In recent years, Groww has emerged as a prominent player in India’s digital investment landscape. Founded in 2016 by former Flipkart employees, the platform offers a range of services including mutual funds, stocks, ETFs, IPOs, and digital gold . With over 13 million active clients as of April 2025, Groww has positioned itself as a leading choice for retail investors.

However, despite its widespread popularity, Groww is not without its shortcomings. This review aims to provide a comprehensive analysis of the platform’s features, highlighting both its strengths and areas where it falls short.

Groww – User Interface: A Double-Edged Sword

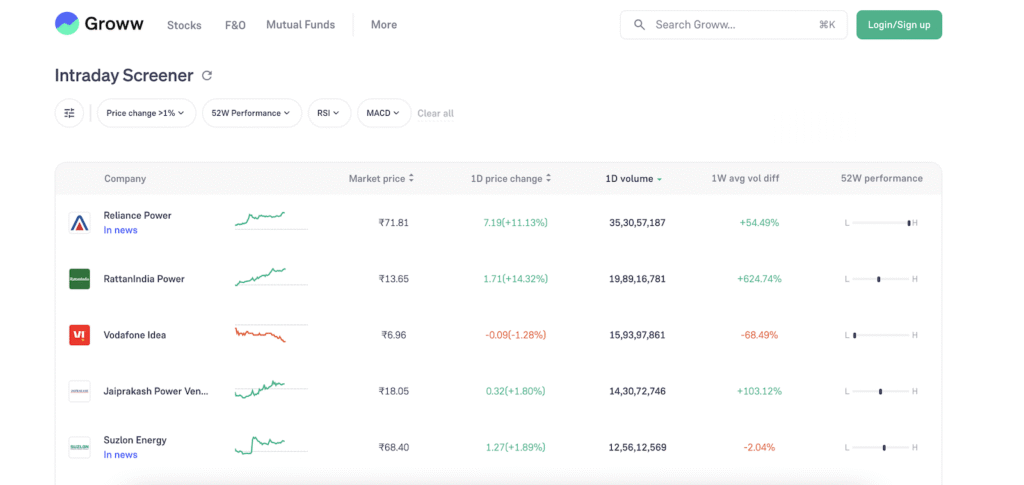

Groww’s user interface is often lauded for its simplicity and ease of use. The platform’s design is clean, making navigation intuitive for beginners. However, this simplicity comes at a cost. Advanced features are often buried within menus, making them difficult to access for experienced investors. For instance, tools like the stock screener and advanced charting options are not as prominent as they should be, potentially hindering users who rely on these features for in-depth analysis.

Additionally, the mobile app, while functional, has been reported to experience occasional lags and crashes, especially during peak market hours. Such performance issues can be detrimental for users who require real-time data to make informed decisions.

Customer Support: A Critical Weakness

One of the most significant drawbacks of Groww is its customer support. Users have reported long response times and inadequate resolutions to their issues. For a platform handling financial transactions, efficient customer support is paramount. Unfortunately, Groww’s current support infrastructure falls short of expectations.

While the platform offers support through email and in-app chat, the responses are often generic and lack the depth needed to address complex queries. This can be particularly frustrating for investors dealing with time-sensitive issues or technical difficulties.

Groww – Fees and Charges: Transparency Issues

Groww’s fee structure has been a topic of controversy among its user base. In 2024, the platform announced a 150% increase in brokerage fees on small-value trades, a move that was met with criticism from many users . Such significant hikes in fees can erode the returns of retail investors, particularly those engaging in frequent trading.

Moreover, the platform’s fee structure lacks clarity. While Groww claims to offer zero-commission trading on mutual funds, hidden charges and service fees are not always transparently disclosed. This lack of transparency can lead to unexpected costs, undermining the trust that investors place in the platform.

Limited Educational Resources

For novice investors, educational resources are crucial. Groww provides some basic content, such as articles and videos, aimed at educating users about investing. However, these resources are limited in scope and depth. Advanced topics like technical analysis, portfolio diversification, and risk management are scarcely covered.

This limitation can be a significant barrier for users looking to deepen their investment knowledge. While Groww offers a user-friendly platform, the lack of comprehensive educational content means that investors may need to seek information elsewhere, which can be inconvenient and time-consuming.

Regulatory Compliance and Security Concerns

Groww operates under the oversight of the Securities and Exchange Board of India (SEBI) and is registered as a stockbroker with the NSE and BSE . While this regulatory compliance provides a layer of security, there have been concerns regarding the platform’s data protection measures. Instances of unauthorized access and data breaches have raised questions about the robustness of Groww’s cybersecurity infrastructure.

For investors entrusting their financial data to the platform, these security concerns are not trivial. The lack of transparency regarding data protection protocols and past security incidents can undermine user confidence in Groww’s ability to safeguard sensitive information.

Conclusion on Groww

While Groww has made significant strides in democratizing investment opportunities in India, it is not without its flaws. The platform’s user-friendly interface and wide range of investment options are commendable. However, issues such as inadequate customer support, opaque fee structures, limited educational resources, and security concerns cannot be overlooked.

For investors seeking a comprehensive and reliable investment platform, it is essential to weigh these drawbacks against the benefits that Groww offers. While the platform may suit casual investors or those just starting their investment journey, more experienced traders may find its limitations restrictive.

In conclusion, Groww presents a mixed bag of features. Potential users should conduct thorough research and consider their individual investment needs before committing to the platform. As the digital investment landscape continues to evolve, it remains to be seen how Groww will address these challenges and whether it can maintain its position as a leading investment platform in India.

Stay Safe with Scam Insights from Invests.Finance