In the ever-expanding world of online trading, Evest has emerged as a platform that promises a seamless trading experience with its user-friendly interface and a wide range of financial instruments. However, beneath the polished surface lies a series of concerns that potential traders should be aware of before committing their capital. This review delves into the various aspects of Evest, highlighting the areas where it falls short and what traders need to consider.

Evest Broker – Regulatory Oversight: A Grey Area

Evest operates under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC) and the Financial Sector Conduct Authority (FSCA) in South Africa. While these licenses may provide a semblance of legitimacy, they are often considered less stringent compared to regulators in regions like the European Union or the United States. This raises concerns about the level of investor protection and the platform’s adherence to international financial standards.

Trading Platforms: Limited and Outdated

Evest offers a web-based platform and mobile applications for trading. While these platforms are accessible, they lack the advanced features and customization options found in industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Traders accustomed to the extensive tools and flexibility of MT4/MT5 may find Evest’s offerings restrictive and limiting.

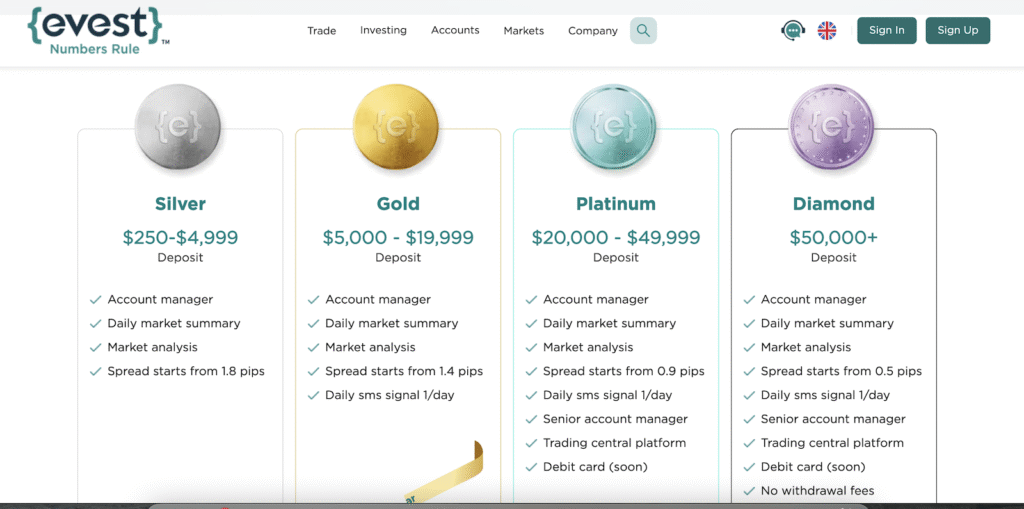

Account Types and Minimum Deposits

Evest provides several account types, including Silver, Gold, Platinum, and Diamond, each with varying minimum deposit requirements. The Silver account, for instance, requires a minimum deposit of $250, which is relatively high compared to other brokers offering micro or cent accounts with lower deposit thresholds. Additionally, the spreads start at 3 pips for the Silver account, which is significantly higher than the industry average, potentially leading to increased trading costs.

Fees and Charges: Hidden Costs

While Evest advertises zero deposit fees, it imposes a $5 withdrawal fee, which is uncommon among reputable brokers that typically offer free withdrawals. Moreover, the platform charges a substantial inactivity fee of $75 after two months of no trading activity, which can significantly impact users who do not trade frequently. After 12 months of inactivity, accounts may be considered dormant and subject to additional fees.

Customer Support: Slow and Unresponsive

Customer support is a critical aspect of any trading platform, and unfortunately, Evest falls short in this area. Users have reported slow response times and unhelpful assistance when seeking support, leading to frustration and unresolved issues. Effective customer service is essential, especially when dealing with financial transactions and potential disputes.

Educational Resources: A Mixed Bag

Evest offers a Trading Academy with various educational materials, including tutorials and webinars. While these resources can be beneficial for beginners, they may not be comprehensive enough for advanced traders seeking in-depth analysis and strategies. The quality and depth of educational content are crucial for traders aiming to enhance their skills and make informed decisions.

Conclusion on Evest Broker: Proceed with Caution

While Evest presents itself as a modern and accessible trading platform, several factors warrant caution. From regulatory concerns to limited platform features, high fees, and subpar customer support, potential traders should carefully consider these aspects before engaging with the platform. It’s advisable to explore other brokers that offer more robust features, lower costs, and stronger regulatory oversight to ensure a safer and more efficient trading experience.

Stay Safe with Scam Insights from Invests.Finance