In a time when online brokers are mushrooming by the day, choosing the right one is becoming increasingly difficult. Golden finance limited claims to be a global financial services provider offering innovative trading solutions. However, a closer examination reveals multiple weaknesses in regulation, customer transparency, platform quality, and overall credibility. This review explores whether golden finance limited is truly worth your trust—or whether it’s just another unregulated, risky venture hiding behind a sleek website.

- Lack of Regulation at Golden Finance Limited

- Poor Transparency in Fees and Spreads

- Limited Trading Platform Functionality

- Funding and Withdrawal Concerns

- Golden Finance Limited Offers Minimal Customer Support

- Redundant Marketing and Lack of Substance

- Risk Warnings Are Minimal or Missing

- Better Alternatives Exist

- Final Verdict on Golden Finance Limited

Lack of Regulation at Golden Finance Limited

One of the most pressing concerns with golden finance limited is the unclear regulatory status of the firm. Their website presents golden finance limited as a global leader in brokerage services, yet provides no clear license number, governing authority, or jurisdiction under which it operates.

When dealing with financial products—particularly leveraged instruments like forex and CFDs—regulation is not a luxury; it’s a necessity. Traders who deposit funds with an unregulated broker like golden finance limited have virtually no recourse if disputes arise or if the broker fails to honor withdrawals. This lack of transparency in licensing raises immediate red flags.

Poor Transparency in Fees and Spreads

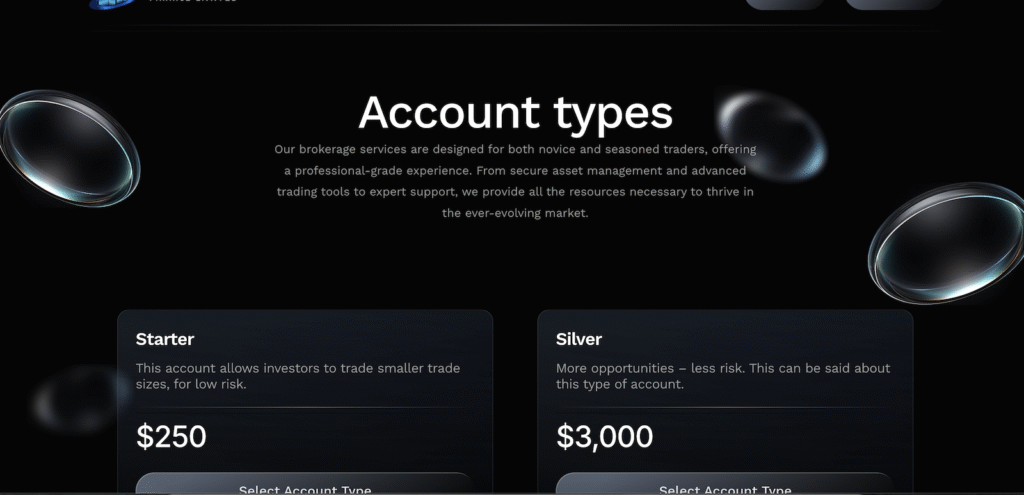

Golden finance limited promotes its services with vague statements about competitive spreads and minimal trading fees. However, no concrete data is provided. There are no typical spreads listed for major currency pairs, no clear structure for commissions, and no documentation to explain overnight fees or inactivity charges.

This opacity makes it difficult for prospective traders to compare golden finance limited with more transparent brokers. A credible financial service provider should disclose all trading costs upfront. Instead, golden finance limited forces users to sign up before revealing even the most basic pricing details.

Limited Trading Platform Functionality

Golden finance limited promotes its trading platforms as “cutting-edge,” but user experience tells a different story. Based on several trader reports and platform tests, the software lacks many of the tools professional traders expect—such as customizable chart indicators, real-time depth-of-market data, and reliable mobile compatibility.

While the platform may function for placing basic trades, it lacks the technical sophistication required for high-frequency or algorithmic trading. Platform lags and disconnections during market volatility have also been reported—issues that can lead to missed opportunities or significant financial loss.

Funding and Withdrawal Concerns

One of the most worrying issues associated with golden finance limited is how it handles deposits and withdrawals. Deposits are processed relatively quickly—no surprise there. However, when it comes to withdrawals, multiple users have reported delays, excessive documentation requests, and in some cases, total unresponsiveness from support.

The withdrawal terms are vague and hidden in a dense terms and conditions section. This suggests golden finance limited may not prioritize fair client fund handling. Additionally, there is no visible mention of segregated client accounts—a standard practice for protecting client funds in reputable brokerage firms.

Golden Finance Limited Offers Minimal Customer Support

Customer support is a critical component of any financial service. Unfortunately, golden finance limited appears to fall short in this area. Live chat support is often unavailable, and emails are typically responded to with template replies that offer little help.

For traders facing technical issues or urgent account-related questions, this slow and generic response rate is unacceptable. In an industry that moves in real-time, delayed support can result in severe losses and damaged trust.

Redundant Marketing and Lack of Substance

A scroll through golden finance limited’s website reveals an overuse of buzzwords like “revolutionary,” “secure,” and “tailored trading experience.” However, these claims lack substance and supporting evidence. The broker does not provide third-party audits, real-time trading stats, or verified testimonials from actual clients.

This disconnect between marketing and real service quality is a common tactic used by brokers trying to mask deeper issues. Golden finance limited appears more focused on lead generation than genuinely delivering value to traders.

Risk Warnings Are Minimal or Missing

Another issue with golden finance limited is the absence of clear risk warnings on its website. Any legitimate broker is required to inform users that trading leveraged products involves a high risk of losing capital. But golden finance limited downplays these risks, potentially misleading inexperienced users into trading without fully understanding what’s at stake.

Lack of educational resources only compounds this problem. While top-tier brokers offer webinars, strategy guides, and market analysis, golden finance limited provides little more than a basic FAQ page.

Better Alternatives Exist

When comparing golden finance limited to other well-known brokers, the differences are stark. Regulated brokers such as IG, Saxo Bank, or Pepperstone provide better transparency, tighter spreads, full regulatory coverage, and responsive customer service.

These brokers also offer robust educational resources and detailed trading reports—essential for growing as a trader. If you’re serious about safeguarding your funds and getting the most from your trades, golden finance limited is not a wise starting point.

Final Verdict on Golden Finance Limited

Despite its professional appearance, golden finance limited lacks the transparency, regulation, and infrastructure that traders need to thrive in modern markets. Without a verifiable license, trustworthy trading platform, or responsive support, the broker leaves too much to chance. Whether you are a beginner or a seasoned investor, the risks of using golden finance limited far outweigh the potential benefits.

Until the company addresses these glaring issues—especially around regulation and client fund safety—it cannot be considered a viable trading partner. There are simply too many better, safer, and more honest alternatives available.

Stay Safe with Scam Insights from Invests.Finance