When evaluating Nexus investment, it’s essential to recognize both the promise and the pitfalls this online broker platform presents. This honest review takes a deep dive into the services behind Nexus investment, scrutinizes user experience, and highlights key issues that potential clients need to know before signing up.

- What is Nexus Investment?

- Registration and Compliance Concerns

- Usability and Platform Performance

- Nexus investment: Fees and Account Funding Transparency

- Customer Support and Responsiveness

- Asset Range and Trading Instruments

- Nexus investment: Security and Fund Protection

- Educational Resources and Tools

- Nexus investment: Withdrawal Process Examination

- Summary of Key Issues

- Final Verdict: Does Nexus Investment Deserve Trust?

What is Nexus Investment?

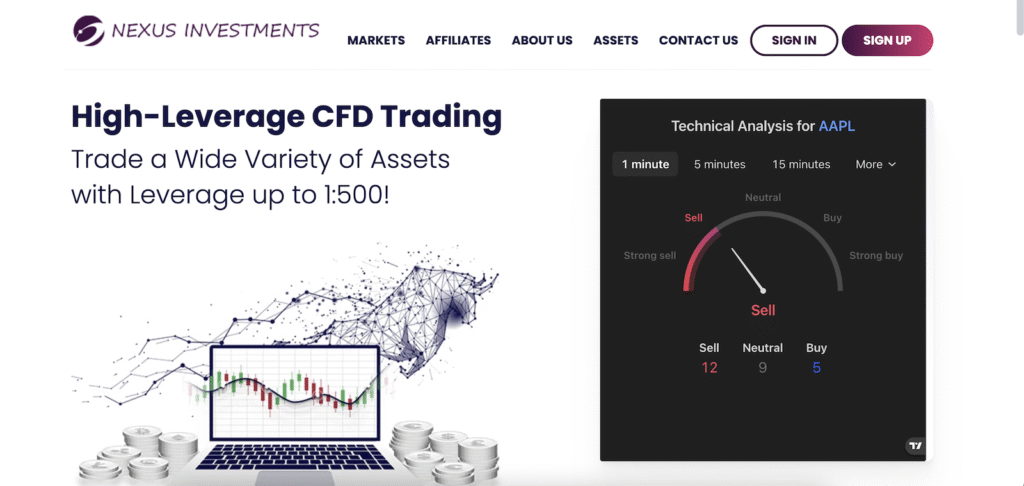

Nexus investment positions itself as a versatile broker service offering access to stocks, forex, cryptocurrencies, and commodities. The platform claims advanced trading tools, responsive support, and competitive spreads. Still, our assessment surfaces several red flags that contradict these assertions.

Registration and Compliance Concerns

Signing up with Nexus investment is quick, but the verification process often shows delays—sometimes taking days without clear updates. This is troubling for users who expect timely access to funds. Moreover, Nexus investment does not mention registration with major financial regulators like FCA, SEC, or ASIC. The absence of such credentials questions the transparency and safety of client funds.

Usability and Platform Performance

On paper, Nexus investment offers a web-based trading terminal with charting tools and order-management features. In practice, the interface can be clunky and sluggish. Many users report frequent lags when opening positions and occasional platform freezes during high volatility. For active traders, this poses considerable execution risk.

Nexus investment: Fees and Account Funding Transparency

Although Nexus investment advertises low spreads, hidden fees erode transparency. Withdrawal charges, inactivity penalties, and platform fee structures are not clearly detailed beforehand. This lack of clarity forces users to discover the fees later—often after noticing deductions in their account. Such insufficient disclosure undermines trust.

Customer Support and Responsiveness

Nexus investment boasts 24/7 support via live chat and email. Yet, testing these channels revealed inconsistent response times. Chat support often replies with generic scripts, and email queries sometimes go unanswered for 48 hours. For users who need prompt assistance, this level of support is unsatisfactory.

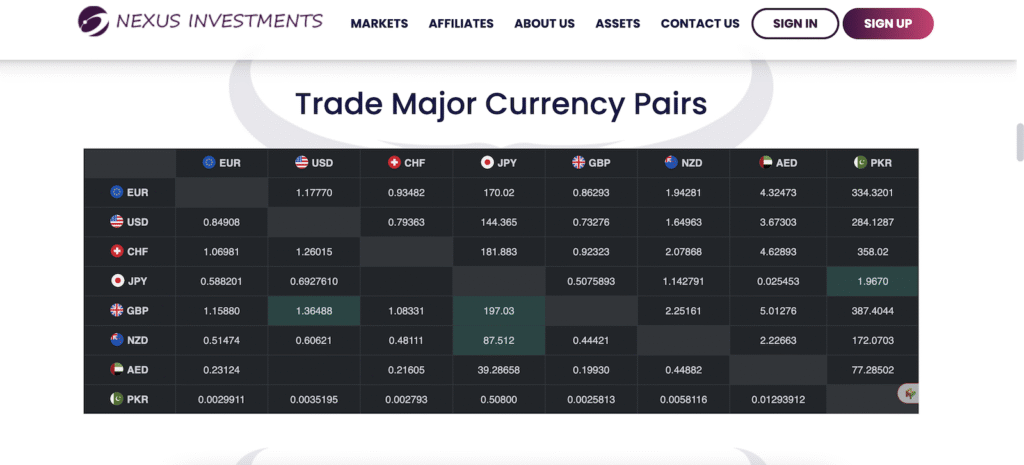

Asset Range and Trading Instruments

The Nexus investment platform promotes a wide array of instruments—stocks, indices, crypto, and forex pairs. However, the selection within each asset class is limited. Forex offerings exclude exotic pairs, and equities are restricted to only a handful of major markets. Additionally, crypto access is limited to top-tier coins, ignoring emerging altcoins often sought by active traders.

Nexus investment: Security and Fund Protection

Security measures at Nexus investment include SSL-encryption and two-factor authentication. However, without disclosure of fund segregation or deposit protection, it’s unclear whether client funds are held separately from company capital. The absence of these critical details raises concerns that Nexus investment may not adequately guard clients’ money.

Educational Resources and Tools

While Nexus investment purports to support trader education with webinars and tutorials, the actual content is sparse and dated. Webinars are infrequent, and tutorial articles often rehash generic topics like “What is forex?” rather than providing insights into strategy or market analysis. Users seeking actionable learning resources will likely feel disappointed.

Nexus investment: Withdrawal Process Examination

A key red flag in our Nexus investment review is the withdrawal process. Though listed as “fast,” many users report withdrawal requests taking five to seven business days, plus extra delays when additional documentation is required. Handling KYC is standard, but the prolonged delays and withholding of withdrawal details are worrisome.

Summary of Key Issues

| Concern | Description |

|---|---|

| Regulation | No mention of oversight by recognized regulators |

| Hidden Fees | Undisclosed charges erode trust |

| Platform Stability | Lags and freezes hamper execution |

| Customer Support | Slow, generic responses |

| Limited Assets | Narrow range compared to competitors |

| Withdrawal Delays | Requests stalled by lack of transparency |

Final Verdict: Does Nexus Investment Deserve Trust?

Considering the above, Nexus investment falls short of expectations for a reputable broker. Lack of regulatory compliance, poor fee disclosure, technical issues, and subpar customer service should alarm serious traders and investors. Without addressing these fundamental concerns, Nexus investment remains a high-risk choice.

Have you had experience with Nexus investment—positive or negative? Share your story in the comments below. If you’re considering signing up, weigh the drawbacks carefully and compare alternatives with strong regulatory oversight and transparent practices.

Stay Safe with Scam Insights from Invests.Finance