In the ever-evolving world of online trading, selecting a reliable broker is paramount. Errante Trading presents itself as a trustworthy partner for traders worldwide. However, a closer examination reveals several concerns that potential users should be aware of.

Errante Trading: Regulatory Ambiguities

Errante Trading claims regulation by the Cyprus Securities and Exchange Commission (CySEC). Yet, discrepancies arise when verifying this claim. Some sources suggest a lack of clear regulatory oversight, raising questions about the platform’s legitimacy.

Furthermore, the company’s association with jurisdictions like Saint Vincent and the Grenadines and Antigua and Barbuda—known for lenient financial regulations—adds to the skepticism.

Elevated Trading Costs

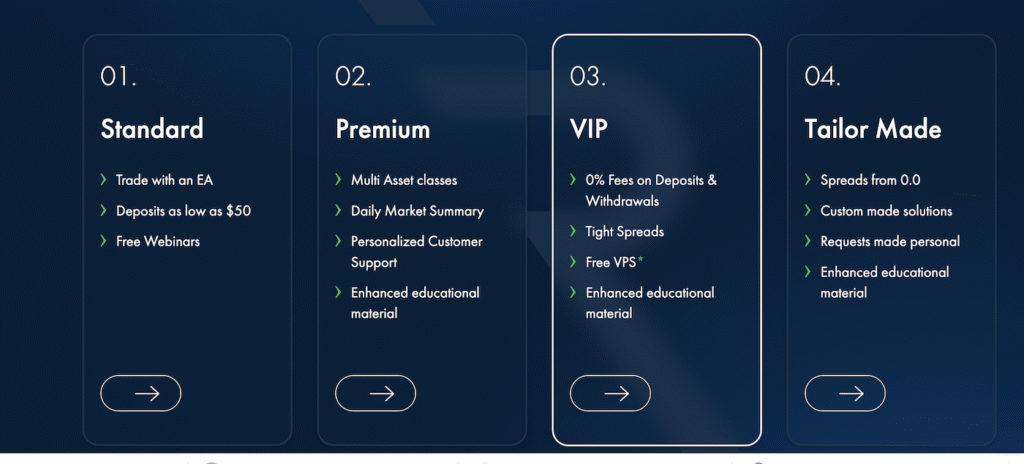

Errante Trading’s fee structure is notably higher than industry averages. For instance, the Standard account features spreads starting from 1.5 pips, which can erode potential profits. Additionally, the platform imposes a $15 maintenance fee after 150 days of inactivity, followed by a $5 monthly charge.

Such fees, combined with high spreads, make Errante Trading a less cost-effective option for traders, especially those with limited capital.

Limited Educational Resources

While Errante Trading offers educational materials, access is restricted. Advanced videos require a minimum deposit of $300, potentially alienating novice traders seeking to learn without significant financial commitment.

Moreover, the depth and breadth of the educational content are limited compared to other brokers, potentially hindering traders’ growth and understanding of complex market dynamics.

Questionable Marketing Practices

Reports have surfaced accusing Errante Trading of employing misleading marketing tactics, including fake testimonials and aggressive promotion strategies. Such practices can mislead potential clients, painting an overly optimistic picture of the platform’s capabilities and reliability.

Platform Limitations

Errante Trading’s platform has been criticized for its lack of user-friendliness and occasional sluggish performance. Traders have reported challenges with charting tools and overall navigation, which can impede timely decision-making—a critical aspect of successful trading.

Conclusion on Errante Trading

While Errante Trading positions itself as a comprehensive solution for traders, multiple red flags suggest caution. From regulatory uncertainties and high fees to limited educational resources and questionable marketing practices, potential users should thoroughly research and consider alternative platforms before committing their investments.

Stay Safe with Scam Insights from Invests.Finance