In the rapidly evolving world of online trading, platforms like Orderflow Copytrading have emerged, promising users the ability to mirror expert trades and achieve financial success. While the concept of copy trading is appealing, a closer examination of Orderflow Copytrading reveals several concerns that potential investors should consider before committing their funds.

Understanding Orderflow Copytrading

Orderflow Copytrading positions itself as an innovative platform designed to democratize stock trading, making it accessible to individuals from all walks of life. The platform offers a range of trading options, including futures, stocks, forex, and oil and gas stock trading. It emphasizes features such as a user-friendly interface, integrated signals with purported 87% accuracy, and a variety of trading indicators.

Regulatory Oversight and Security Measures

One of the primary considerations for any trading platform is its regulatory status. Orderflow Copytrading claims to be regulated by the Seychelles Financial Services Authority (FSA) with Securities Dealer’s license number SD018. However, it’s important to note that the FSA’s regulatory standards may differ from those of more established financial authorities. Investors should exercise caution and conduct thorough due diligence when dealing with platforms regulated in jurisdictions with less stringent oversight.

In terms of security, the platform mentions the implementation of two-factor authentication (2FA) to protect user accounts and transactions. While 2FA is a standard security measure, the overall effectiveness of the platform’s security protocols remains unclear without independent verification.

Transparency and Customer Support Concerns

Transparency is crucial in the financial services industry. Orderflow Copytrading provides limited information about its founding team and operational history. The absence of detailed background information can make it challenging for potential users to assess the credibility and expertise of the individuals behind the platform.

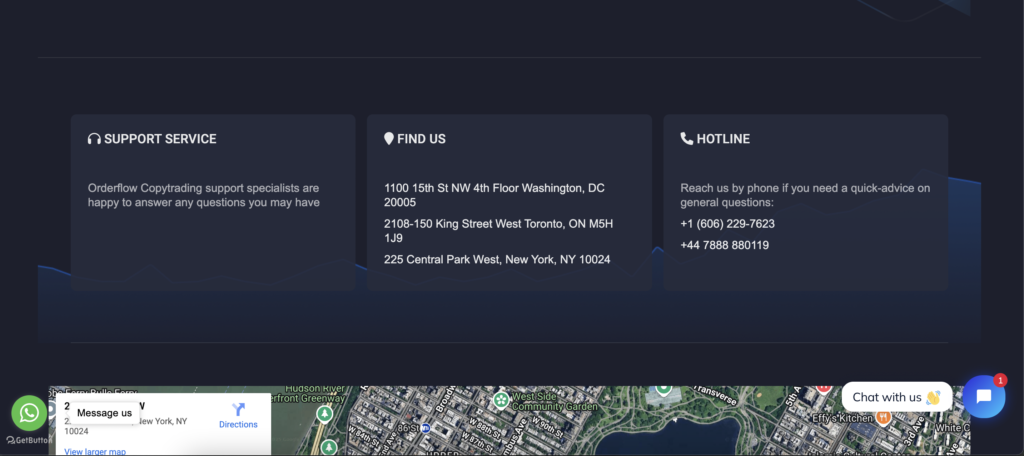

Customer support is another area of concern. Effective communication channels and responsive support are vital for user confidence, especially in financial trading platforms where timely assistance can be critical. The platform’s website lacks clear information on customer support availability, response times, and methods of contact, which may leave users feeling uncertain about where to turn for help.

User Feedback and Market Reputation

Assessing user feedback is essential when evaluating any trading platform. However, there is a notable scarcity of independent reviews and testimonials for Orderflow Copytrading on reputable third-party websites. This lack of user-generated content makes it difficult to gauge the experiences of actual users and raises questions about the platform’s market presence and reputation.

In contrast, other platforms with similar names, such as orderflows.com, have received negative reviews regarding customer support and product performance. For instance, users have reported issues with unresponsive customer service and problems with software functionality. While these reviews pertain to a different entity, they highlight the importance of thorough research and caution when engaging with online trading platforms.

Educational Resources and Tools

Orderflow Copytrading claims to offer a wealth of educational resources aimed at empowering traders with the knowledge needed to navigate the stock market. However, the depth, quality, and accessibility of these resources are not clearly detailed on the website. Effective educational materials are essential for traders to make informed decisions, and the lack of transparency in this area may hinder users’ ability to fully utilize the platform’s offerings.

Conclusion about the Orderflow Copytrading

While Orderflow Copytrading presents itself as an innovative solution for individuals seeking to engage in copy trading, several factors warrant caution. The platform’s regulatory environment, limited transparency regarding its team and operations, unclear customer support structures, and the absence of independent user feedback collectively raise red flags. Potential investors are advised to conduct comprehensive research, seek out platforms with robust regulatory oversight and transparent operations, and consider the availability of responsive customer support before committing their funds to any trading platform.