We have reviewed Flirzinkles with a critical eye. While many users praise their purported ability to recover lost funds from scams, we believe there are serious concerns and gaps that deserve attention. If you are seeking financial or legal help for scam recovery, understanding the full picture is essential. Below, we present an objective, detailed analysis of their services, strengths, risks, and how you might proceed—followed by ways you can share your concerns or request further action.

What Flirzinkles Claims to Do vs What They Deliver

Flirzinkles positions itself as a scam recovery service focused on chargebacks, recovering lost funds, and assisting victims of varied scams—investment fraud, crypto projects, Forex, binary options, real estate scams, phishing fraud etc. Flirzinkles They promise “expert consultation,” evidence gathering, case evaluation, and transparent processes.

However, some red flags suggest the reality may not fully align with those promises.

Key Red Flags & Areas of Concern

- Transparency of track record and proof Although numerous testimonials on Flirzinkles’s own site and on Trustpilot show impressive amounts recovered (e.g. tens of thousands of dollars), detailed case studies or verifiable documentation are scarce. We found user reviews, but many are unverified or vague. Trusted legal and financial services usually publish detailed results, including documentation, disclaimers, and outcomes. Flirzinkles does not clearly publish many of these.

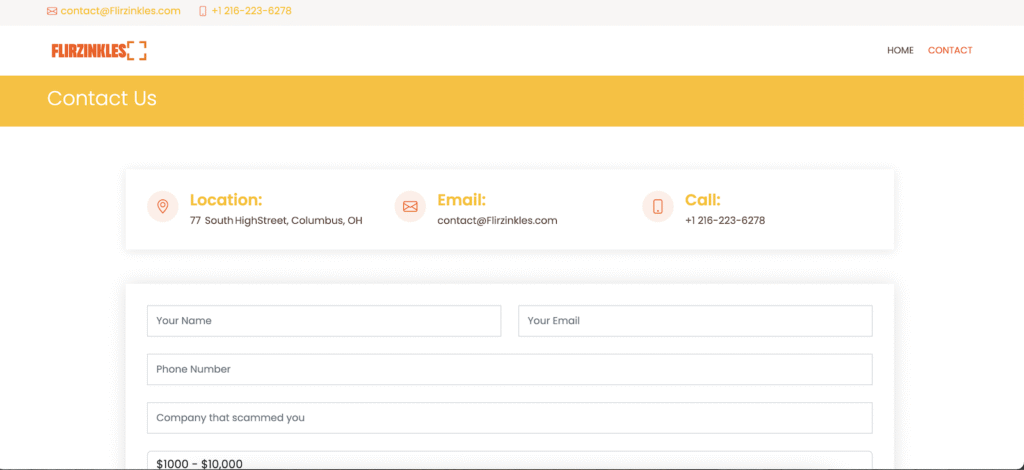

- Pricing and cost structure It is unclear how fees are determined. The website has complaint filing options with various monetary ranges ($1,000‑$10,000; $10,000‑$30,000, etc.) Flirzinkles, but does not provide clear schedules of fees, success‑fee percentages, or what portion of recovered funds the client must pay. This lack of clarity can lead to surprises, or even exploitation.

- Legal jurisdiction, licensing and credentials Flirzinkles claims to be based in Columbus, Ohio, U.S.A. However, there is limited public information on whether they are fully licensed attorneys or legal firms in the jurisdictions where clients are based. Scam recovery often intersects with legal representation, demands compliance with local law, ethics, and regulation. Without clear licensing details, clients may be vulnerable.

- Timeline and guarantees The website and many reviews offer optimistic timelines (e.g. “handled my case smoothly and recovered over $35,000 in a short period of time”) . But legal and financial recovery from scams (especially across borders) often takes months or years, with uncertain outcomes. Promising or implying fast or guaranteed recovery may set unrealistic expectations.

- Customer service issues and communication Some reviews praise responsiveness; others suggest delays or lack of detailed updates. Because recovery depends heavily on timely gathering of evidence, working with banks or intermediaries, any delay in communication or misalignment of expectations can undermine the case. Flirzinkles may not always set out clearly what the client must provide or do.

What Flirzinkles Does Well (Strengths)

Despite the concerns, Flirzinkles does show certain strengths that might make their services valuable if used cautiously:

- They appear to specialize exclusively in scam recovery, which means their team claims focus and familiarity with common scam types (investment fraud, crypto, forex).

- They have accumulated positive feedback from some clients, which indicates that for some situations, funds have indeed been recovered.

- Their site offers a “File a Complaint” mechanism and case evaluation tools, which can help victims begin a formal process.

Comparative Analysis: How Flirzinkles Measures Up

When we compare Flirzinkles to more established legal/financial recovery firms, the differences become clearer:

| Feature | What good firms provide | Flirzinkles current status |

|---|---|---|

| Clear fee / success fee schedule | Transparent contracts, fixed or percentage fees, disclaimers | Fee structure vague; success fee not clearly specified |

| Licensed attorneys or legal firms | Licensed professionals, admitted in relevant jurisdictions | Unclear licensing credentials; less visible proof of attorney‑client legal status |

| Documented case studies | Public, verifiable case studies, possibly with court filings, bank letters, evidence | Mostly testimonials without deep documentation |

| Realistic timelines & risk warnings | Explicit statements that recovery may fail; timelines depend on external entities | Some optimistic language; risks less emphasized |

| Strong client support & updates | Assigned case manager, regular status updates, clearly defined responsibilities for client | Mixed feedback on communication; what client must do not always clear |

Is Flirzinkles Right For You?

We believe Flirzinkles might be useful for those who:

- Have already gathered some documentation of a scam (bank statements, contracts, transaction records) and just need help formalizing a recovery claim or initiating chargeback.

- Are willing to proceed without guaranteed success, understanding legal risks and costs.

- Do not have access to a good licensed attorney in their jurisdiction, or prefer working with a service with international orientation.

But Flirzinkles may not be ideal if:

- You expect full disclosure, strong guarantees, or immediate results.

- Your loss is large and cross‑border, involving complex legal systems, where you may need an attorney in your country.

- You are unable or unwilling to pay upfront fees or unclear service charges or commit to long waiting periods.

Recommendations / What You Should Ask Before Hiring Flirzinkles

Before engaging with Flirzinkles, we advise that you:

- Request a written agreement detailing: the precise services provided; what you must provide; timelines; what happens if recovery fails; how fees are calculated (success fee versus upfront costs).

- Check credentials: Ask whether they are licensed or affiliated with legal or financial regulatory bodies. Try to verify their office address and professional licenses in your country.

- Ask for case studies with documentation: names of clients (with consent), jurisdictions, type of scams, amount lost vs amount recovered.

- Seek external verification of reviews: Not only testimonials on their site, but independent reviews, complaints at regulatory bodies, online forums, etc.

- Compare with other firms or services: Sometimes local law firms or consumer protection organizations may offer similar help or guidance with better accountability.

Conclusion on Flirzinkles

While Flirzinkles may deliver results in some cases, we believe that their service comes with enough uncertainty, limited transparency, and risk that you should not proceed without due diligence. If you are a victim of financial or legal fraud, don’t rush into a contract. Prioritize clarity, check credentials, demand proof, and be realistic about possible outcomes.

If you’ve used Flirzinkles or comparable services, leave a comment below with your experience. Did they deliver as promised? Were costs and timelines clear? Your input can help others decide wisely.If you want, we can also prepare a comparison of Flirzinkles vs trusted law firms or financial recovery specialists in your region, so you can choose safer alternatives.