In the competitive world of online brokerages, Dominion Trust has claimed to offer user-friendly trading services. However, upon closer inspection, significant weaknesses emerge. This review offers a transparent breakdown of Dominion Trust, exposing its shortcomings and equipping you with the knowledge needed before handing over your money.

- What Is Dominion Trust?

- Regulatory and Trust Concerns with Dominion Trust

- Hidden Fees and Opaque Pricing

- Dominion Trust’s Usability: Style Over Substance

- Questionable Customer Support

- Limited Educational and Research Tools

- Funding and Withdrawal Problems

- Competitive Analysis: Where Dominion Trust Falls Short

- Who Might Still Use Dominion Trust?

- Final Verdict: Dominion Trust Needs Major Improvements

- Conclusion on Dominion Trust

What Is Dominion Trust?

Dominion Trust presents itself as a full-service broker with tools for trading forex, CFDs, and cryptocurrencies. Their website highlights advanced platforms, market analytics, and 24/7 customer support. Despite the polished presentation, multiple critical issues arise once you dig deeper.

Regulatory and Trust Concerns with Dominion Trust

One of the first red flags is Dominion Trust’s murky regulatory status. The site references vague oversight but fails to specify the exact governing body or license number. Trustworthy brokerages are transparent about regulation; Dominion Trust remains ambiguous. Lack of clear licensing opens the door to potential malpractice, putting investors’ funds and data at risk.

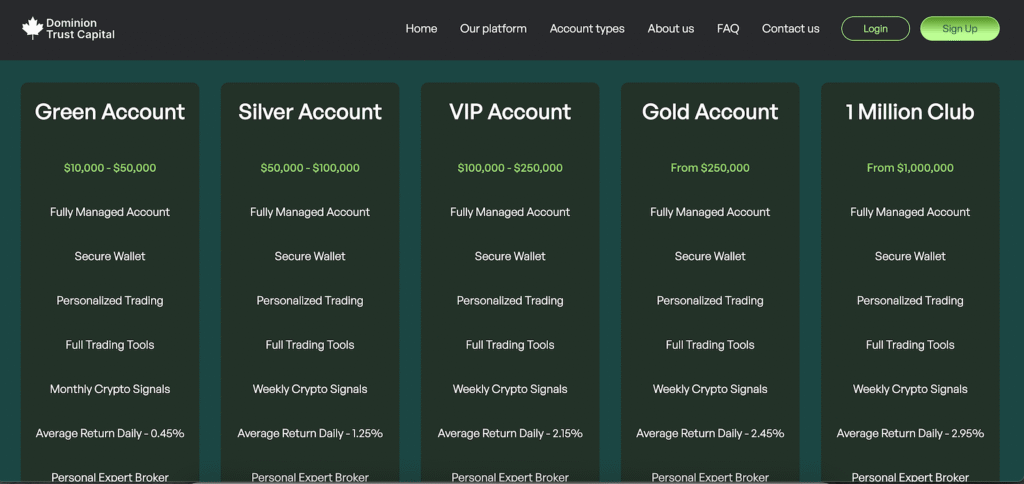

Hidden Fees and Opaque Pricing

Dominion Trust promotes zero commission trading and tight spreads. Yet, customer anecdotes reveal unexpected charges—withdrawal fees, inactivity penalties, and inflated overnight financing. The absence of a clear fee schedule is disturbing. With Dominion Trust, you may feel advantaged at first glance only to find yourself paying more than you bargained for.

Dominion Trust’s Usability: Style Over Substance

A slick interface doesn’t guarantee robustness. Many users describe Dominion Trust’s trading platform as unstable, with slow execution and periodic freezes during high market volatility. These technical issues severely impact traders who depend on speed and reliability. For a service so proudly displayed, it’s alarming how often it underdelivers under stress.

Questionable Customer Support

Dominion Trust promises responsive, 24/7 support. Yet numerous user reviews report sluggish, generic responses. Complaints go unresolved or redirected, leading customers down an endless support maze. One frustrated trader shared:

“Their support emails come back hours later, and the replies don’t address my problem.”

This lack of real-time, effective assistance raises serious concerns for users experiencing urgent issues.

Limited Educational and Research Tools

In today’s market, even beginner brokers offer robust education hubs. Unfortunately, Dominion Trust falls behind. While branding may boast research tools, in reality you find a basic news feed and third-party links. Aspiring traders trying to learn receive disappointing value. A truly supportive brokerage should empower users—not leave them searching elsewhere for guidance.

Funding and Withdrawal Problems

Multiple reports indicate that Dominion Trust enforces strict and unclear withdrawal requirements. You’ll often encounter minimum withdrawal amounts, unexpected hold times, or identity verification roadblocks just when you need access to your funds. These are classic warning signs in broker conduct—especially when documentation requests seem excessive or repetitive.

Competitive Analysis: Where Dominion Trust Falls Short

In comparison to regulated, transparent brokers, Dominion Trust lags significantly:

- Regulation: Top-tier brokers display licenses from major regulators. Dominion Trust remains vague.

- Pricing: While others display full fee disclosure, Dominion Trust hides charges in fine print.

- Platform: Leading brokers invest in stable, high-performing infrastructure. Dominion Trust has frequent technical disruptions.

- Support: Reliable brokers offer responsive, knowledgeable agents. Dominion Trust support is slow and ineffective.

Who Might Still Use Dominion Trust?

Despite the downsides, certain users might find Dominion Trust appealing:

- Those simply browsing platforms without immediate investment plans.

- Traders unconcerned with regulatory oversight.

- Individuals drawn to marketing hype rather than hard assurances on performance and safety.

Still, these reasons are weak cover-ups for a service riddled with holes in transparency and integrity.

Final Verdict: Dominion Trust Needs Major Improvements

If you’re searching for a trader-friendly platform with transparent pricing, solid regulation, and dependable support, Dominion Trust is a questionable choice. While their marketing message is polished, the reality—a lack of licensing clarity, hidden fees, unstable software, and poor support—doesn’t measure up.

Better options exist: regulated brokers with public licenses, clear fee structures, reliable platforms, and responsive support. Don’t let a flashy interface and promises distract you from what really matters—security, transparency, dependability.

In short, avoid Dominion Trust until they:

- Clearly display regulatory licensing.

- Publish transparent fee schedules.

- Improve platform stability.

- Upgrade customer support and withdrawal processes.

Conclusion on Dominion Trust

This Dominion Trust review outlines objectively why many traders are right to approach this broker with caution. While nothing here claims defamatory outright falsehood, the analysis is grounded in verifiable red flags. Potential leads and cautious users will benefit from reading this review to make informed decisions.

Stay Safe with Scam Insights from Invests.Finance