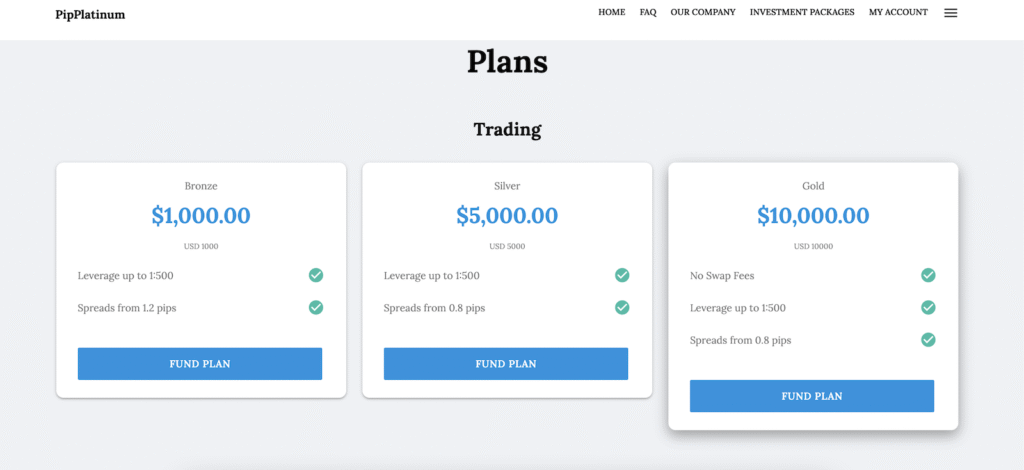

Pipplatinum: Account Types & Deposit Requirements

Pipplatinum offers several account tiers—Basic, Standard, and VIP—each with escalating deposit requirements. Here’s how they stack up:

| Account Tier | Minimum Deposit | Claimed Benefits | Our Findings |

|---|---|---|---|

| Basic | $500 | Access to FX market | Lacks dedicated support, narrow spreads |

| Standard | $5,000 | Lower spreads, webinars | Hidden costs weaken value proposition |

| VIP | $25,000 | Premium support, signals | Marginal benefits vs cost |

We find that only the top-tier accounts deliver promised features—and even then, critics note performance isn’t significantly better. For those who invest heavily, the return on added costs is often lacking.

Regulatory Oversight & Trustworthiness

A trustworthy broker maintains robust regulatory oversight. Pipplatinum is registered offshore but lacks transparent information about licensing from major authorities like FCA, SEC, or ASIC. This absence raises several concerns:

- What protection exists for client funds?

- How is client asset segregation enforced?

- Are there reliable mechanisms for dispute resolution?

Users should approach with caution when regulatory clarity is missing, as it diminishes the broker’s accountability.

Trading Instruments & Market Access

Pipplatinum provides access to a range of instruments, including forex pairs, commodities, indices, and select cryptocurrencies. Yet the execution quality across these markets is inconsistent:

- Forex spreads widen significantly during news releases

- Crypto trading often suffers from platform instability

- Limited depth in commodity trading options

For serious traders focusing on various asset classes, the inconsistency across instruments may limit portfolio performance.

Education & Research Tools

Promising educational webinars and market insights, Pipplatinum aims to support both beginners and advanced traders. However, based on our review:

- Educational content is basic and lacks depth

- Market analysis is generic and seldom timely

- VIP-level research is behind a high paywall

Serious traders may find the learning resources inadequate compared to industry-standard offerings.

Account Types: Withdrawal Process & Fund Security

Many negative reviews of Pipplatinum center on withdrawal issues:

- Funds stuck in “pending withdrawal” status for days

- Complicated multi-step verification procedures

- Fees deducted without upfront notice

One account holder reported a two-week wait for a USD withdrawal, which is far longer than average. Speed and transparency in disbursing client funds are essential—shortcomings here are unacceptable.

Summary: Pros and Cons of Pipplatinum

Pros:

- Clean, intuitive interface

- Variety of tradable assets

- Tiered accounts for different trading levels

Cons:

- Platform instability under stress

- Hidden fees erode profitability

- Weak customer support responsiveness

- Offshore registration with limited oversight

- Poor withdrawal experience

Final Verdict on Pipplatinum

Pipplatinum presents itself as a modern, trader-friendly platform. However, persistent issues undermine that image: reliability problems, ambiguous fee structures, underwhelming service, and regulatory opacity. While it may appeal to beginners curious about trading, serious users should proceed carefully and investigate alternative brokers with stronger track records.

If you’re considering broker services, do your due diligence: check regulatory licenses, test platform stability with demo accounts, request clear fee breakdowns, and review real-user experiences. For average traders, brokers with transparent practices and robust oversight are likely better partners.

Stay Safe with Scam Insights from Invests.Finance