What Are Meme Coins?

Meme coins are a category of cryptocurrency inspired by internet memes, jokes, or viral content. Unlike Bitcoin or Ethereum, which were created to solve specific technological or financial problems, meme coins are often launched as a form of satire or social commentary. However, despite their humorous origins, some meme coins have achieved significant market capitalization and amassed large, loyal communities.

In essence, meme coins combine elements of pop culture, social media virality, and decentralized finance (DeFi). They often thrive on hype, online trends, and community engagement rather than underlying utility or technological innovation.

Key Characteristics of Meme Coins:

• Community-Driven: The value often depends on the enthusiasm of online communities rather than traditional market fundamentals.

• High Volatility: Prices can skyrocket or plummet based on memes, celebrity endorsements, or viral trends.

• Low Entry Barriers: Many meme coins are inexpensive, encouraging mass participation.

• Humorous Branding: Logos, names, and marketing materials typically reflect internet humor.

The Origins of Meme Coins

The history of meme coins dates back to 2013 with the creation of Dogecoin (DOGE). Software engineers Billy Markus and Jackson Palmer created Dogecoin as a joke, combining the popularity of Bitcoin with the viral “Doge” meme featuring a Shiba Inu dog and broken English captions like “such wow” and “much coin.”

Initially launched as a parody, Dogecoin quickly gained traction, thanks to its fun and friendly image. It became popular for tipping content creators online and even sponsored a NASCAR driver and a Jamaican bobsled team to the Winter Olympics.

Dogecoin’s rise proved that humor, community, and virality could coexist with financial speculation—and it laid the groundwork for future meme coins.

Notable Successful Meme Coins

While many meme coins have come and gone, a few have stood out due to massive community support, mainstream attention, or celebrity endorsements.

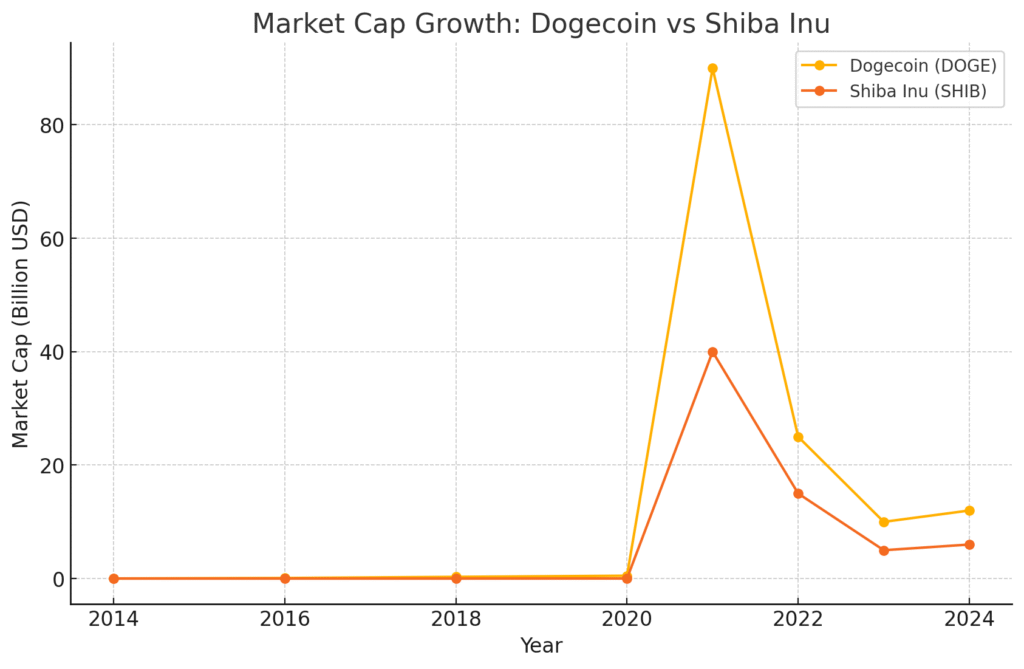

Dogecoin (DOGE)

• Launch Date: December 2013

• Highlight: In 2021, Dogecoin experienced a meteoric rise fueled by social media hype and tweets from Elon Musk, reaching an all-time high of $0.73.

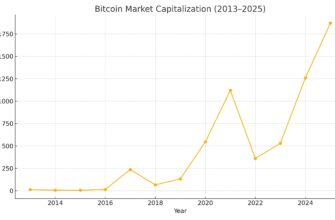

• Market Cap (2024): Still one of the top cryptocurrencies by market capitalization.

• Use Case: Tipping, donations, and general transactions.

Shiba Inu (SHIB)

• Launch Date: August 2020

• Highlight: Marketed as the “Dogecoin Killer,” Shiba Inu gained rapid popularity by leveraging DeFi trends and building its own decentralized ecosystem, including SHIBSwap and NFTs.

• Key Event: Listed on major exchanges like Binance and Coinbase, further boosting its visibility.

• Market Cap (2024): Remains within the top 20 cryptocurrencies.

Pepe (PEPE)

• Launch Date: April 2023

• Highlight: Inspired by the infamous “Pepe the Frog” meme, PEPE saw an explosive surge in price shortly after its launch, largely due to speculative trading and internet meme culture.

• Market Cap (Peak): Over $1 billion in just a few weeks after launch.

• Controversy: Criticized for having no real utility, but praised for showcasing the power of meme-driven markets.

Floki Inu (FLOKI)

• Launch Date: Mid-2021

• Highlight: Named after Elon Musk’s dog, Floki Inu combined meme appeal with a promise to create utility projects like Floki University (crypto education platform) and an NFT metaverse.

• Community Slogan: “Powered by the people.”

The Market Dynamics of Meme Coins

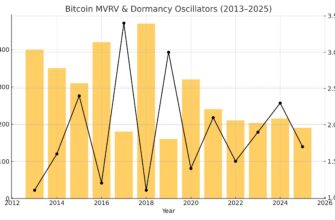

1. Speculation and Sentiment

Meme coins often rely more heavily on investor sentiment than fundamental analysis. Positive news, viral posts, or celebrity endorsements can lead to sudden spikes, while negative sentiment can trigger rapid sell-offs.

2. Community and Hype

The strength and dedication of the community are often the most critical factors. Reddit, Twitter, Discord, and Telegram play massive roles in coordinating buys, organizing campaigns, and pushing visibility.

3. Low Liquidity Risks

New or less established meme coins may suffer from low liquidity, leading to higher price manipulation risks and “rug pulls” where developers abandon the project after pumping the token price.

4. Accessibility

Because meme coins are usually cheap (e.g., fractions of a cent), retail investors are drawn to the possibility of huge percentage gains with small investments.

Meme Coin Success Factors

Despite their humorous roots, successful meme coins share several important attributes:

• A strong narrative: Dogecoin and Shiba Inu both told compelling stories around community and rebellion against “serious” financial projects.

• Celebrity or Influencer Endorsement: Elon Musk’s repeated support for Dogecoin undeniably played a key role in its mainstream success.

• Exchange Listings: Being listed on major crypto exchanges increases accessibility and legitimacy.

• Community Building: Projects that invest in building a vibrant, engaged community tend to outperform others.

Criticisms and Risks of Meme Coins

While the potential for high returns is tempting, meme coins carry considerable risks:

• Lack of Utility: Many meme coins offer no technological innovation or practical use case beyond speculation.

• Extreme Volatility: Investors can lose substantial amounts within hours if hype diminishes.

• Scams and Rug Pulls: The unregulated nature of meme coin projects leaves room for fraudulent activities.

• Market Saturation: Thousands of meme coins exist, but only a handful gain lasting traction.

The Future of Meme Coins

Meme coins have proven that community, culture, and humor can hold surprising power in financial markets. Going forward:

• Integration with DeFi: Some meme projects are branching into decentralized finance ecosystems (e.g., ShibaSwap).

• NFT and Metaverse Connections: Meme coins are increasingly tied to NFT markets and metaverse initiatives, opening new utility possibilities.

• Regulatory Scrutiny: As meme coins grow in influence, governments and regulators may impose tighter controls on their issuance and marketing.

Overall, while most meme coins will likely fade away, the concept has carved out a permanent place in the crypto world.

Final Thoughts

Meme coins are more than just jokes—they’re a phenomenon that combines internet culture, financial speculation, and grassroots marketing into an explosive package. Whether you’re a casual investor, a crypto enthusiast, or a seasoned trader, understanding the world of meme coins is essential in navigating the broader cryptocurrency ecosystem.

However, caution is paramount. Always research thoroughly, invest responsibly, and never underestimate the power—and danger—of a good meme.

FAQ About Meme Coins

What is the safest meme coin to invest in?

There is no completely “safe” investment in the cryptocurrency world, especially with meme coins. However, Dogecoin (DOGE) and Shiba Inu (SHIB) are considered relatively safer due to their established communities, higher liquidity, and listings on major exchanges. Still, investors should exercise caution and only invest what they can afford to lose.

Can you really make money with meme coins?

Yes, many investors have made significant profits with meme coins—especially early adopters. However, meme coins are highly volatile and can lose value rapidly. Timing, community sentiment, and market trends play huge roles in potential profits.

Why are meme coins so popular?

Meme coins combine humor, social media trends, and the hope of quick profits. Their low prices make them attractive to a broad audience, and online communities drive mass interest and adoption. Viral marketing is a key factor in their success.

What are the risks of investing in meme coins?

• Extreme price volatility

• Potential scams and rug pulls

• Lack of real-world utility

• Regulatory uncertainty

Investors should always perform their own research (DYOR) and beware of hype-driven markets.

How do meme coins gain value?

Meme coins gain value through:

• Social media hype and memes

• Celebrity endorsements

• Exchange listings

• Community-driven promotions

Unlike traditional assets, meme coins often lack intrinsic value and are highly speculative.