In the vast world of online trading platforms, PinnacleAssetsTRD has emerged as a name that warrants caution. While the platform offers enticing features like raw spreads and a wide range of tradable instruments, a closer inspection reveals several red flags that potential investors should be aware of.

PinnacleAssetsTRD: Lack of Regulatory Oversight

One of the most glaring concerns with PinnacleAssetsTRD is its lack of regulation. The Financial Conduct Authority (FCA) in the UK has issued warnings against similar entities, such as Pinnacle Assets and Pinnacle Asset, for operating without proper authorization. This absence of regulatory oversight means that investors have no legal recourse if issues arise.

Transparency Issues

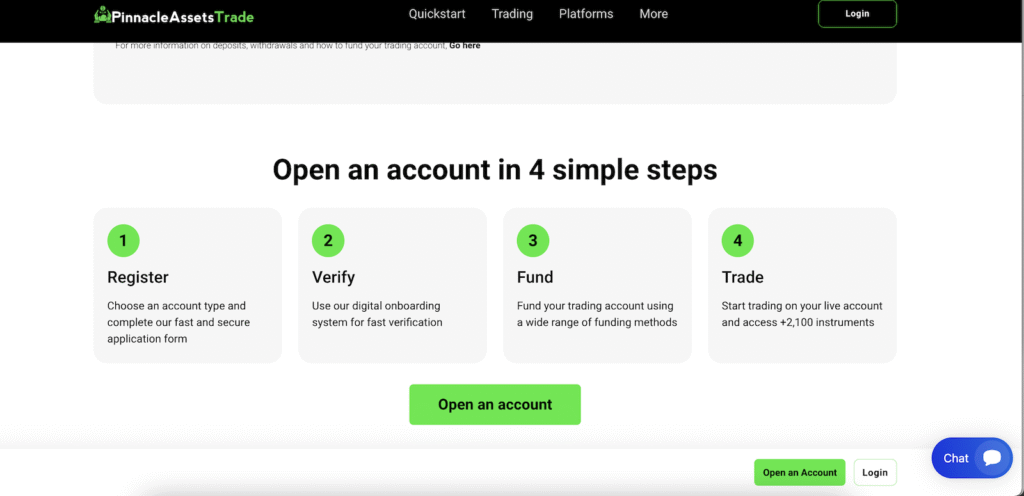

Transparency is a cornerstone of trust in the financial industry. However, PinnacleAssetsTRD falls short in this regard. The platform provides limited information about its team, operational history, and regulatory status. Such opacity can be a significant deterrent for potential investors seeking clarity and assurance.

PinnacleAssetsTRD: Customer Feedback and Reputation

Customer reviews and feedback play a pivotal role in assessing the credibility of a trading platform. Unfortunately, PinnacleAssetsTRD has garnered negative reviews across various forums. Users have reported difficulties in withdrawing funds, lack of responsive customer support, and issues with account verification. These concerns highlight the platform’s potential risks and the challenges investors may face.

Promises vs. Reality

PinnacleAssetsTRD advertises features like zero-pip spreads and high leverage, which can be appealing to traders. However, such promises often come with hidden costs or conditions that are not immediately apparent. Investors should approach such claims with skepticism and thoroughly review the platform’s terms and conditions before committing.

Conclusion on PinnacleAssetsTRD

While PinnacleAssetsTRD presents itself as a competitive trading platform, the lack of regulation, transparency issues, and negative customer feedback raise significant concerns. Potential investors are advised to exercise caution and consider alternative platforms with established reputations and regulatory oversight.

Stay Safe with Scam Insights from Invests.Finance