Maxitoptie (https://maxitoptier.com/) claims to be a leading online broker offering competitive spreads, versatile trading tools, and responsive support. It markets itself as ideal for both beginners and experienced traders. But beyond its glossy façade, many users report significant issues that question the true value of its services.

- Maxitoptie and Hidden Fees

- Platform Performance Issues

- Maxitoptie Customer Support: A Weak Link

- Regulatory Status: A Cause for Concern

- Maxitoptie Mobile Experience: Lacking Refinement

- Account Opening: Not as Smooth as Advertised

- Why Traders Abandon Maxitoptie

- Summary: Is Maxitoptie Right for You?

- Alternatives to Consider

- Final Thoughts on Maxitoptie

Maxitoptie and Hidden Fees

One of the most troubling aspects of Maxitoptie is its fee structure. Although the broker advertises low spreads, experienced users note unexpected charges:

- Withdrawal fees: Traders report being hit with flat-rate withdrawal charges, even when opting for standard bank transfers.

- Inactivity fees: Accounts left dormant for 30–60 days are automatically penalized, with up to $50 monthly deductions.

- Data or platform fees: Additional hidden charges apply for premium charts, real-time data, or API access—services many traders consider standard.

These surprise fees can add up, making Maxitoptie less affordable than competitors that are upfront about costs.

Platform Performance Issues

The trading platform provided by Maxitoptie promises speed and reliability. In practice, however:

- Latency problems: Users in Europe and North America report sluggish order execution during volatile market conditions.

- Frequent downtime: System updates are often unannounced and disrupt trading. Even scheduled maintenance lacks clear timeframes, causing frustration.

Such performance issues compromise the integrity of trading strategies and the trust traders place in the broker. If execution speed and stability matter to you, Maxitoptie may not deliver.

Maxitoptie Customer Support: A Weak Link

Customer service is a critical component of a reputable broker. Maxitoptie’s support system shows several flaws:

- Slow response times: Live chat delays exceed 24 hours at times. Emails receive generic replies.

- Inconsistent agent knowledge: Support staff frequently contradict information on spreads, margins, or documentation requests.

- Lack of escalation: There’s minimal follow-up or accountability when problems arise, leaving users stuck in back-and-forth loops.

A broker with subpar support can expose clients to stress and financial risk during critical moments.

Regulatory Status: A Cause for Concern

When evaluating any broker, regulatory oversight is paramount. Maxitoptie’s public-facing site makes no mention of a recognized financial authority. Investigations show:

- The broker is not registered with major regulators such as the UK’s FCA, Australia’s ASIC, Canada’s IIROC, or the US SEC.

- It appears to operate under a lightly regulated or offshore license, which limits protections for traders.

Without a strong regulatory framework, customers may struggle to resolve disputes or reclaim funds in worst-case scenarios.

Maxitoptie Mobile Experience: Lacking Refinement

Mobile trading is essential for modern investors. Yet Maxitoptie’s mobile app has several shortcomings:

- Unintuitive design: The user interface is cluttered and lacks customization.

- Missing features: Advanced charting tools and order types available on desktop are omitted from the mobile app.

- Frequent crashes: Several Android and iOS users reported app instability after recent updates.

Given the importance of mobile convenience, Maxitoptie’s inability to match its desktop experience is a serious drawback.

Account Opening: Not as Smooth as Advertised

Maxitoptie advertises a streamlined onboarding process. In reality:

- Verification delays: The KYC process can take weeks, with repetitive document requests.

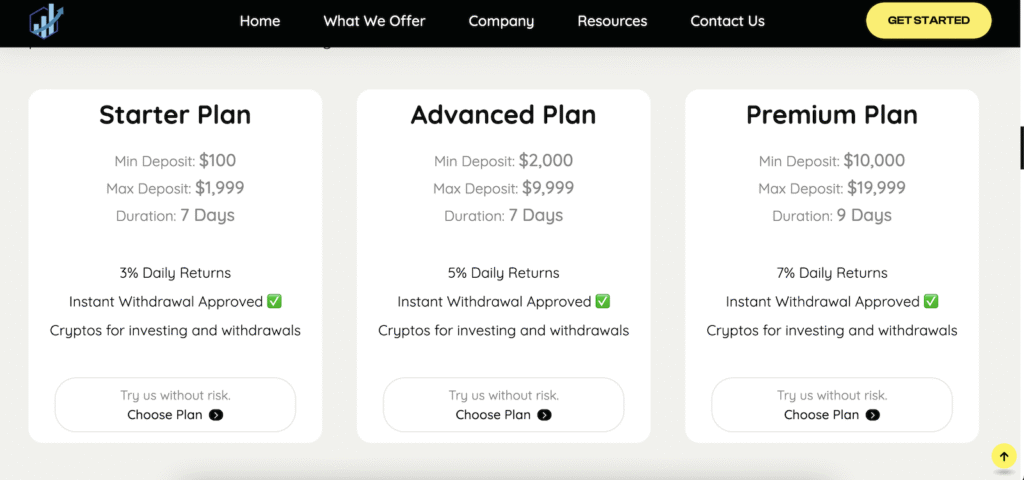

- Deposit limitations: Minimum deposits start low, but withdrawal thresholds are confusing and inconsistent.

- Account tiers unclear: Brokers usually define account types clearly—but Maxitoptie fails to outline what benefits (if any) come with each tier.

These gaps create friction for new traders and reduce confidence in the broker’s transparency.

Why Traders Abandon Maxitoptie

In community forums and social media channels, users frequently express regret after opening accounts with Maxitoptie. Common complaints include:

- “My withdrawal took 10 days and then they charged an extra fee.”

- “When I contacted support during a market spike, I got no response.”

- “They claim low spreads, but I pay a lot more in hidden costs.”

These voices illustrate why prospective traders should question Maxitoptie before entrusting their capital.

Summary: Is Maxitoptie Right for You?

To summarize:

| Category | Maxitoptie Rating |

|---|---|

| Fees | Poor – hidden charges |

| Platform | Unstable with downtime |

| Customer Support | Slow and unprofessional |

| Regulation | Light or absent oversight |

| Mobile Trading | Lacking and buggy |

| Onboarding Experience | Cumbersome and unclear |

Maxitoptie offers enticing marketing messages, but the real-world experience is inconsistent at best. If you value transparency, reliability, and regulated protections, investigating alternatives makes sense.

Alternatives to Consider

Before signing up, research other brokers with verified licenses, clear pricing, stable platforms, and solid support. User communities, financial watchdog listings, and independent review sites can be invaluable.

Final Thoughts on Maxitoptie

Maxitoptie may look compelling on paper, but a deeper dive reveals deficiencies in fees, platform performance, service quality, and regulatory safeguards. These weaknesses have prompted many traders to close accounts and look elsewhere.

If you’re seeking honest broker services, Maxitoptie may not live up to expectations. Use the comments below to share your experience with Maxitoptie or ask questions—your insight could help others navigate the complex world of online trading.

Stay Safe with Scam Insights from Invests.Finance