When we evaluate the broker FxPro (fxpro.com) we do so by examining its key attributes: regulation and trustworthiness, trading platforms and instruments, costs and fees, support and services, as well as strengths and weaknesses. Our intention is to provide a balanced, objective overview that helps potential clients decide whether FxPro is a good fit for their trading or investment needs — and to encourage action if they see fit to leave feedback or enquire further.

Regulation & Company overview of FxPro

FxPro was established in 2006 and has grown into a global brokerage offering forex and CFD trading across numerous jurisdictions. The company is regulated by several major bodies: for example the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Regulation in multiple jurisdictions is a strong positive: it offers clients increased confidence that the broker is subject to oversight and must meet certain standards of client funds segregation, reporting, and operational transparency.

According to review sources, FxPro operates a No-Dealing-Desk (NDD) model: meaning that client orders are processed without the broker acting as a counter-party to the trade. The use of multiple liquidity providers and high-speed execution infrastructure (servers located in major data centres) further supports the claim of institutional-level execution quality.

In short: from a regulatory and structural standpoint, FxPro meets many criteria that traders look for in a robust broker.

Trading platforms and instruments

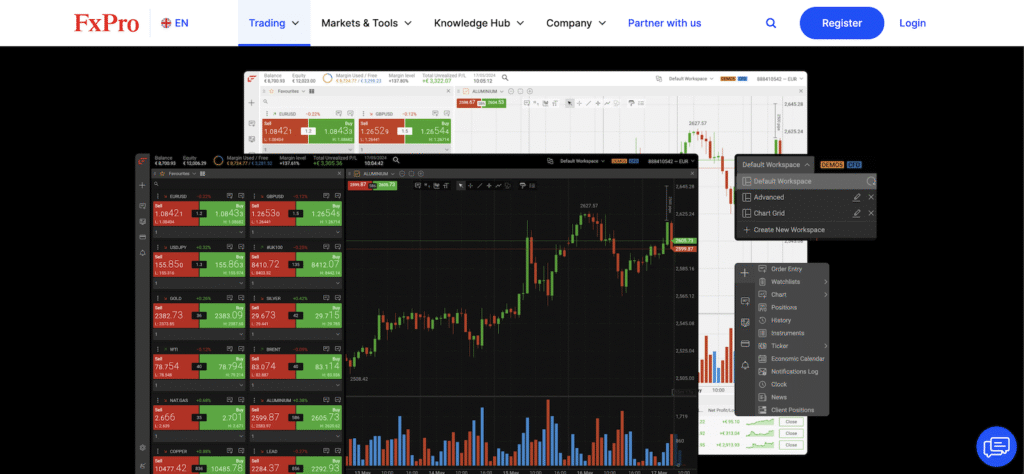

When it comes to trading platforms, FxPro offers a broad range of choices. According to sources, the broker supports well-known third-party platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader — as well as its own proprietary mobile/web solution. This flexibility allows traders of varying skill levels (beginners through to algorithmic, institutional-type) to select an environment that suits them.

In terms of tradable instruments, FxPro provides access to over 2,000 markets across multiple asset classes: forex currency pairs, indices, commodities, stocks, futures, and more. This diversity enables portfolio diversification — for example, a trader can move beyond just FX to include commodities or shares.

Execution speed and technology are highlighted as well. One review notes average execution times around 11 milliseconds via its proprietary aggregator system. That said, platform-choice and instrument-choice are only one part of the equation; how they perform under real conditions (spreads, latency, order-fill quality) matters significantly.

Costs, spreads and account types

No broker is perfect, and cost structure is an area where traders need to read the fine print. For FxPro, while many features are strong, some trade-offs do exist.

Pros in this area include transparent execution, multiple account types (standard, raw/commission, etc.), and competitive spread options on certain account tiers. For example, sources cite spreads starting from 0.0 pips on certain ECN-style accounts (though often requiring a higher minimum deposit).

On the flip side, some accounts or conditions carry higher costs relative to ultra-low-cost brokers. Typical cons identified: higher trading costs for some account types, inactivity fees, and fewer promotions for EU clients. For instance, one review states: “Trading costs are higher than top low-cost forex brokers.”

Thus, traders who prioritise the absolute lowest cost per trade (and are highly cost-sensitive) might find alternatives offering narrower spreads or lower commissions. But those who prioritise regulation, broad instrument access and platform choice may view the cost as reasonable.

Support, education & extra services

Support and auxiliary services form the backbone of a trader’s user experience. On this front, FxPro reviews show generally favourable feedback. According to BrokerListings, the 24/5 live chat, phone, email and help centre are “reliable and easy to access.” The diversity of communication channels and the fact that multi-lingual support is available in many regions are positive features.

Education-wise, however, the picture is more mixed. While FxPro does offer market analysis, webinars, and basic tutorials, reviewers suggest that its educational content is not as extensive as some specialist brokers that prioritise training for beginners. In practice this means that if you are a complete novice trader and want very comprehensive training materials and mentoring, you may need to supplement with external educational resources.

Strengths of FxPro

Putting together the facts, here are the standout strengths:

- Regulation and safety: Multi-jurisdiction regulation provides strong background for trust.

- Platform variety: The ability to choose between MT4/MT5/cTrader and proprietary platforms, mobile and desktop.

- Broad market access: 2,000+ instruments across asset classes allow diversification.

- Execution model: No-Dealing-Desk model, multiple liquidity providers and high-speed servers.

- Reliable support: Good access to customer service and decent responsiveness according to multiple testers.

Weaknesses & areas for caution

No service is perfect. Key areas to watch:

- Costs: While spread-and-commission offerings are competitive in some cases, they are not always the lowest in the industry. Traders focused on minimal cost may find better alternatives.

- Account minimums / advanced account tiers: Some of the most competitive spreads require larger minimum deposits or higher volume accounts.

- Educational materials: For those seeking deep training resources, this might be an area where the broker is not top-tier.

- Regulatory jurisdiction specifics: While the major entity is well-regulated, users in certain countries may be directed to offshore branches or entities with different rules (this has been flagged by some users).

- Inactivity fees: Some reviews note charges for accounts that are left dormant.

Is FxPro suitable for you?

After weighing the above, how should you decide whether FxPro is right for you?

- If you prioritise strong regulation, wide market access, and platform flexibility, then FxPro is a very credible choice.

- If you are an experienced trader who uses algorithmic or institutional-style tools, the platform variety and execution model will likely satisfy you.

- If cost per trade is your major (and possibly only) criterion, you might want to compare alternatives with ultra-low spreads and commissions and see if the trade-off in regulation and platform is acceptable.

We strongly recommend that you open a demo account first (many brokers including FxPro offer one) to test execution speed, spreads in your instrument of choice, deposit/withdrawal procedures, and how support works for your region and language.

Finally, if you decide to proceed, please ensure you are aware of all risk disclosures: CFD trading involves leverage and can magnify losses; always check regulatory status in your jurisdiction and whether you are interacting with the entity regulated in that region.

Conclusion: Our verdict on FxPro

In summary, FxPro offers a balanced offering: strong regulatory framework, solid platform range, broad instrument access, and reliable service. It is well-suited for traders who are looking for a broker with credibility and flexibility rather than simply the lowest price. The cost structure may not be the absolute cheapest, but the trade-offs appear justified by the added features and safeguards.

We recommend visiting the official website (fxpro.com), reviewing the terms for your country, and speaking to support if you have questions (especially around deposit/withdrawal, account types in your jurisdiction, and regional regulations). If after that your experience is positive, feel free to share your impressions or leave a comment below — we encourage potential clients to engage and ask questions, and we welcome readers leaving their insights in the comment section.

If you’re ready to take the next step, you can leave a comment below with your region and goals and we’ll help with the best account type or features to focus on.