In the ever-evolving world of online investment platforms, Opulet Wealth presents itself as a promising avenue for investors seeking high returns across various sectors. However, upon closer inspection, several aspects of the platform raise concerns regarding its legitimacy and operational transparency. This article delves into a comprehensive analysis of Opulet Wealth, highlighting potential red flags that prospective investors should consider.

Opulet Wealth: Company Overview

Opulet Wealth claims to be a seasoned investment firm with over a decade of experience, offering services in diverse sectors such as oil and gas, real estate, agriculture, cryptocurrency trading, mining, loans, and NFTs. The platform boasts a global clientele and emphasizes its commitment to maximizing investor capital through strategic investments.

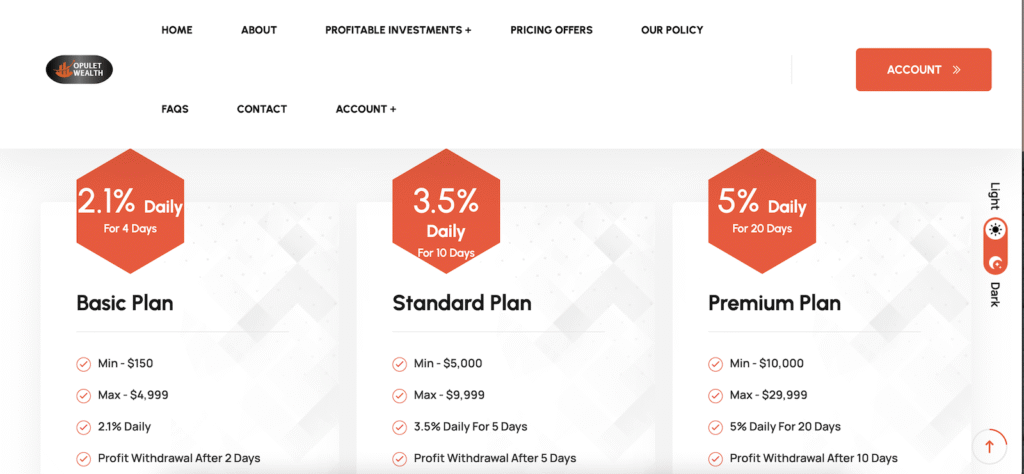

Investment Plans and Promises

The platform offers several investment plans with daily returns ranging from 2.1% to 7%, depending on the amount invested. For instance, the “Representative Plan” promises a 7% daily return for 30 days with a minimum investment of $30,000. Such high returns are often indicative of high-risk ventures, and it’s crucial to assess the underlying assets and strategies before committing substantial funds.

Lack of Regulatory Oversight

One of the most glaring issues with Opulet Wealth is the absence of regulatory oversight. The platform does not provide any information regarding its registration with financial authorities or adherence to investment regulations. This lack of transparency is a significant concern, as legitimate investment firms are typically registered with relevant regulatory bodies to ensure compliance with financial laws and to protect investors.

Unverifiable Claims and Testimonials

Opulet Wealth showcases testimonials and success stories on its website, claiming to have completed over 89,000 investments and served 794,000 clients worldwide. However, these figures lack verifiable sources or third-party validation. The absence of independent reviews or testimonials from reputable sources further casts doubt on the authenticity of these claims.

Opulet Wealth: Red Flags in Business Practices

Several aspects of Opulet Wealth’s operations raise concerns:

- High-Pressure Sales Tactics: The platform encourages immediate investments with promises of quick returns, which is a common tactic used by fraudulent schemes.

- Referral Commission Structure: Offering a 5% referral commission can incentivize users to recruit others, potentially leading to a pyramid-like structure rather than a sustainable investment model.

- Limited Withdrawal Options: The platform specifies that users cannot deposit an amount equal to or less than their previous withdrawal, which can complicate the withdrawal process and may lead to delays or issues when attempting to access funds.

Domain Age and Ownership

The domain “opuletwealth.com” was registered in December 2024, making it less than a year old. Newly registered domains can sometimes be indicative of platforms that may not have a long-term commitment to their operations. Additionally, the domain registration details are obscured, which is a common practice among entities seeking to maintain anonymity.

Conclusion on Opulet Wealth

While Opulet Wealth presents itself as a lucrative investment opportunity, the lack of regulatory oversight, unverifiable claims, and questionable business practices warrant caution. Prospective investors should exercise due diligence, seek independent financial advice, and consider the risks associated with high-return investment platforms before making any commitments.

Stay Safe with Scam Insights from Invests.Finance