Investors are often lured by sleek websites and bold promises, but what lies beneath? This Invescoplc review dives deep into the downsides, shedding light on pitfalls potential clients must know before leaving anything to chance.

Why Invescoplc Raises Red Flags

Invescoplc positions itself as a reliable broker, yet there are multiple warning signs:

- Opaque Fee Structure

- The Invescoplc fee schedule is buried in fine print. Hidden spreads and withdrawal charges can quickly erode returns.

- No clear demonstration of comparative trading costs—competitors often provide transparent fee calculators.

- Limited Regulatory Oversight

- Invescoplc claims compliance, but documentation is vague.

- Lacking verifiable licenses from recognized authorities such as FCA, SEC, or ASIC is deeply concerning.

- Shaky Platform Reliability

- Numerous user reports mention frequent platform lag and unexpected logouts during trades.

- Downtime at critical market moments compounds risk for serious traders.

- Poor Customer Support

- Response times cited by users range from 24 to 72 hours.

- Support agents often offer generic answers, and live chat can vanish without warning.

Invescoplc Trading Tools—All Hype?

Marketing materials for Invescoplc trumpet robust charting tools and analytics, but in practice:

- Charting graphs miss key indicators that serious traders rely on daily.

- Delayed quotes and stale historical data make real-time decisions difficult.

- Educational content is thin—tutorials are brief and lack depth, offering little guidance for beginners or advanced users.

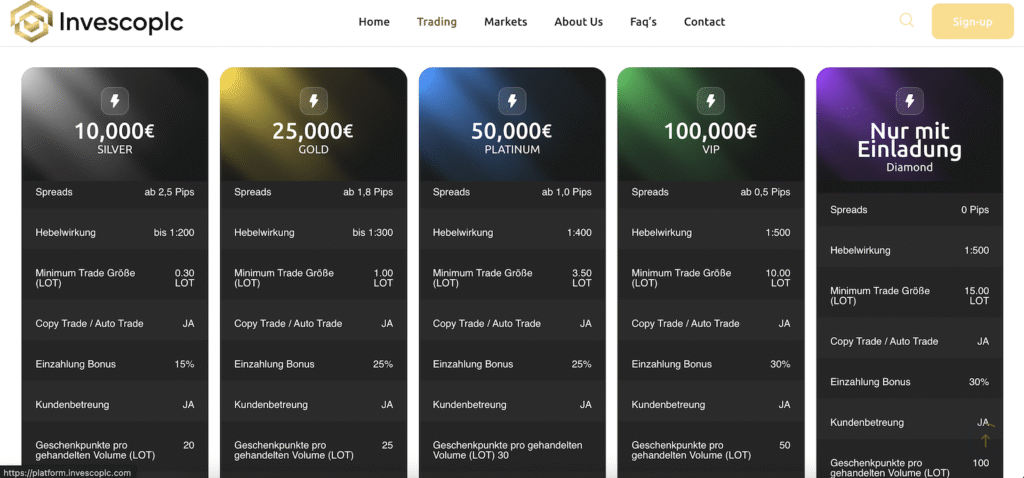

Account Types

Execution Speed and Order Slippage at Invescoplc

- Slippage is frequent, sometimes costing traders more than 2% per position.

- Order execution times lag behind competitors, which can be critical in fast-moving markets.

- These execution issues may cost more than the advertised low commission rates.

Transparency—Or Lack Thereof?

Transparency is vital, yet with Invescoplc:

- Company information is vague, with no clear details on headquarters, officers, or audited financials.

- Minimal regulatory disclosures fuel doubts about accountability.

- Ambiguous asset listings leave traders uncertain if certain forex, crypto, or derivatives instruments are even available.

Comparing Invescoplc to Better Alternatives

Mainstream brokers consistently outperform Invescoplc in areas such as:

- Full regulatory compliance backed by documented licenses.

- Transparent fee structures, with online calculators and clear schedules.

- Robust platforms offering fast execution, extensive charting, and mobile apps.

- Responsive support through live chat, phone, and multilingual teams.

Investors risk inefficiency and poor results by choosing Invescoplc over more established providers.

Is Invescoplc Worth the Risk?

After weighing all evidence, it’s clear: Invescoplc’s shortcomings are significant. Hidden costs, unreliable platform performance, and weak transparency paint a picture of an underwhelming broker. Serious traders and investors would do better elsewhere.

Final Verdict on Invescoplc

- Fees: Lack transparency—hidden spreads and charges.

- Reliability: Platform instability and delayed data feeds.

- Trust: Unclear regulation and corporate opacity.

- Support: Slow and unhelpful service.

Invescoplc fails to meet the expectations of professional or even intermediate traders. If you’re seeking a dependable brokerage experience, this is one to avoid.

Take Action—Choose Better

If you’ve encountered similar issues with Invescoplc services, or want to find a reliable alternative, leave your experience or questions in the comments. Smart money chooses transparency, stability, and accountability—opting out of brokers like Invescoplc.

Stay Safe with Scam Insights from Invests.Finance