In the ever-evolving landscape of financial services, Oskar Finance has emerged as a platform offering investment opportunities, particularly in the realm of cryptocurrency. While the company presents itself as a regulated entity with a focus on automated trading and personalized account management, a closer inspection reveals several areas of concern.

Oskar Finance: Lack of Regulatory Oversight

One of the most glaring issues with Oskar Finance is its apparent lack of regulation. Despite claims of being an “authorized and regulated brokerage,” there is no verifiable information available to substantiate these assertions. The absence of regulatory oversight poses significant risks to investors, as it implies a lack of accountability and legal protection.

Transparency Concerns

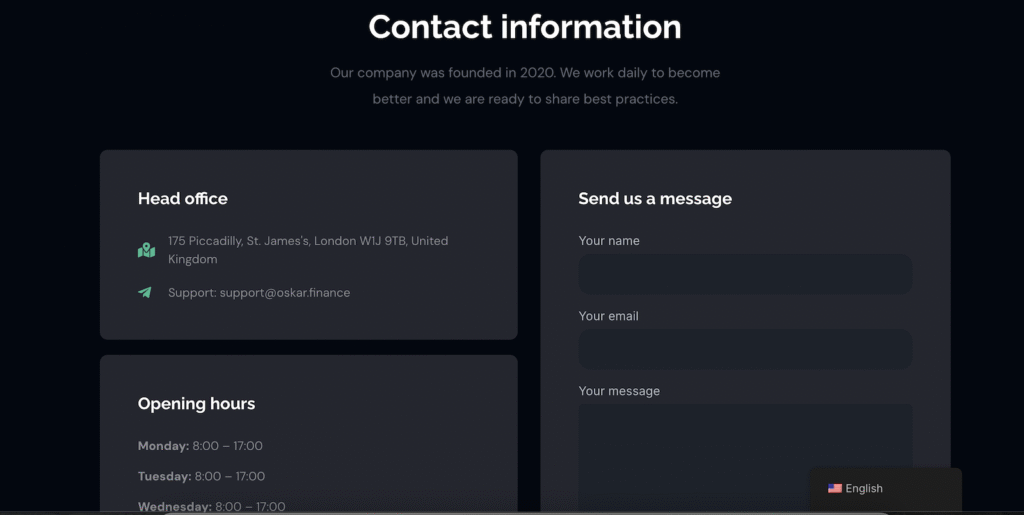

Transparency is a cornerstone of trust in financial services. However, Oskar Finance’s website offers limited information about its team, operational processes, and financial credentials. This lack of transparency raises questions about the company’s legitimacy and its commitment to providing clear and honest information to its users.

Customer Service Challenges

Effective customer support is crucial for addressing client concerns and fostering trust. Unfortunately, numerous reviews indicate that Oskar Finance’s customer service is lacking. Users have reported difficulties in reaching support, with some experiencing long response times and unhelpful interactions. This inadequate customer service exacerbates the challenges faced by investors seeking assistance.

Withdrawal Issues

A particularly troubling aspect of Oskar Finance’s operations is the reported difficulty users face when attempting to withdraw funds. Numerous accounts detail delays and complications in processing withdrawal requests, with some users waiting weeks or even months to access their money. Such issues are indicative of potential liquidity problems and raise serious concerns about the company’s financial practices.

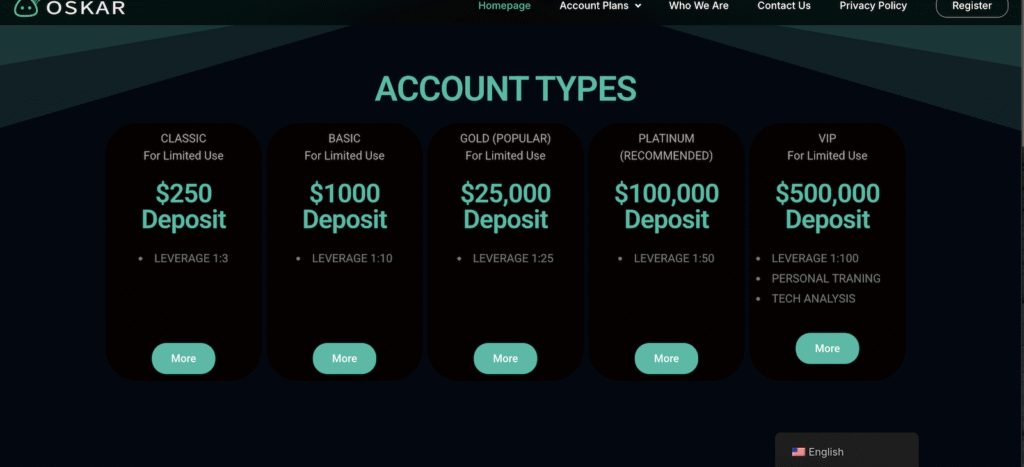

Questionable Marketing Practices

Oskar Finance employs aggressive marketing tactics, including promises of high returns and personalized account management. While these strategies may attract potential investors, they often lead to unrealistic expectations. When these expectations are not met, clients may feel misled and dissatisfied with the services provided.

Conclusion on Oskar Finance

While Oskar Finance presents itself as a modern and innovative financial platform, a thorough examination reveals several significant concerns. The lack of regulatory oversight, transparency issues, inadequate customer service, withdrawal complications, and questionable marketing practices collectively paint a picture of a company that may not be fully committed to the best interests of its clients. Potential investors are advised to exercise caution and consider these factors before engaging with Oskar Finance.

Stay Safe with Scam Insights from Invests.Finance