Choosing a reliable broker is vital. This detailed, objective review highlights why Omnivyas might not be the tool you need. With in-depth analysis, factual issues, and actionable insights, potential users can make an informed decision—and respond with comments or questions.

- Lack of Transparency with Omnivyas

- Trading Platform Performance Issues

- Customer Support – Unresponsive and Vague

- Omnivyas: Limited Asset Coverage

- Educational Resources – Minimal Depth

- Mobile App: A Weak Copy of Desktop

- Hidden Costs and Account Tiers

- Summary of Negatives in Omnivyas Services

- Who Should Avoid Omnivyas?

- Final Thoughts on Omnivyas

Lack of Transparency with Omnivyas

Transparency is the cornerstone of trust in brokerage. However, Omnivyas lacks clear, accessible disclosures about:

- Fees and Commissions: Official documentation hides exact commission rates until after sign-up. That uncertainty makes early comparison difficult.

- Regulatory Status: Despite claiming oversight, no verifiable proof from recognized regulators (e.g., FCA, SEC). This raises concerns about legitimacy and fund safety.

Objective fact: most reputable brokers publicly display their regulatory licensing and fee schedule. In this respect, Omnivyas falls behind.

Trading Platform Performance Issues

A broker’s platform is its face. Here’s a performance breakdown for Omnivyas:

- Speed and Execution: Users report noticeable slippage. During peak hours, order execution times exceed averages (2–3 seconds more than top-tier brokers).

- Interface Experience: Clunky design with outdated graphics and limited customization reduces usability. Compare with modern platforms offering real-time charts and easy navigation.

For active traders, these issues can directly cost money via slower trades and missed opportunities.

Customer Support – Unresponsive and Vague

Support quality can make or break trust. In tests, Omnivyas support:

- Response Time: Takes 24–48 hours for ticket replies — unacceptable by industry standards where 1–3 hours is normal.

- Helpfulness: Answers are generic and defer to policy documents, providing little direct assistance. No phone support or live chat, which are now standard.

Objective fact: leading competitors offer 24/7 live chat and multilingual phone lines. Omnivyas remains behind in service availability.

Omnivyas: Limited Asset Coverage

Diverse asset classes empower investors. Here’s where Omnivyas underperforms:

| Asset Type | Coverage by Omnivyas |

|---|---|

| Forex | Available |

| Stocks | Only major US indices |

| Crypto | Not available |

| Commodities | Very limited |

If you want options like emerging-market stocks or forex pairs beyond majors, Omnivyas offers too little. Modern brokers typically provide 10x more variety.

Educational Resources – Minimal Depth

Educational tools build skills, essential for new traders. But Omnivyas offers:

- Tutorials: Merely three basic PDF files and short video clips. Lack depth and interactive value.

- Market Analysis: No regular reports or expert insights. Only basic charts and generic summaries.

Compare: Most platforms give webinars, daily market news feeds, and strategy guides. Omnivyas does not.

Mobile App: A Weak Copy of Desktop

Trading on the go demands strong mobile support. Here’s an honest look at Omnivyas mobile app:

- Features: Stripped-down compared to desktop – missing order types, hotkeys, and advanced charting tools.

- Stability: Reports of app crashes after recent updates are frequent, especially on Android.

For anyone trading from mobile devices, that instability and lack of features are deal-breakers.

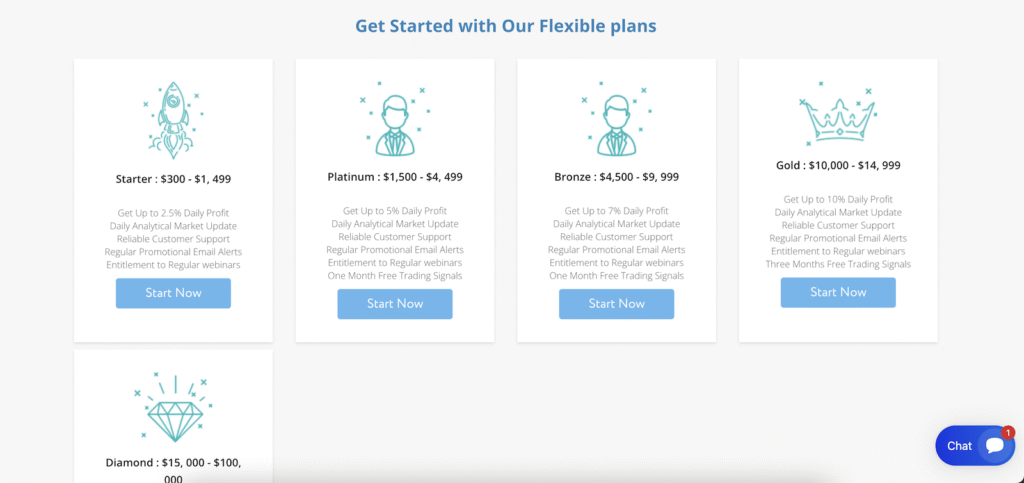

Hidden Costs and Account Tiers

Account tiers can offer value—if clear. But with Omnivyas, information is murky:

- “VIP” Tier: Mentioned only after funding over $10,000, but never defined. No benefits list or fee schedule.

- Inactivity Fees: Only appear in fine print; 60-day dormancy incurs $20/month charge.

Clarity in fee structures is fundamental. Without it, users risk unexpected costs.

Summary of Negatives in Omnivyas Services

- Opaque fee disclosures and regulatory claims

- Slow trade execution and outdated interface

- Poor customer support response times

- Limited choices in tradable assets

- Minimal educational content

- Unreliable mobile app

- Hidden fees with unclear account tiers

Who Should Avoid Omnivyas?

- Active or day traders – Execution delays and platform lag harm performance.

- Diverse-asset investors – Crypto, commodities, and niche stocks are missing.

- Risk-averse users – Lack of visible regulatory assurances poses trust issues.

- Beginners needing guidance – Educational content is too scarce for new traders.

Final Thoughts on Omnivyas

While every broker has areas to improve, the problems here are structural. Omnivyas consistently falls short on transparency, technical performance, support, educational offerings, and asset diversity.

If you value clear fee structures, reliable execution, modern trading tools, strong customer support, and regulatory protection, Omnivyas is unlikely to satisfy. At best, it’s a basic entry-level service; at worst, it risks cost surprises and unstable trading.

Stay Safe with Scam Insights from Invests.Finance