In the ever-evolving world of online investment platforms, Invix (invix.pro) has emerged as a subject of scrutiny. While the platform presents itself as a gateway to various investment opportunities, a closer examination reveals several concerning aspects that potential investors should consider.

Invix: Company Overview

Invix positions itself as a comprehensive investment platform, offering services across multiple sectors. However, the lack of transparency regarding its operational framework and regulatory compliance raises significant questions about its legitimacy and reliability.

Regulatory Concerns

One of the most pressing issues with Invix is the absence of verifiable regulatory oversight. Legitimate investment platforms are typically registered with recognized financial authorities, ensuring they adhere to industry standards and protect investors’ interests. Invix’s lack of such affiliations suggests a potential disregard for regulatory norms, increasing the risk for investors.

Platform Transparency

Transparency is a cornerstone of trust in the financial sector. Invix’s vague explanations about its investment strategies and the absence of detailed information about its team and operations contribute to an atmosphere of uncertainty. Without clear insights into how investments are managed, users are left in the dark about the safety and viability of their funds.

Invix: User Experiences

Feedback from users who have engaged with Invix has been mixed, with several expressing concerns about the platform’s practices. Some users report difficulties in withdrawing funds, while others question the authenticity of the investment opportunities presented. These experiences highlight the importance of conducting thorough research before committing to any investment.

Financial Promises

Invix advertises high returns on investments, a common tactic used by dubious platforms to attract investors. While high returns are enticing, they often come with increased risk. The promises made by Invix should be approached with caution, as they may not be sustainable or achievable.

Security Measures

In the digital age, robust security measures are essential to protect users’ personal and financial information. Invix’s security protocols have not been independently verified, raising concerns about the safety of user data and funds. Potential investors should be wary of platforms that do not prioritize cybersecurity.

Customer Support

Effective customer support is crucial for resolving issues and maintaining trust. Invix’s customer service has been criticized for being unresponsive and lacking in support. This can be particularly troubling when users encounter problems with their accounts or transactions.

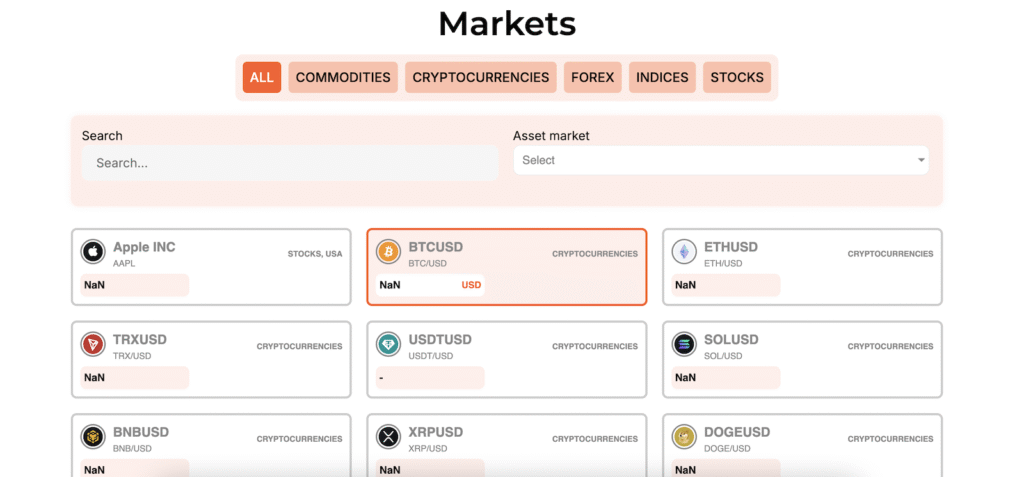

Market Position

While Invix claims to offer a range of investment opportunities, its market presence is limited, and its reputation is still developing. Without a proven track record or widespread recognition, investing with Invix carries inherent risks.

Conclusion on Invix

While Invix may appear to be a promising investment platform, the concerns outlined above suggest that potential investors should exercise caution. The lack of regulatory oversight, transparency, and verified security measures are significant red flags. As with any investment, it’s crucial to conduct thorough research and consider all risks before proceeding.

Stay Safe with Scam Insights from Invests.Finance