In the digital age, legal tech platforms like Justicefield claim to make financial and legal help more accessible, faster, and affordable. However, not all that glitters is gold. While the company presents itself as a streamlined legal and financial solution provider, we conducted a thorough analysis of Justicefield’s services, operations, and user feedback — and what we uncovered raises several concerns.

If you’re considering using Justicefield for legal representation, financial advice, or debt resolution, we strongly recommend reading this review first.

- What Is Justicefield?

- Justicefield: More Questions Than Answers

- Service Delivery: Is Justicefield Actually Helping?

- Poor Client Communication

- Questionable Legal Expertise

- Aggressive Sales Tactics

- Trust and Credibility: A Growing Concern

- Justicefield Alternatives Worth Considering

- Final Thoughts: Is Justicefield Worth Your Time?

What Is Justicefield?

Justicefield is an online platform that positions itself as a provider of legal and financial support services. According to its website, the company offers services including:

- Debt settlement

- Legal representation

- Credit consultation

- Bankruptcy guidance

- Contract disputes

At first glance, the site seems polished and promises fast solutions, low fees, and professional expertise. However, behind this slick presentation lie issues that prospective clients should be aware of.

Justicefield: More Questions Than Answers

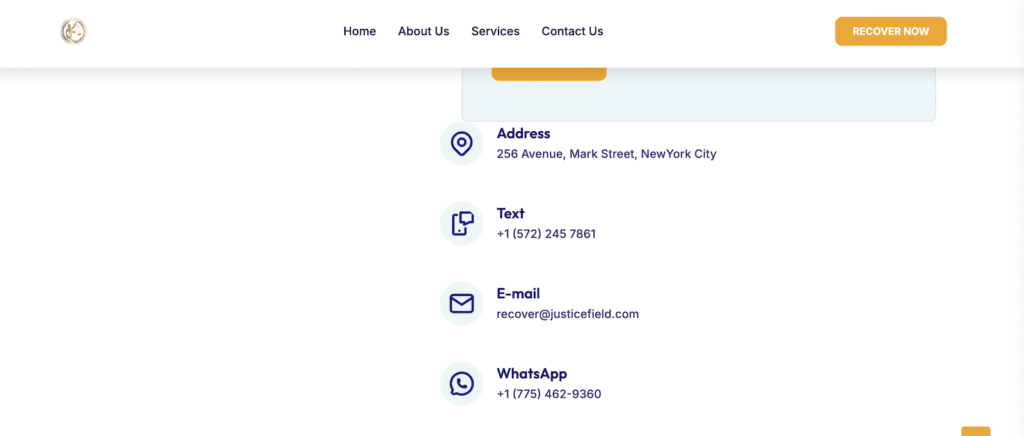

One of the first red flags with Justicefield is the lack of transparency. Key information that would typically be available on a reputable legal services website is either missing or hidden:

- No clear team profiles. There is no disclosure about who the lawyers or financial advisors are, what licenses they hold, or what jurisdictions they operate in.

- Ambiguous pricing structure. While Justicefield claims to offer affordable services, actual costs are vague and appear only after consultation, making it hard to compare with competitors.

- Overreliance on buzzwords. Terms like “justice,” “protection,” and “results-driven” appear frequently, but without specifics or measurable outcomes.

This kind of presentation often appeals to clients in distress — people facing lawsuits, debt collectors, or legal threats — but it doesn’t provide the trust signals that a serious legal service provider should.

Service Delivery: Is Justicefield Actually Helping?

We examined client reviews and case studies available online, and unfortunately, the consistency and effectiveness of Justicefield’s services are questionable at best.

Poor Client Communication

One of the most common complaints is poor follow-up and unresponsive support. Many users report:

- Delays in communication after signing up

- No updates on legal proceedings

- Difficulty reaching assigned representatives

This can be especially devastating in legal and financial contexts where time-sensitive decisions are crucial.

Questionable Legal Expertise

Justicefield advertises broad legal services, yet there’s little proof of actual courtroom experience or tangible case outcomes. Several reviewers have shared stories of receiving generic advice, being referred to third-party firms, or even paying fees for consultations that led nowhere.

Aggressive Sales Tactics

Another concern is how Justicefield acquires and retains clients. Multiple users reported receiving repeated calls and emails pushing them to sign up quickly — often before they fully understand the scope or cost of services.

This level of pressure raises questions about the company’s ethics and its prioritization of sales over client outcomes.

Trust and Credibility: A Growing Concern

While Justicefield attempts to appear credible, a deeper analysis reveals several troubling patterns:

- Lack of verified testimonials. The reviews posted on the site are unverified and overwhelmingly positive, contrasting sharply with neutral or negative third-party reviews.

- No social proof or industry recognition. There is no indication that Justicefield is recognized by bar associations, legal watchdogs, or financial regulation bodies.

- Unclear privacy policy and terms. Given the sensitive nature of legal and financial matters, we found the platform’s policies to be overly generic and insufficiently protective of client data.

If you’re trusting a company with your financial records, legal documents, or even representation in court, transparency is non-negotiable. With Justicefield, the absence of clear credentials should be a serious red flag.

Justicefield Alternatives Worth Considering

If you’re seeking real legal help or debt relief, there are other platforms and traditional law firms that offer:

- Verified attorney credentials

- Transparent pricing

- Face-to-face consultations

- Proper confidentiality guarantees

- Proven case results

Don’t fall for polished branding alone. Look for firms or platforms backed by bar associations or independent reviews with verifiable success stories.

Final Thoughts: Is Justicefield Worth Your Time?

Based on our analysis, Justicefield appears more focused on marketing itself as a legal-tech solution than actually solving legal or financial problems in a reliable, client-focused way.

The platform lacks transparency, verifiable expertise, and consistent service quality. It may be a tempting choice for people under financial or legal pressure, but we strongly advise due diligence before engaging with them.

If you’ve already had an experience with Justicefield — positive or negative — we invite you to share your story in the comments. Transparency helps others make informed decisions.

Leave your situation in the comments below and get a real response from professionals who care about outcomes — not just sales.