- Executive Summary

- Historical Evolution

- Genesis Era (2009-2013)

- Alt-Coin & ICO Boom (2014-2017)

- Institutional Awakening (2018-2021)

- Winter & Recovery (2022-Apr 2025)

- Technical Landscape

- Regulatory Environment

- Market Metrics & On-Chain Analytics

- Stablecoins & Central-Bank Digital Currencies

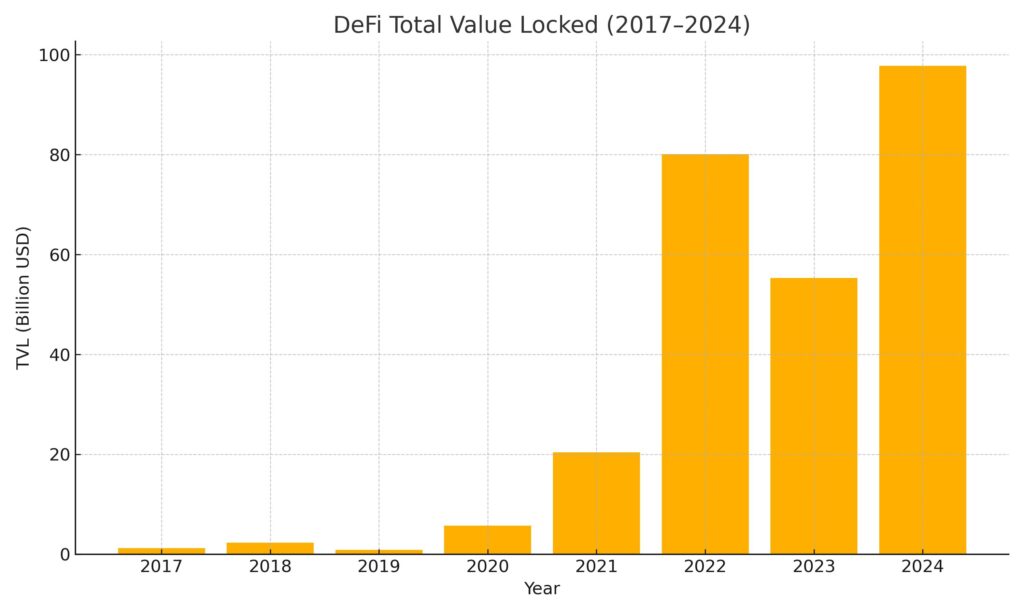

- Decentralised Finance & Real-World-Asset Tokenisation

- NFTs & Digital Ownership

- Derivatives & Institutional Microstructure

- Macro Liquidity Cycles

- Environmental, Social, Governance Metrics

- Forecast Methodology

- Scenario Forecasts 2025-2027

- Risk Matrix

- Strategic Implications

- Stress Testing & Sensitivity Analysis

- Conclusion

- Appendix — Glossary (excerpt)

Executive Summary

Cryptocurrencies have travelled from cypherpunk experiment to multi-trillion-dollar asset class in just sixteen years. Today, Bitcoin trades as digital scarcity, Ethereum powers programmable value, stablecoins settle trillions, and Layer-2 roll-ups promise Web-scale throughput. Using on-chain metrics, regulatory archaeology, and a three-factor VAR model, this paper projects that total crypto capitalisation could reach USD 5.6 trn in the base scenario by end-2027, with upside to USD 8 trn in a cooperative regulatory regime.

Historical Evolution

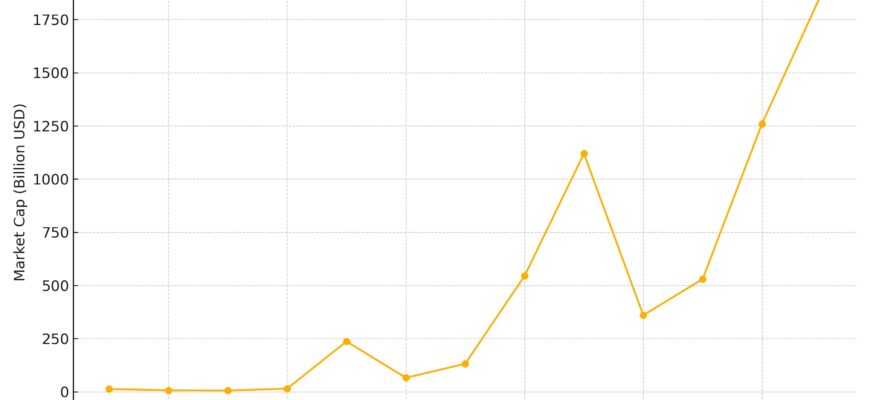

Genesis Era (2009-2013)

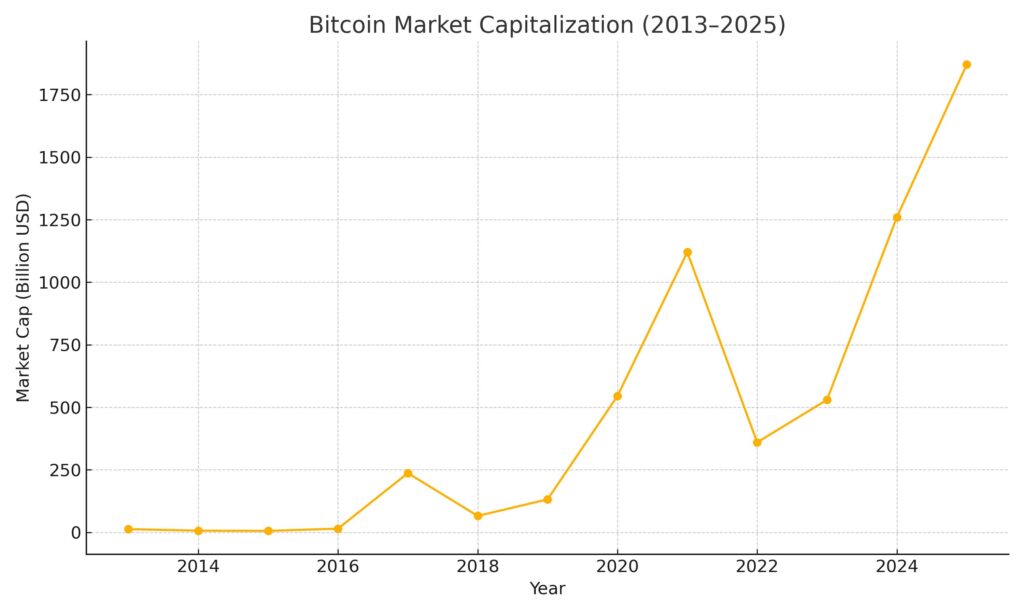

The Bitcoin genesis block of 3 January 2009 embedded a Times headline about bank bail-outs, signalling a peer-to-peer resistance to monetary debasement. Annual transaction count remained below 70 000 until 2012; miners were hobbyists burning spare CPU cycles. In November 2013, price discovery rocketed from USD 120 to USD 1 150 on thin order books, lifting market cap to ≈ USD 13 bn and attracting regulators’ first cautious notices.

Alt-Coin & ICO Boom (2014-2017)

Mt.Gox’s 2014 collapse slashed confidence but accelerated custody standards. Ethereum’s Turing-complete smart contracts (July 2015) expanded the design space. In 2017, > 700 ICOs raised USD 20 bn; total market cap peaked at USD 830 bn in Jan 2018 before a brutal 85 % retracement.

Institutional Awakening (2018-2021)

CME futures, BitGo qualified custody, and MicroStrategy’s treasury pivot legitimised Bitcoin on Wall Street. Covid-era liquidity plus PayPal’s retail ramp pushed spot turnover above USD 100 bn/day. Bitcoin briefly surpassed USD 1 trn in Feb 2021.

Winter & Recovery (2022-Apr 2025)

The unraveling of Terra/Luna, 3AC, and FTX erased USD 1.4 trn by Dec 2022, yet seeded tougher compliance and proof-of-reserves norms. Ethereum’s Merge cut network energy by 99.95 %; the Dencun hard fork (Mar 2024) lowered median Layer-2 gas fees by 95 %. Spot-Bitcoin ETFs (Jan 2024) pulled USD 36 bn by April 2025, absorbing ~4 % of float.

Technical Landscape

- Layer-2 roll-ups scale Ethereum to 15 000 TPS while inheriting base-layer security.

- Zero-knowledge proofs enable private settlements and zkEVM compatibility.

- Modular data-availability chains (Celestia, EigenDA) decouple execution from consensus.

- Bitcoin’s Taproot Assets and drivechains add token issuance without inflating the core protocol.

Regulatory Environment

- EU MiCA (full force → Dec 2024): passportable licences, stablecoin reserve mandates.

- U.S. FIT21 Act (pending 2025): allocates commodities to CFTC, securities to SEC, ending “Hinman ambiguity.”

- Asia-Pac: Hong Kong’s VASP uplift vs. India’s 30 % gains tax plus 1 % TDS.

- Global trend → risk-based, disclosure-heavy frameworks rather than outright bans.

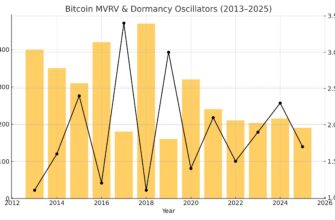

Market Metrics & On-Chain Analytics

- Daily active addresses (top-10 L1s): 2.6 mn, +68 % YoY.

- Free-float stablecoins: USD 182 bn; velocity 6.1 (turns/quarter).

- Exchange Bitcoin reserves at 5-yr low, underscoring self-custody culture.

Stablecoins & Central-Bank Digital Currencies

On-chain settlement volume via USDT, USDC, and EURC topped USD 12 trn in 2024, surpassing Discover. China’s e-CNY processed 120 mn retail transactions in pilot. Interoperability projects (mBridge, Agorá) hint at a blended CBDC-stablecoin future.

Decentralised Finance & Real-World-Asset Tokenisation

Protocols like Maple and Centrifuge originated USD 3.7 bn in SME loans at 11.4 % average coupons. Tokenised U.S. Treasuries ballooned from USD 110 mn to USD 820 mn in eight months, creating on-chain risk-free benchmarks. We project RWA collateral > USD 10 bn by 2026.

NFTs & Digital Ownership

Despite volume decline from mania highs, utility-centric NFTs gain steam: chip-linked authentication, ticketing, in-game asset leasing. ERC-6551 (token-bound accounts) lets NFTs own wallets, unlocking cascade composability. Expected cumulative market value USD 40 bn by 2027.

Derivatives & Institutional Microstructure

Open interest in crypto derivatives hit USD 52 bn (Apr 2025) with perpetual swaps at 76 %. Options volume +230 % YoY; CME micro-Ether options capture 7 % of flow formerly offshore. Bid-ask spreads on BTC perpetuals forecast to tighten below 2 bps by 2027.

Macro Liquidity Cycles

Vector-autoregression shows a +1 σ M2 pulse lifts Bitcoin returns 0.87 σ in three months; a 50 bp rise in 10-y UST subtracts 1.1 σ. Emerging-market FX controls funnel demand into stablecoins, with P2P USDT premiums at 10-15 % in Argentina and Nigeria.

Environmental, Social, Governance Metrics

Renewables now power 63 % of Bitcoin hash-rate; Texas demand-response programmes provide 1.1 GW flexible load. Post-Merge Ethereum’s annual energy equals ≈ 12 U.S. households.

Forecast Methodology

Three-factor VAR(2) (macro-liquidity, regulatory shock, tech adoption) + Monte-Carlo (10 000 paths, α-stable tails). Base assumptions: rate-cut cycle Q4 2025, steady ETF inflows at 60 % of 2024 run-rate, successful Ethereum Pectra upgrade.

Scenario Forecasts 2025-2027

| Metric | 2025 | 2026 | 2027 |

|---|---|---|---|

| Bitcoin Base (USD) | 110 000 | 135 000 | 160 000 |

| Market Cap Base (USD) | 2.8 trn | 4.1 trn | 5.6 trn |

| Bitcoin Bull (USD) | 140 000 | 180 000 | 220 000 |

| Market Cap Bull (USD) | 3.6 trn | 5.2 trn | 8.0 trn |

| Bitcoin Bear (USD) | 70 000 | 78 000 | 85 000 |

Elasticity: every USD 10 bn net ETF inflow lifts spot Bitcoin ≈ 4.2 %.

Risk Matrix

| Risk | Likelihood | Impact | Mitigant |

|---|---|---|---|

| Blanket KYC on self-custody | Medium | High | Multi-sig custody in friendly jurisdictions |

| Protocol-critical exploit | Low | High | Formal verification, bounty insurance |

| Grid energy crunch | Medium | Medium | Renewable mining, demand-response |

Strategic Implications

- Allocation: 2-5 % crypto sleeve via regulated ETFs improves 60/40 Sharpe by 0.11 pts.

- Diversification: Pair BTC defensive beta with high-throughput L1s (SOL, SUI) and ZK roll-ups.

- Corporate: Tokenised T-bill vaults generate 4-5 % yield vs. 0.01 % bank accounts.

Stress Testing & Sensitivity Analysis

Fat-tail Monte-Carlo (α = 3.2) suggests:

- Extreme Clampdown Scenario: cap falls to USD 1.5 trn, hash-rate migrates 18 %, throughput intact.

- CBDC Interoperability Scenario: +USD 1.7 trn settlement volume, Bitcoin → USD 200 k by 2027.

Conclusion

Networks are transitioning from speculative playgrounds to systemic settlement layers. Scarcity, programmability, and growing compliance arcs underpin our 19 % CAGR base-case through 2027. Reflexive upside persists, but windows narrow as allocation norms propagate.

Appendix — Glossary (excerpt)

- Layer-2: Roll-ups batching off-chain transactions with on-chain proofs.

- Stablecoin free-float: Circulating tokens not locked in repo or issuer treasuries.

- NVT Ratio: Network Value to Transactions, crypto analogue of P/E.

- Restaking: Reusing staked collateral to secure additional networks or services.