In finance, trust and regulation are crucial. For brokerage services, understanding the regulatory body is vital. In Singapore, the Monetary Authority of Singapore (MAS) stands as a formidable institution. This review explores the key role of the Monetary Authority of Singapore – MAS – www.mas.gov.sg in protecting investors and maintaining market integrity.

- The Mandate of the Monetary Authority of Singapore – MAS – www.mas.gov.sg

- Monetary Policy and Economic Growth

- Financial Regulation and Supervision

- Developing Singapore as a Financial Centre

- Prudential Oversight and Market Conduct

- Safeguarding Your Investments: How the Monetary Authority of Singapore (MAS) Protects Investors

- Rigorous Licensing and Due Diligence

- Mandated Segregation of Client Funds

- Strict Capital Requirements

- High Conduct and Disclosure Standards

- Combating Financial Crime: AML and CFT Measures

- Proactive Enforcement Actions

- The Mechanics of Regulation: Licensing and Compliance Under the Monetary Authority of Singapore (MAS)

- Key Aspects of Licensing and Ongoing Compliance

- The Impact on Brokerage Services: Why MAS Regulation Matters for You

- Verifying Your Broker: Leveraging the Resources of the Monetary Authority of Singapore – MAS – www.mas.gov.sg

- Conclusion: Your Trusted Path in Finance, Guided by the Monetary Authority of Singapore (MAS)

The Mandate of the Monetary Authority of Singapore – MAS – www.mas.gov.sg

The Monetary Authority of Singapore (MAS) serves as Singapore’s central bank and integrated financial supervisor. Established in 1971, it unified monetary and financial functions previously handled by various departments. This consolidation was key to Singapore becoming a global financial center.

The core mandate of the Monetary Authority of Singapore – MAS – www.mas.gov.sg includes:

Monetary Policy and Economic Growth

MAS formulates and implements monetary policy. Its goal is to promote sustained, non-inflationary economic growth. This involves managing exchange rates and central bank operations.

Financial Regulation and Supervision

Furthermore, the Monetary Authority of Singapore (MAS) directly impacts brokerage services. MAS supervises and regulates all Singaporean financial institutions. This includes banks, insurers, capital market intermediaries, and financial advisors. Its oversight ensures a stable financial services sector.

Developing Singapore as a Financial Centre

Beyond regulation, the Monetary Authority of Singapore – MAS – www.mas.gov.sg actively develops Singapore’s financial sector. This involves fostering innovation, developing infrastructure, and enhancing industry skills.

Prudential Oversight and Market Conduct

Finally, MAS ensures financial institutions are sound and manage risks effectively. It also promotes sound market conduct and investor education. This creates fair and transparent dealings.

Safeguarding Your Investments: How the Monetary Authority of Singapore (MAS) Protects Investors

Choosing an MAS-regulated broker offers robust investor protection. MAS uses a multi-faceted approach to shield investors.

Rigorous Licensing and Due Diligence

Any entity operating as a broker in Singapore must obtain a license from the Monetary Authority of Singapore (MAS). This rigorous process assesses financial soundness and management integrity. Only credible firms gain entry.

Mandated Segregation of Client Funds

MAS regulations mandate that brokers segregate client funds. Your investment funds are held separately from the broker’s operational capital. This means funds are safe from the broker’s insolvency or creditors. It provides significant security.

Strict Capital Requirements

The Monetary Authority of Singapore – MAS – www.mas.gov.sg imposes stringent capital requirements on financial institutions. These ensure brokers maintain sufficient capital. This helps them absorb losses and meet client obligations, even in adverse markets.

High Conduct and Disclosure Standards

MAS sets high standards for market conduct. This includes transparent fees, fair order execution, and clear risk disclosure. Brokers must provide comprehensive information. This helps investors make informed decisions and avoid hidden charges.

Combating Financial Crime: AML and CFT Measures

The Monetary Authority of Singapore (MAS) actively combats financial crime. It implements robust Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies. These measures ensure the integrity and stability of the financial system, indirectly protecting legitimate investors.

Proactive Enforcement Actions

The Monetary Authority of Singapore – MAS – www.mas.gov.sg has broad investigative powers. It monitors compliance and takes swift action against breaches. Penalties, prohibition orders, and legal action underscore MAS’s commitment to standards. Recent MAS actions against institutions for AML breaches prove this commitment.

The Mechanics of Regulation: Licensing and Compliance Under the Monetary Authority of Singapore (MAS)

For brokerage firms, navigating MAS regulations is essential. Licensing requirements depend on the broker’s activities. Brokers dealing in capital market products or providing financial advisory services typically need a Capital Market Services (CMS) Licence or a Financial Advisers (FA) Licence from the Monetary Authority of Singapore (MAS).

Key Aspects of Licensing and Ongoing Compliance

- Fit and Proper Criteria: All applicants, including the firm and its key personnel, must demonstrate competence, integrity, and financial soundness.

- Operational Resilience: Brokers need robust internal controls, risk management, and business continuity plans. This ensures operational stability and protects client assets.

- Reporting Obligations: Licensed entities report regularly to the Monetary Authority of Singapore (MAS). This includes financial statements and compliance reports, allowing MAS continuous monitoring.

- Ongoing Supervision and Inspections: The Monetary Authority of Singapore – MAS – www.mas.gov.sg conducts periodic inspections. This helps identify and resolve issues early.

- Technology and Cybersecurity Focus: MAS emphasizes cybersecurity due to increased digitization. Brokers must implement strong measures to protect against cyber threats and data breaches.

The Impact on Brokerage Services: Why MAS Regulation Matters for You

Choosing an MAS-regulated broker offers distinct advantages for investors.

- Enhanced Security of Funds: Client fund segregation and strong capital requirements provide high security for your investments.

- Fair and Transparent Practices: MAS rules promote transparency in fees and fair trading practices. This builds confidence.

- Access to a Reputable Financial Hub: MAS-regulated brokers operate within a globally respected financial ecosystem. This often means access to diverse products and advanced platforms.

- Effective Dispute Resolution: The Monetary Authority of Singapore – MAS – www.mas.gov.sg provides clear avenues for resolving disputes. This ensures fair and impartial grievance handling.

- Confidence and Trust: Trading with an MAS-regulated broker instills confidence. Knowing the Monetary Authority of Singapore – MAS – www.mas.gov.sg oversees operations allows you to focus on your strategy.

Verifying Your Broker: Leveraging the Resources of the Monetary Authority of Singapore – MAS – www.mas.gov.sg

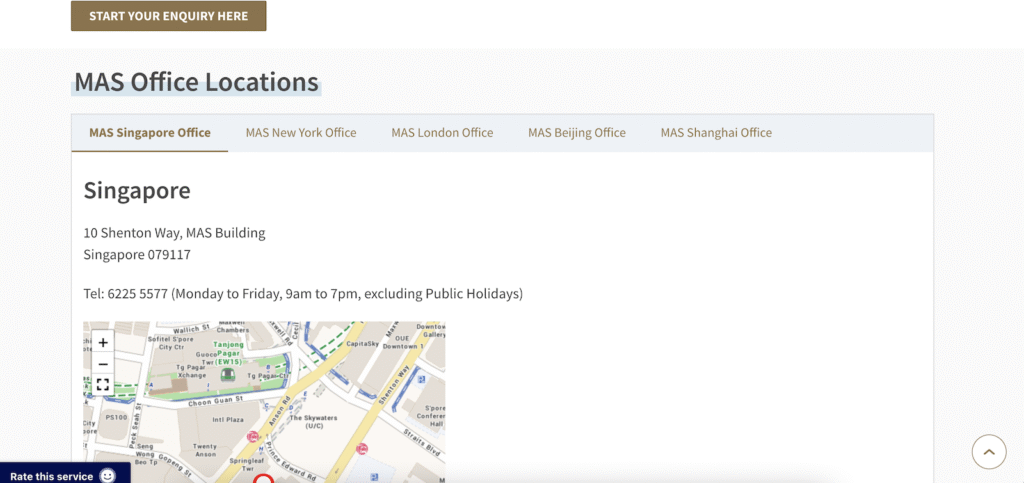

Always verify a broker’s regulatory status. The Monetary Authority of Singapore – MAS – www.mas.gov.sg offers accessible resources.

- Financial Institutions Directory: The official MAS website, www.mas.gov.sg, lists all regulated financial institutions. Use it to confirm your broker’s license.

- Register of Representatives: MAS maintains this register for individuals performing regulated activities. Verify the person you are dealing with here.

- Investor Alert List: Check this list for entities wrongly perceived as MAS-licensed. This helps identify potential scams.

Always use the official website, www.mas.gov.sg, for verification. Do not trust claims that cannot be substantiated officially.

Conclusion: Your Trusted Path in Finance, Guided by the Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore – MAS – www.mas.gov.sg showcases Singapore’s commitment to a robust financial sector. Its framework, licensing, and supervision create a secure investor environment. For brokerage services, choosing an MAS-regulated firm is a prudent decision. It offers significant protection and builds confidence. The oversight of the Monetary Authority of Singapore – MAS – www.mas.gov.sg ensures a safer financial journey.