The Investment Industry Regulatory Organization of Canada (https://www.ciro.ca/) plays a pivotal role in Canada’s financial landscape. Founded to oversee investment dealers and trading activity, this self‑regulatory organization is essential for maintaining integrity, transparency, and fair practices in Canada’s financial markets. As you search for a dependable broker, understanding the functions of the Investment Industry Regulatory Organization of Canada can guide you toward safer, more responsible choices.

- What is the Investment Industry Regulatory Organization of Canada?

- Why the Investment Industry Regulatory Organization of Canada Matters to Investors

- Structure and Governance of the Investment Industry Regulatory Organization of Canada

- Licensing and Supervision of Investment Dealers

- Trading Surveillance and Market Activity

- Financial Strength and Capital Requirements

- Professional Conduct and Standards

- Complaint Handling and Disciplinary Process

- Collaboration with Other Regulatory Bodies

- Investor Education and Resources

- Key Strengths and Limitations

- Why Choosing an IIROC-Regulated Broker is Smart

- How to Verify Investment Industry Regulatory Organization of Canada Licensing

- Final Thoughts about Investment Industry Regulatory Organization of Canada

What is the Investment Industry Regulatory Organization of Canada?

The Investment Industry Regulatory Organization of Canada (https://www.ciro.ca/) serves as Canada’s primary self‑regulatory body for investment dealers and trading platforms. IIROC sets and enforces high standards in areas such as trading surveillance, market regulation, financial compliance, and professional conduct. Its core mission is to protect investors and reinforce confidence in Canadian capital markets.

Why the Investment Industry Regulatory Organization of Canada Matters to Investors

- Consumer protection

IIROC ensures that brokerages manage client accounts responsibly and that sales representatives act ethically. This serves as a crucial safety net for retail investors. - Market integrity

Through continuous oversight, the Investment Industry Regulatory Organization of Canada prevents unfair trading practices like insider trading or market manipulation. - Financial stability

IIROC demands robust capital reserves from member firms, reducing the risk of broker insolventcies impacting clients. - Dispute resolution

When investors face issues with their dealers, IIROC provides a formal complaints handling and disciplinary framework—avoiding costly legal battles.

Structure and Governance of the Investment Industry Regulatory Organization of Canada

The Investment Industry Regulatory Organization of Canada operates under a board comprising industry professionals and independent directors. Funding is generated through member fees and fines. Key responsibilities include:

- Licensing and overseeing dealers and advisors

- Investigating compliance and market incidents

- Enforcing rules and imposing penalties

- Collaborating with other regulatory bodies like provincial securities commissions and the Canadian Investor Protection Fund (CIPF)

Licensing and Supervision of Investment Dealers

When you select a broker, confirming its affiliation with the Investment Industry Regulatory Organization of Canada is essential. The organization’s oversight includes:

- Initial licensing – verifying the qualifications of firms and personnel

- Ongoing reviews – monitoring financial health, trading accuracy, and regulatory adherence

- Audits and examination – unannounced inspections ensure continuous compliance

Trading Surveillance and Market Activity

The Investment Industry Regulatory Organization of Canada monitors trading in real time, identifying suspicious activities such as insider trading or spoofing. It also requires firms to submit transaction reports. Timely detection and enforcement help preserve market confidence.

Financial Strength and Capital Requirements

To mitigate systemic risk, IIROC mandates that member firms maintain sufficient capital. Firms must submit audited financials regularly and meet liquidity rules. In crises, only IIROC‑regulated firms can rely on mechanisms like the Canadian Investor Protection Fund, which offers client insurance up to certain limits.

Professional Conduct and Standards

A core function of the Investment Industry Regulatory Organization of Canada is establishing conduct rules for dealers and representatives. The organization enforces:

- Ethical sales practices

- Clear client disclosures

- Suitability assessments ensuring investment recommendations match client needs

Supplied with information about your financial goals and risk appetite, regulated brokers must tailor strategies appropriately.

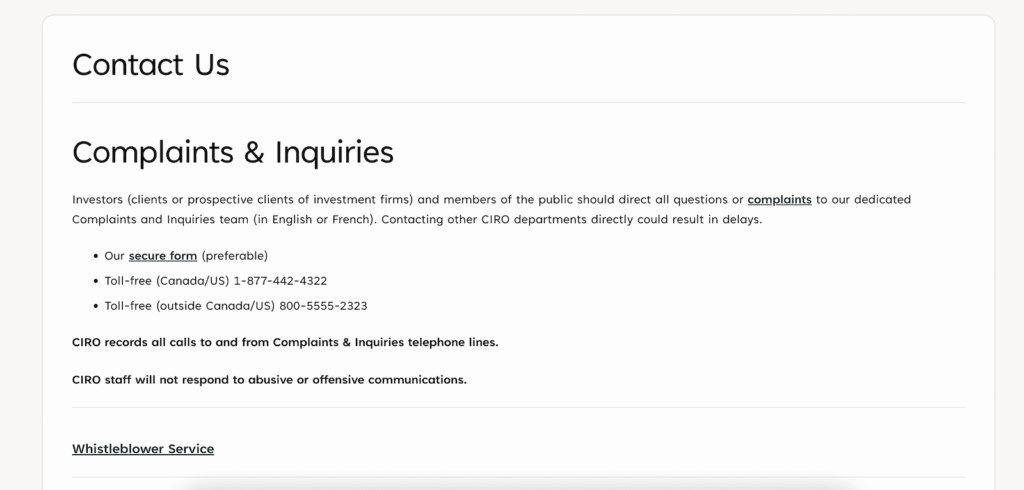

Complaint Handling and Disciplinary Process

If an investor feels wronged—because of unauthorized trades or inadequate advice—the Investment Industry Regulatory Organization of Canada allows complaints to be filed. IIROC can launch fact‑finding, reorder restitution, fine or suspend professionals, or revoke licenses. This system enhances accountability throughout the industry.

Collaboration with Other Regulatory Bodies

The Investment Industry Regulatory Organization of Canada does not work in isolation. It coordinates with:

- Provincial securities commissions for broader market regulation

- Financial Services Tribunal on administrative appeals

- Canadian Investor Protection Fund (CIPF) for client compensation in case of dealer failure

This cooperative network ensures layered investor protection and market stability.

Investor Education and Resources

Beyond enforcing rules, IIROC provides educational tools—firm directories, complaint toolkits, and risk awareness guides. Prospective broker clients can use these resources to check license validity or regulatory history before selecting a firm.

Key Strengths and Limitations

| Strengths | Limitations |

|---|---|

| Rigorous oversight and surveillance | Limited proactive investor alerting |

| Robust enforcement with real penalties | Can take time to resolve complaints |

| High professional standards | Regulatory scope limited to investments within its mandate |

Why Choosing an IIROC-Regulated Broker is Smart

Looking for broker services? Ensuring your firm is under the Investment Industry Regulatory Organization of Canada signifies:

- Credible oversight

- Higher professional standards

- Access to complaint and compensation processes

- Added financial safety net mechanisms

By prioritizing a broker regulated by IIROC, you reduce the risk of misconduct and increase peace of mind.

How to Verify Investment Industry Regulatory Organization of Canada Licensing

- Visit the Investment Industry Regulatory Organization of Canada website (https://www.ciro.ca/)

- Access the dealer and advisor directory

- Input the broker or representative’s name

- Review their license status, disciplinary record, and firm affiliation

Final Thoughts about Investment Industry Regulatory Organization of Canada

In summary, the Investment Industry Regulatory Organization of Canada shapes Canada’s investment landscape through enforcement, regulation, and investor protection. While not perfect, it offers a substantial assurance for anyone considering broker services in Canada. Its presence is central to modern investing—and should be a key decision factor.