Summit Chargeback presents itself as a chargeback dispute resolution service aimed at helping businesses fight fraudulent transactions and recover lost revenue. According to its website, the service helps merchants manage disputes more easily and supports those facing high chargeback ratios. However, a deeper investigation into Summit Chargeback reveals that the company may not deliver on all of its promises. With a lack of transparency, minimal verifiable success data, and poor online presence, this service may not be the reliable solution it claims to be.

- Lack of Transparency on Summit Chargeback’s Website

- No Verifiable Track Record or Testimonials

- Potential Brand Confusion and Trust Issues

- Summit Chargeback vs. Other Industry Leaders

- Summit Chargeback – Red Flags That Can’t Be Ignored

- Who Might Still Consider Summit Chargeback?

- What to Ask Before Signing with Summit Chargeback

- Final Verdict: Is Summit Chargeback Worth It?

- Share Your Experience

Lack of Transparency on Summit Chargeback’s Website

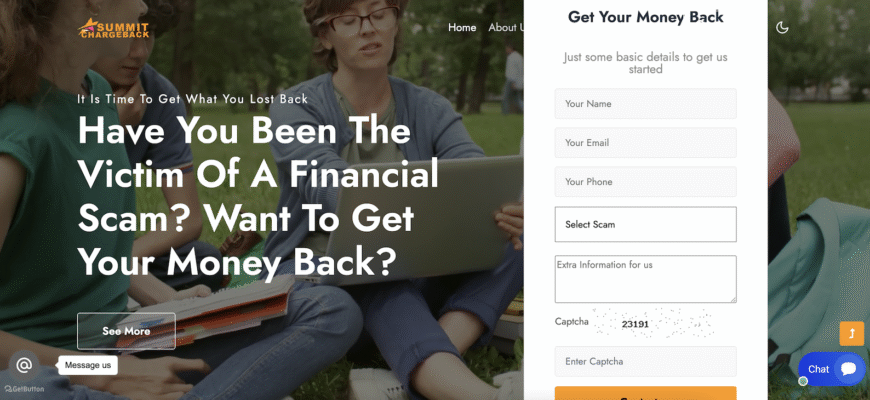

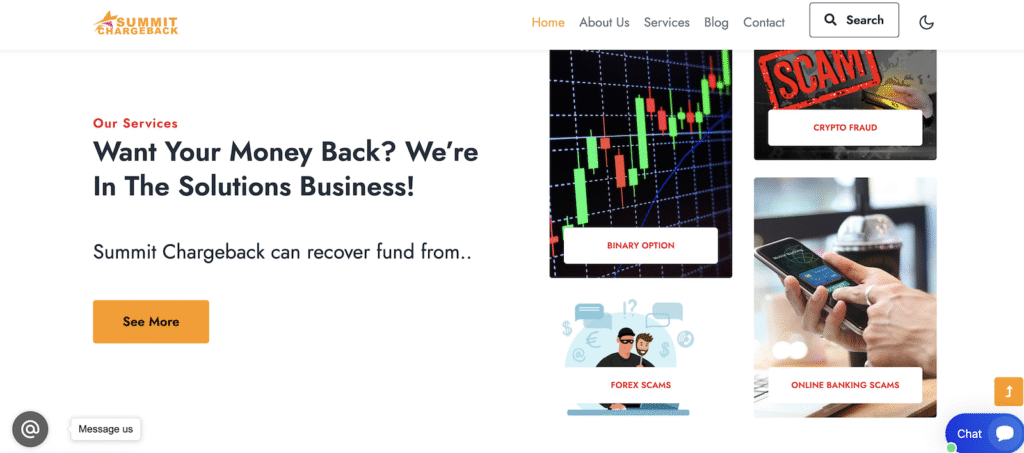

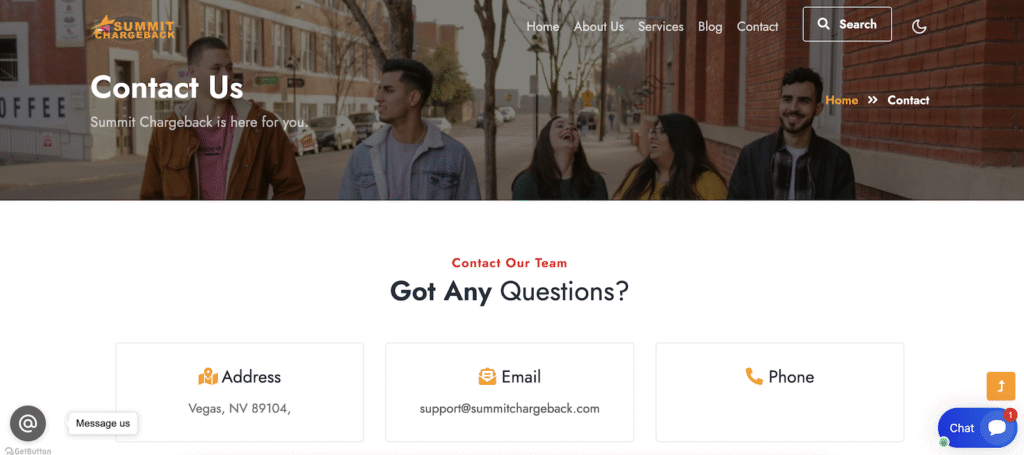

One of the first concerns with Summit Chargeback is the striking absence of key information on its official website, summitchargeback.com. There are no clearly defined pricing structures, service level agreements, or performance statistics provided. For businesses evaluating a chargeback mitigation partner, transparency is crucial. Without specific details about service fees or results, it’s difficult for potential clients to assess the value or risk associated with using Summit Chargeback.

The site leans heavily on general language and vague claims, with no concrete case studies or success stories. This lack of accountability creates uncertainty about the actual effectiveness of Summit Chargeback’s services.

No Verifiable Track Record or Testimonials

Reputable chargeback companies often publish statistics showing win rates, average time to resolve disputes, and merchant testimonials. Unfortunately, Summit Chargeback does not offer any such data. There are no third-party reviews, industry comparisons, or merchant success stories available. A company that deals in recovering lost revenue must demonstrate its results to earn trust, but in this case, Summit Chargeback provides no measurable proof of performance.

Without real reviews or even third-party verification, it becomes difficult to gauge whether Summit Chargeback has successfully helped businesses reduce their chargeback ratios or recover funds.

Potential Brand Confusion and Trust Issues

Another issue to consider is the confusing use of the name “Summit.” Several companies with similar names—such as Summit Merchant Solutions and Summit Collection Services—have a poor reputation online. Some firms in this space have drawn criticism for hidden fees, aggressive sales tactics, and unresolved complaints. Although Summit Chargeback isn’t directly affiliated with these companies, the similarity in branding may raise concerns among potential clients who are cautious about choosing the wrong provider or encountering questionable practices.

Businesses looking for dispute resolution services should not have to question whether they’re engaging with a reputable provider. The burden falls on Summit Chargeback to distinguish itself clearly and provide transparent, verifiable information. As of now, that separation isn’t clear enough.

Summit Chargeback vs. Other Industry Leaders

In today’s market, successful chargeback management firms leverage automation, artificial intelligence, and advanced analytics to prevent disputes before they occur. These companies also offer real-time dashboards, detailed reporting, and flexible pricing models. Many well-established providers also boast case studies and client feedback showcasing significant ROI.

By contrast, Summit Chargeback offers none of these standard features—at least not publicly. There is no mention of what tools or technologies are used. The absence of this information raises questions about whether Summit Chargeback uses modern tools at all, or if it’s relying on manual, outdated methods that may be less effective.

Summit Chargeback – Red Flags That Can’t Be Ignored

Here are some of the most concerning factors that stand out when evaluating Summit Chargeback:

- No pricing or contract details available: Users must contact the company directly to get any concrete information, which increases the risk of hidden fees or fine print traps.

- No third-party reviews or rankings: Trusted review sites, forums, and business directories barely mention the company, making it nearly invisible in the digital reputation space.

- No verified performance metrics: Without data, all performance claims are unverifiable.

- Confusing name and potential brand overlap: The shared name with other poorly rated companies may cause unnecessary confusion and reputational damage.

For a company that positions itself as a trusted financial ally to merchants, Summit Chargeback has done very little to earn that trust.

Who Might Still Consider Summit Chargeback?

There may be a narrow group of small businesses or sole proprietors who are new to chargeback disputes and are simply looking for basic guidance. If Summit Chargeback offers affordable, entry-level packages and direct phone support, it could serve as a short-term solution. However, even in this context, the risks and lack of visible credentials should not be ignored.

Before engaging with Summit Chargeback, merchants would be wise to thoroughly compare it with well-known alternatives that offer more clarity, stronger reputations, and proven results.

What to Ask Before Signing with Summit Chargeback

If you’re still considering Summit Chargeback, ask the following before proceeding:

- What is the average win rate for dispute resolution?

- What is the pricing model? Is it commission-based or subscription-based?

- Are there contract cancellation fees or long-term obligations?

- What tools or platforms are used to manage disputes?

- Can they provide verifiable merchant testimonials or case studies?

If the company cannot confidently answer these questions, it’s a major warning sign.

Final Verdict: Is Summit Chargeback Worth It?

Summit Chargeback promises to help merchants recover revenue and reduce fraudulent activity, but at this stage, too many questions remain unanswered. The lack of transparency, combined with a minimal online footprint and zero verified reviews, suggests caution. Businesses that rely on data, accountability, and clarity will find Summit Chargeback an incomplete solution at best.

The brand’s resemblance to others with tarnished reputations only adds to the unease. Until Summit Chargeback clearly defines its pricing, demonstrates its effectiveness, and distinguishes itself from similarly named firms, merchants may be better off considering other options.

Share Your Experience

Have you worked with Summit Chargeback? Did it help your business—or leave you frustrated? Share your story in the comments below. Your experience could help other business owners make smarter choices.