CTI Capital, operating through ctimarket.com, presents itself as a full-service brokerage firm offering a range of financial services, including brokerage, research, and portfolio management. However, a closer examination uncovers several red flags that potential investors should be aware of before engaging with this platform.

CTI Capital: Lack of Regulatory Oversight

One of the most pressing concerns about CTI Capital is its apparent lack of regulation by any recognized financial authority. The firm’s website does not provide clear information about its regulatory status, and there is no evidence of oversight by bodies such as the Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC). Operating without proper regulation raises significant questions about the firm’s legitimacy and the safety of client funds .

Opaque Ownership and Management Structure

Transparency is a cornerstone of trust in the financial industry. CTI Capital falls short in this regard, offering minimal information about its ownership and management team. The absence of identifiable leadership makes it challenging for clients to assess the firm’s credibility and accountability. Such anonymity is often a characteristic of entities that may not have clients’ best interests at heart.

Questionable Withdrawal Practices

Numerous reports have surfaced regarding difficulties in withdrawing funds from CTI Capital accounts. Clients have alleged that withdrawal requests are met with delays, additional verification requirements, or are outright ignored. In some cases, clients have been unable to retrieve their funds entirely, leading to suspicions of fraudulent activity.

CTI Capital: Misleading Marketing and Promises

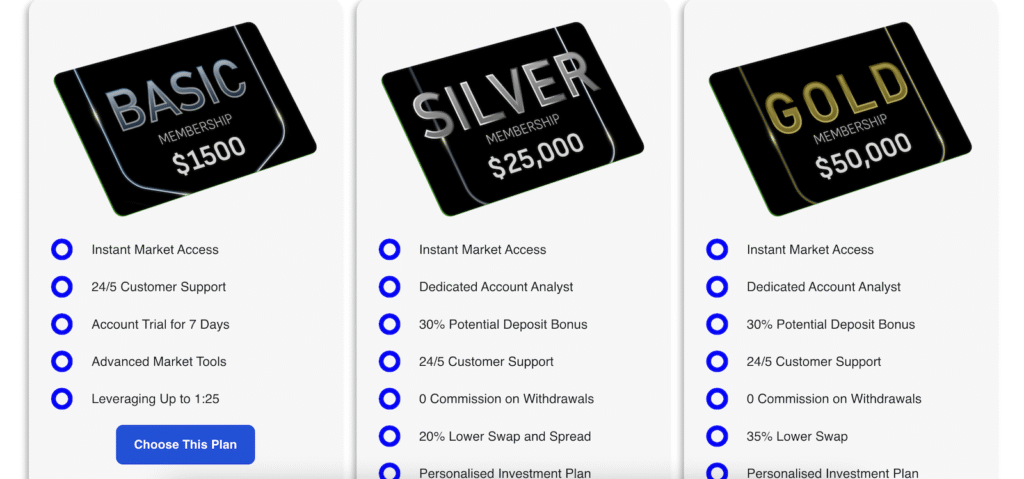

CTI Capital’s marketing materials boast about providing “safe and secure” investment opportunities and claim to have a “trusted platform” with “real-time data” and “customizable charts” . However, these assertions are not substantiated by verifiable evidence. The lack of transparency and regulatory oversight contradicts the firm’s claims of trustworthiness and security.

Absence of Verifiable Performance Data

While CTI Capital touts its proprietary market models and successful trading strategies, there is a notable absence of verifiable performance data. The firm does not provide audited financial statements or independent assessments of its investment performance. This lack of transparency makes it difficult for potential clients to evaluate the firm’s effectiveness and reliability.

Conclusion on CTI Capital

The analysis of CTI Capital reveals several concerning aspects, including the lack of regulatory oversight, opaque ownership, questionable withdrawal practices, and unsubstantiated marketing claims. These factors collectively suggest that potential investors should exercise extreme caution when considering engagement with CTI Capital. It is advisable to seek out well-regulated and transparent financial service providers to ensure the safety and security of your investments.

Stay Safe with Scam Insights from Invests.Finance