In today’s digital landscape, many platforms claim to offer seamless access to global markets, promising transparency, speed and profits. One such entrant is Capexgo, accessible via capexgo.com. In this article we provide an objective, detailed overview of Capexgo: its services, structure, strengths, concerns and what prospects (especially in financial and legal services) should carefully consider before engaging. Our aim is to assist potential clients in making a well-informed decision, and to clarify when leaving a comment or seeking further contact is appropriate.

- What is Capexgo and what services does it claim to provide

- Strengths and positive features

- Concerns, risk signals and issues

- Operational and service analysis

- Comparison with industry norms

- Who might consider using Capexgo — and under what conditions

- Suitable for:

- Avoid if:

- Key take-aways and recommendation

- Final thoughts about Capexgo

What is Capexgo and what services does it claim to provide

Capexgo presents itself as a full-service trading and investment platform, offering access to multiple asset classes: currencies (60+ pairs), commodities, futures, equities (2000+ stocks), and cryptocurrencies. Their marketing emphasises “no hidden fees”, “bank-grade security”, “fast execution”, “dedicated account manager”, “educational tools & live signals”.

From a service viewpoint, such broad access can be attractive: if you are a trader or investor seeking a one-stop platform covering multiple markets, then the convenience of Capexgo could appeal. The pledge of multilingual support, personal account guidance and mobile access adds to the promise of a turnkey solution.

However, the wide range of services also implies complexity, and users should ask: how well are each of these services executed, what are the fees, what is the regulation, and how reliable is the withdrawal process?

Strengths and positive features

When analysing Capexgo, there are some features that, on paper, seem positive and may appeal to potential clients:

- Variety of markets and instruments. Having many asset types under one roof can help diversify. Capexgo’s claim to provide 2000+ stocks, futures, commodities, currencies and cryptos is a broad offering.

- Modern interface and mobile access. They emphasise a clean, fast UI with mobile/desktop access and analytics tools — which for active traders can be a practical benefit.

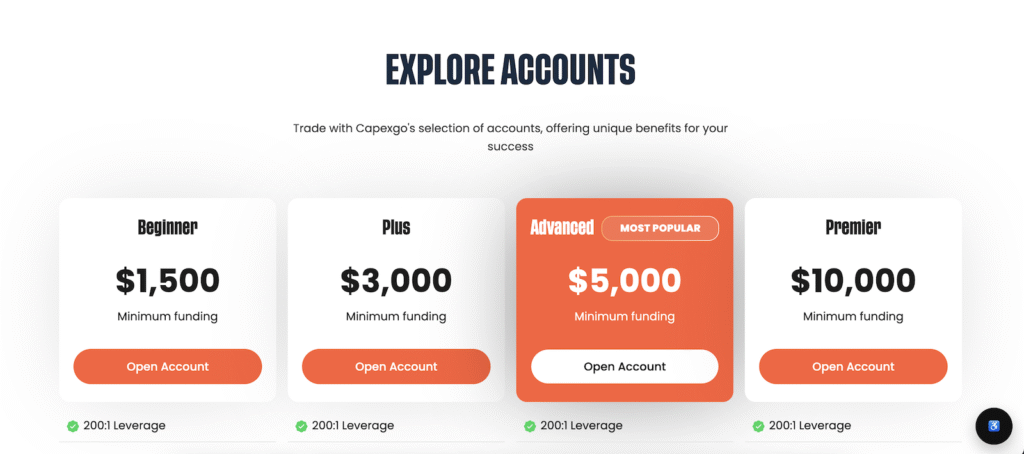

- Account-tiers and transparency claims. The website lists different account types (“Beginner”, “Plus”, “Advanced”, “Premier”) with minimum funding amounts ($1 500 to $10 000) and claims of “transparent plans”.

- Focus on user support and guidance. A dedicated account manager and educational tools are listed as part of the service, which can raise the service-level expectation.

For those seeking a platform combining many services, Capexgo could appear as a one-stop solution. But of course, “on paper” must be verified in practice.

Concerns, risk signals and issues

Despite the attractive service list, there are a number of significant red flags and concerns associated with Capexgo that any potential user should carefully weigh.

- Regulation and licensing questions

- Capexgo’s own site lists “Invoza Limited … Business Number 003262024 … ISA License No. 052955-038 … registered at Island Ring Road, TB office, NRU68, Yeren, Republic of Nauru”.

- Independent reviewers note that Nauru is an offshore jurisdiction with minimal regulatory oversight and that the licence claim is uncorroborated.

- The Whois record hides ownership via a proxy service.

Overall, this suggests the regulatory oversight is weak or unclear — a serious risk in the financial services realm.

- Customer experience and withdrawal difficulties

- On user-review platforms such as Trustpilot, Capexgo (capexgo.com) is rated very poorly (2.1 out of 5 from 54 reviews) with many reports of blocked withdrawals and unresponsive support.

- Legal analysis articles highlight that many users say: “I cannot withdraw my funds”, “I’m being asked to deposit more before I can get my money back”, “service disappears after deposit”.

- One risk-analysis site summarises: “This company shows several warning signs of potential fraud … offshore jurisdiction … high minimum deposit … questionably licensed.”

- Domain age and transparency

- The domain is relatively new, traffic is low, owner obscured. Scamadviser flags this as a low trust score.

- The marketing claims are broad and aggressive (“ultimate trading experience”, “trade freely on any device”), which are typical of high-risk platforms in this sector.

- High minimum funding and leverage risk

- Minimum funding starts at $1 500, which is high relative to some peers.

- Leverage up to 1:200 is listed — high leverage increases both potential gains and significant risk of loss.

Operational and service analysis

From a deeper service-perspective, how the platform operates matters. Here we summarise key operational points:

- Onboarding and verification: Capexgo requires account creation, proof of identity (POI) upload, after which funding is required.

- Funding & account tiers: As mentioned, the minimum funding amounts vary by account tier. Once you fund, you unlock access to instruments.

- Trading platform & execution: Capexgo claims “lightning-fast execution”, “your orders move with the market – every second counts”.

However, user complaints include delays, mismatch of quotes, and platform slowness. - Withdrawals & support: While the site claims “accelerated withdrawals” and “real human support”, multiple users report difficulties in withdrawing and limited help.

- Risk disclosure: The website includes a warning: “The potential for financial loss is significant, and there is no assurance of achieving any particular results.”

This is legally appropriate, but when combined with user complaints about blocked withdrawals, it increases caution.

Comparison with industry norms

In order to understand how Capexgo compares with more established platforms, consider:

- Many regulated brokers operate under jurisdictions such as the UK’s FCA, Australia’s ASIC, EU’s MiFID regimes — offering investor protections, account segregation, transparent audits.

- Minimum funding requirements may be lower; reviews of trusted brokers often emphasise ease of withdrawal, transparent fees, and strong regulatory oversight.

- In contrast, Capexgo’s offshore registration, high minimum funding, low public reputation and multiple user complaints place it at higher risk relative to well-known regulated brokers.

Who might consider using Capexgo — and under what conditions

Given the mix of features and concerns, when could using Capexgo make sense — and when should it be avoided?

Suitable for:

- Experienced traders/investors who understand the high risk of offshore/unregulated platforms and are willing to proceed with caution.

- Individuals who are comfortable with larger initial deposits ($1 500+), high leverage (up to 1:200), and monitoring their positions actively.

- Users who will test with small capital first, verify the withdrawal process, and treat this as a higher-risk service rather than a “safe” broker.

Avoid if:

- You are a novice investor looking for strong regulatory protection, low capital deposit, easy withdrawal, or transparent background.

- You cannot afford to lose the money you deposit — given the elevated risk profile.

- You expect the same safeguards as major regulated brokers (which appear lacking here).

Key take-aways and recommendation

When summarising our findings on Capexgo:

- The platform offers an ambitious set of services — multi-asset access, modern interface, mobile convenience, and account tiers.

- On the positive side, if you are aware of the risks and are comfortable with them, you might benefit from its service set.

- However, significant risk signals exist: offshore jurisdiction, unclear licensing, numerous user complaints about withdrawals and support, high minimum funding and high leverage.

- Especially in the context of financial and legal services, credibility, transparency and regulation are paramount — and these appear weaker for Capexgo.

- Our recommendation: if you are considering using Capexgo, proceed only after performing your own due-diligence:

- Verify actual regulatory registration (check licensing bodies, not just what the website claims).

- Test the platform with a modest amount, attempt a withdrawal, check support responsiveness.

- Keep your expectations realistic: high leverage and “fast execution” statements do not guarantee profit — risk of loss remains high.

- If you’re unsure, consult a professional adviser who can assess the fit for your financial and legal situation.

Final thoughts about Capexgo

In the quest for trading or investment platforms, the balance between opportunity and risk is ever present. Capexgo (capexgo.com) presents a compelling service offer, but also carries material risk elements. For potential users — particularly those in financial and legal service sectors seeking platforms to partner or promote — transparency, withdrawal reliability and regulation are key.

We invite you to comment below with your experiences, questions or if you wish to seek guidance on next steps (e.g., legal review, choosing alternative services or verifying platform reliability). Your feedback helps us all make more informed decisions.