Falling victim to a scam can be devastating, both emotionally and financially. However, if you paid using a credit or debit card, you might have a chance to recover your funds through a process known as a chargeback. This guide provides a step-by-step approach to initiating a chargeback and explores alternative methods for fund recovery.

- What Is a Chargeback?

- When to Consider a Chargeback

- Step-by-Step Guide to Filing a Chargeback

- 1. Contact the Merchant

- 2. Gather Supporting Documentation

- 3. Contact Your Card Issuer

- 4. Follow Up

- Understanding Chargeback Reason Codes

- 1. Report to Consumer Protection Agencies

- 2. File a Police Report

- 3. Consult Legal Counsel

- Preventing Future Scams

- Conclusion

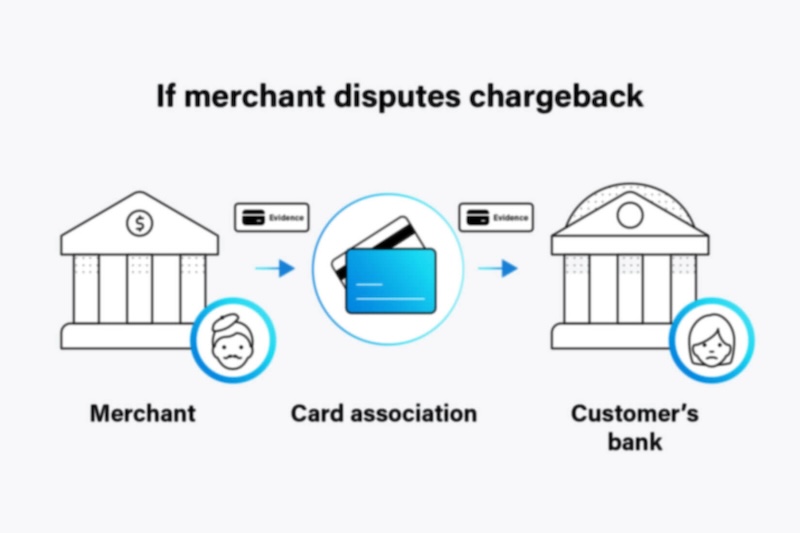

What Is a Chargeback?

A chargeback is a consumer protection mechanism that allows you to dispute a transaction and request a refund directly from your card issuer. It’s particularly useful when dealing with unauthorized transactions or when a merchant fails to deliver goods or services as promised.

When to Consider a Chargeback

You should consider initiating a chargeback if:

• You were charged for goods or services you didn’t receive.

• The product or service received was significantly not as described.

• You were charged multiple times for the same transaction.

• You suspect fraudulent activity on your account.

Step-by-Step Guide to Filing a Chargeback

1. Contact the Merchant

Before initiating a chargeback, attempt to resolve the issue directly with the merchant. Keep records of all communications, as this documentation may be required later.

2. Gather Supporting Documentation

Prepare the following:

• Receipts or proof of purchase.

• Email correspondence with the merchant.

• Screenshots of product descriptions or advertisements.

• Any other evidence supporting your claim.

3. Contact Your Card Issuer

Reach out to your bank or card issuer to initiate the chargeback process. Be prepared to provide all gathered documentation and a detailed explanation of the issue.

4. Follow Up

Stay in contact with your card issuer throughout the process. Respond promptly to any requests for additional information. The resolution time can vary, but staying proactive can help expedite the process.

Understanding Chargeback Reason Codes

Card networks assign specific reason codes to chargeback claims, indicating the nature of the dispute. Understanding these codes can help you provide the appropriate documentation:

• Fraudulent Transaction: Unauthorized use of your card.

• Goods/Services Not Received: You paid but didn’t receive the product or service.

• Product Not as Described: The item received differs significantly from its description.

• Duplicate Charge: You were charged more than once for the same transaction.

Alternatives to Chargebacks

If a chargeback isn’t an option, consider these alternatives:

1. Report to Consumer Protection Agencies

In the U.S., you can file a complaint with the Federal Trade Commission (FTC) at reportfraud.ftc.gov. They can investigate and take action against fraudulent businesses.

2. File a Police Report

Reporting the scam to your local law enforcement can be beneficial, especially for larger fraud cases. A police report may also be required for other recovery methods.

3. Consult Legal Counsel

For significant financial losses, consulting with an attorney can help you explore legal avenues for fund recovery.

Preventing Future Scams

• Verify Sellers: Research businesses before making purchases.

• Use Secure Payment Methods: Prefer credit cards over wire transfers or gift cards.

• Be Skeptical of Unsolicited Offers: Avoid deals that seem too good to be true.

• Monitor Your Accounts: Regularly check your bank statements for unauthorized transactions.

Conclusion

While falling victim to a scam is distressing, mechanisms like chargebacks offer a pathway to recover lost funds. By acting promptly and following the appropriate steps, you can increase your chances of a successful resolution. Stay vigilant and informed to protect yourself from future fraudulent activities.