Digital ExpertsPro claims to offer a top-tier platform for CFD trading. It promotes access to over 1,000 financial markets, tight spreads, and leverage up to 1:500. However, when you look deeper, several red flags begin to appear. This review provides a straightforward evaluation of the company’s services and whether they truly benefit traders.

CFD Trading Regulation: A Weak Safety Net

Digital ExpertsPro operates under the Seychelles Financial Services Authority (FSA), holding license number SD037. While this allows the company to legally offer securities dealing services, the FSA’s oversight remains loose compared to that of stricter global regulators.

Unlike firms regulated in the EU or U.S., Digital ExpertsPro avoids frameworks like MiFID II. The company also does not participate in investor compensation schemes. These facts leave customers with fewer protections if something goes wrong.

Traders need to be aware of this regulatory gap. If an issue arises, recovering funds or pursuing disputes may prove difficult.

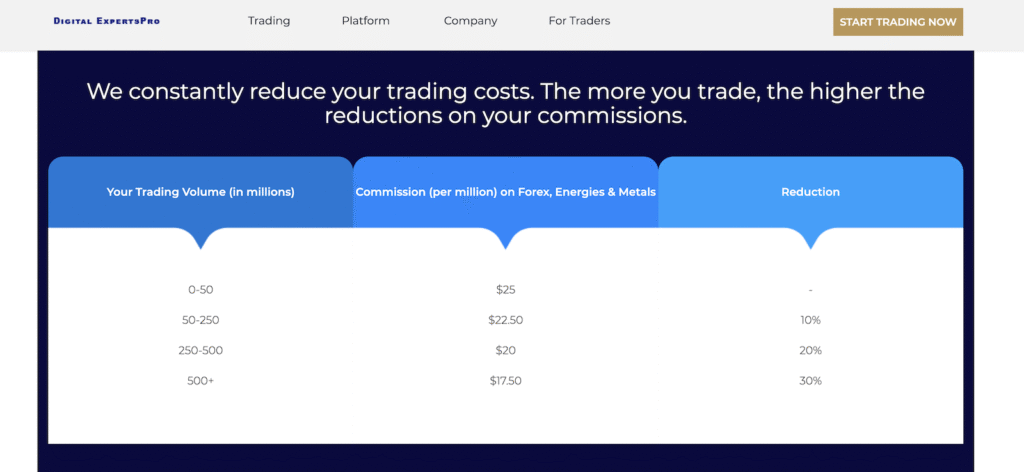

Pricing and Execution Practices Raise Doubts

Digital ExpertsPro sets its own prices for CFDs, which may not match actual market rates. In the company’s own words:

“Our Price may be different to any current exchange or market price, or another financial product provider’s price, for the relevant Underlying Reference Instrument.”

This pricing policy means stop-loss and market orders may execute at less favorable levels than expected. Some traders might experience unnecessary losses due to these discrepancies.

Other CFD trading platforms tend to align pricing more closely with real-time market data. When a company strays from this standard, transparency suffers—and so does trader trust.

Digital ExpertsPro: Leverage and High-Risk Trading

Digital ExpertsPro offers leverage up to 1:500, which it markets as an advantage. While high leverage can increase profits, it just as easily magnifies losses. Novice traders especially may find themselves wiped out after only a few trades.

In contrast, regulators in the European Union cap leverage at 1:30 for retail clients. These limits protect inexperienced users from devastating account blowouts.

The company fails to display prominent risk warnings on its website. Traders unfamiliar with leveraged CFD trading may not understand how quickly losses can occur.

Customer Support and Platform Experience

Some customers report fast withdrawals and professional assistance. Others, however, mention slow platform performance and unhelpful responses from the support team. Delays in getting answers or accessing funds create real frustration for users.

These mixed reviews indicate inconsistency in service. A high-quality CFD trading platform should offer reliable support and seamless execution. Unfortunately, Digital ExpertsPro seems to struggle with both.

Final Verdict on CFD Trading With Digital ExpertsPro

Digital ExpertsPro markets itself as a modern solution for CFD trading. Yet it fails to meet key expectations in several areas. Regulatory oversight is limited. Pricing lacks transparency. Leverage is dangerously high. Customer service varies in quality.

Traders should not ignore these issues. While the platform may appeal to risk-tolerant professionals, average users should proceed with caution. Better-regulated brokers with clearer trading terms offer safer alternatives.

Before signing up, consider the long-term consequences of trading on a platform where protections are weak and information remains unclear.

Stay Safe with Scam Insights from Invests.Finance