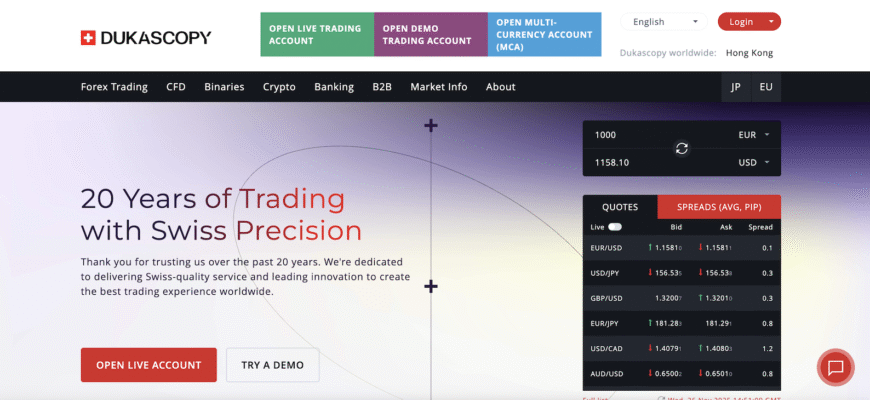

Dukascopy has established itself as a recognized participant in the global financial sector, offering a set of trading and banking services that attract both private and corporate clients. We focus here on a balanced overview intended to help users understand what Dukascopy provides, how its platform is structured and why its services may appeal to different categories of investors. This examination covers platform functionality, account structure, regulatory considerations and available tools without promoting unrealistic expectations.

Core Features Provided by Dukascopy

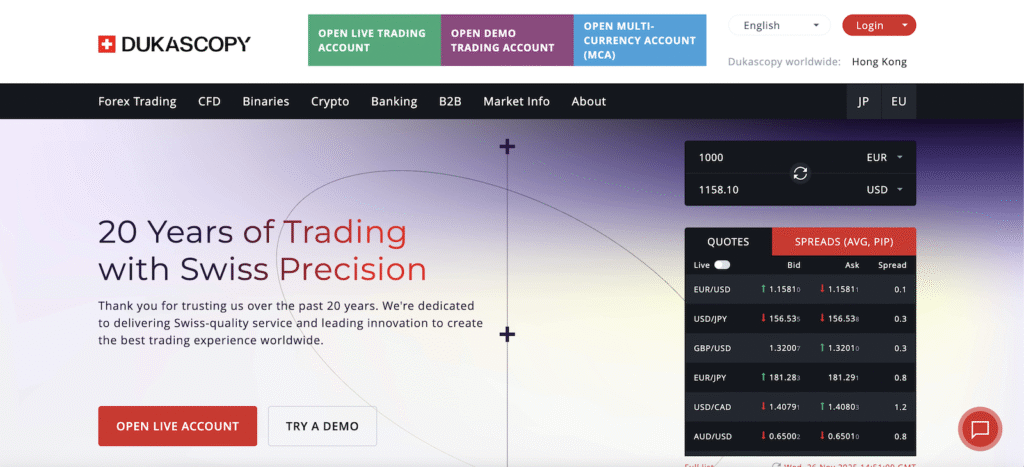

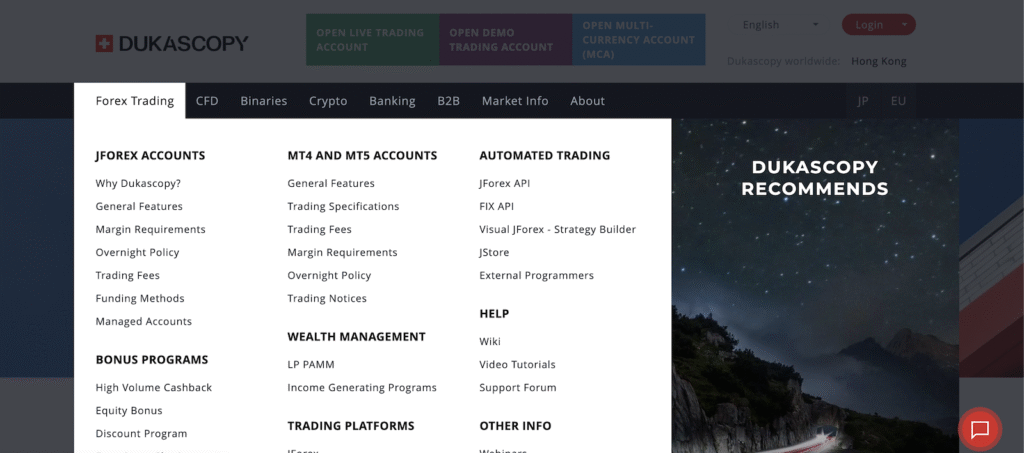

One of the main reasons clients turn to Dukascopy is the combination of trading technology and regulated financial oversight. The company operates a trading environment that gives users access to various asset classes, including currency pairs, precious metals and other instruments commonly used in active strategies. What sets Dukascopy apart for many traders is the emphasis on transparent execution and a structured interface that supports both newer and more experienced users.

Dukascopy also offers mobile and web platforms developed to deliver consistent performance across devices. We view this as an advantage for clients who need flexibility in monitoring their positions. The charting environment, depending on chosen configuration, provides technical indicators and order types appropriate for day trading or longer term analysis. While each user must evaluate platform suitability for their own strategies, the overall structure aims to reduce friction and enable efficient workflow.

Account Options and Accessibility at Dukascopy

A significant aspect of Dukascopy is its range of account formats. Clients can choose between retail accounts with standard deposits and more advanced options designed for professional needs. Since financial objectives differ, this variety supports a broad audience. The onboarding process follows regulatory standards, and clients must complete full verification before starting any activity. We consider this an important part of responsible financial interaction.

Furthermore, Dukascopy maintains online support resources that help users navigate the system. Although the quality of experience may vary among individual clients, the availability of multiple communication channels supports those who require guidance during setup or daily operations.

Regulatory Framework Around Dukascopy

Any reputable financial institution must operate under clear rules. Dukascopy functions within a regulated environment, which adds credibility for clients who prioritize safety and compliance. While this does not remove all risks associated with trading, it contributes to the overall reliability of the institution. We encourage potential users to review official documentation and regulatory disclosures directly on the Dukascopy website to ensure full understanding of obligations and limitations.

Why Prospective Clients Consider Dukascopy

Users evaluating financial platforms often look for stability, platform usability and transparent trading conditions. Dukascopy is often considered by those who want access to established infrastructure backed by clear rules. For corporate users, the combination of banking and trading features can also offer operational efficiency. Our analysis suggests that Dukascopy suits clients who need credible oversight along with competitive execution.

Final Thoughts for Clients Exploring Dukascopy

Choosing a financial service provider requires careful research. Dukascopy offers a structured and consistent set of tools that may match the goals of active traders and businesses seeking regulated financial services. Potential clients who value clarity, regulated conditions and a platform built for continuous operation may find Dukascopy a practical option.

We invite readers who need detailed legal or financial guidance to use the comment section to ask further questions so that they can make informed decisions before opening an account or submitting formal applications.