Defcofx has emerged as an offshore forex and CFD broker, attracting traders with promises of high leverage and low trading costs. Operating from Saint Lucia, the broker offers trading services through the MetaTrader 5 platform. However, beneath the surface, several aspects raise concerns about the reliability and safety of trading with Defcofx.

Defcofx: Regulatory Status and Transparency

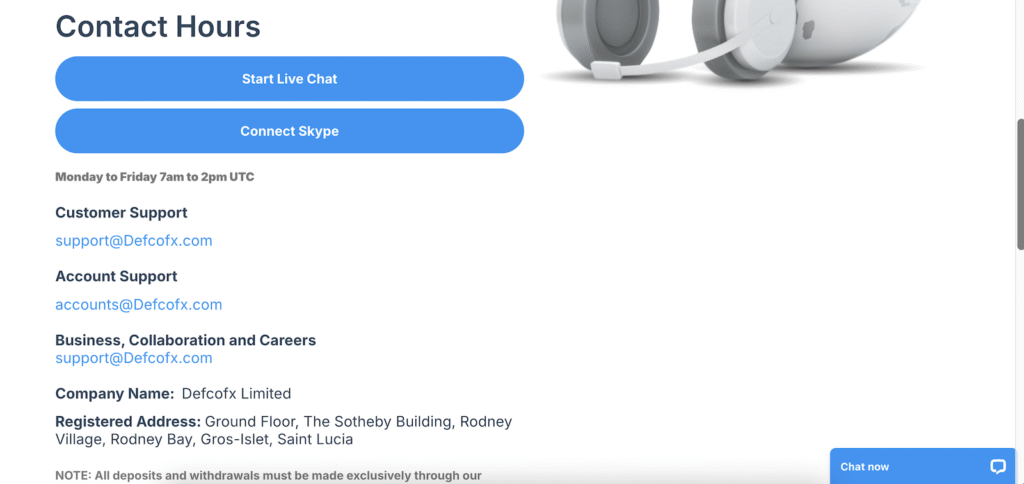

One of the primary concerns with Defcofx is its regulatory standing. The broker is registered in Saint Lucia, a jurisdiction known for its lenient financial regulations. Unlike brokers regulated by authorities such as the UK’s Financial Conduct Authority (FCA) or Australia’s Securities and Investments Commission (ASIC), Defcofx lacks stringent oversight. This absence of robust regulation means that traders have limited protection in the event of disputes or malpractices.

Furthermore, Defcofx does not provide clear information about its ownership or corporate structure. The lack of transparency regarding the company’s leadership and operational practices adds another layer of uncertainty for potential clients.

Trading Conditions and Offerings

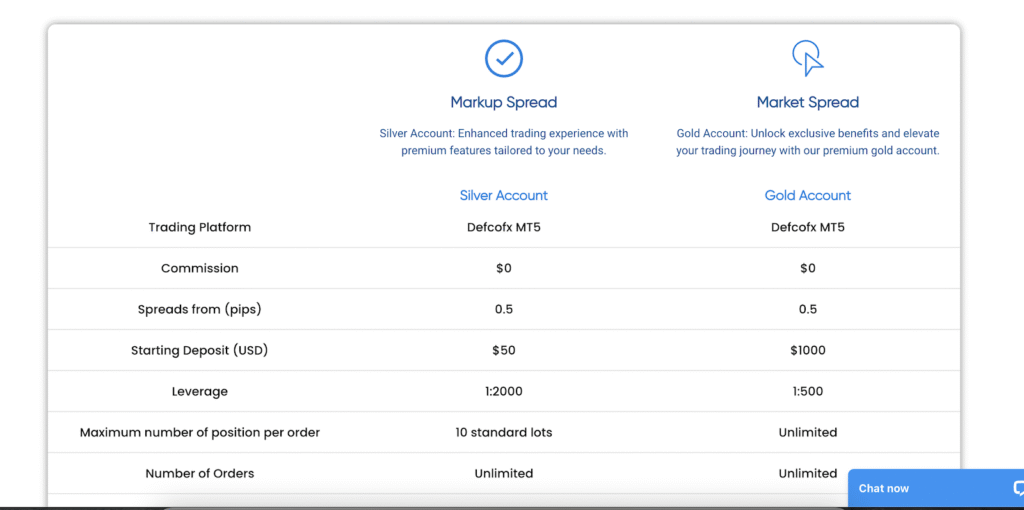

Defcofx offers a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, all accessible via the MetaTrader 5 platform. The broker advertises high leverage ratios, reportedly up to 1:2000, and low spreads starting from 0.3 pips. While these conditions may seem attractive, they come with significant risks.

High leverage can amplify both profits and losses, making it a double-edged sword, especially for inexperienced traders. Moreover, some users have reported discrepancies between quoted spreads and actual execution prices, leading to unexpected losses. Such issues suggest potential problems with the broker’s execution model and price feeds.

Deposit and Withdrawal Concerns

Defcofx primarily accepts deposits and processes withdrawals through cryptocurrencies like Bitcoin and Tether (USDT). While this approach offers certain advantages, it also poses challenges. Cryptocurrency transactions are irreversible and lack the dispute resolution mechanisms available with traditional banking methods. This means that if issues arise, recovering funds can be exceedingly difficult.

Additionally, some traders have reported delays and complications when attempting to withdraw funds from their Defcofx accounts. Such experiences raise questions about the broker’s financial practices and commitment to client satisfaction.

Customer Support and Service

Effective customer support is crucial in the trading industry. Defcofx claims to offer 24/5 support through various channels, including live chat and email. However, user experiences suggest that response times can be slow, and the quality of assistance varies. Inadequate support can be particularly problematic during critical trading moments when timely help is essential.

User Feedback and Reputation

Online reviews of Defcofx are mixed. While some users praise the broker’s trading conditions and platform, others express concerns about execution issues, withdrawal problems, and lack of transparency. It’s important to approach such reviews with caution, as some may be biased or unverified. Nevertheless, the recurring themes of dissatisfaction cannot be ignored.

Conclusion on Defcofx

While Defcofx offers certain appealing features, such as high leverage and a variety of trading instruments, the broker’s lack of robust regulation, transparency issues, and reported operational problems present significant risks. Traders should exercise caution and conduct thorough due diligence before engaging with Defcofx. Considering the potential pitfalls, exploring alternative brokers with stronger regulatory oversight and proven track records may be a safer choice for those seeking a reliable trading environment.

Stay Safe with Scam Insights from Invests.Finance