In the ever-evolving world of cryptocurrency, numerous platforms promise lucrative returns. One such platform is Bitflow Investment. However, beneath its glossy exterior lie several concerns that potential investors should be aware of.

Bitflow Investment – Lack of Transparency

A fundamental aspect of any legitimate investment platform is transparency. Bitflow Investment falls short in this regard.

- Anonymous Ownership: The platform provides no information about its founders or management team. This anonymity raises questions about accountability and trustworthiness.

- Unverified Claims: Bitflow Investment makes bold claims about its profitability without offering verifiable data or third-party audits to support these assertions.

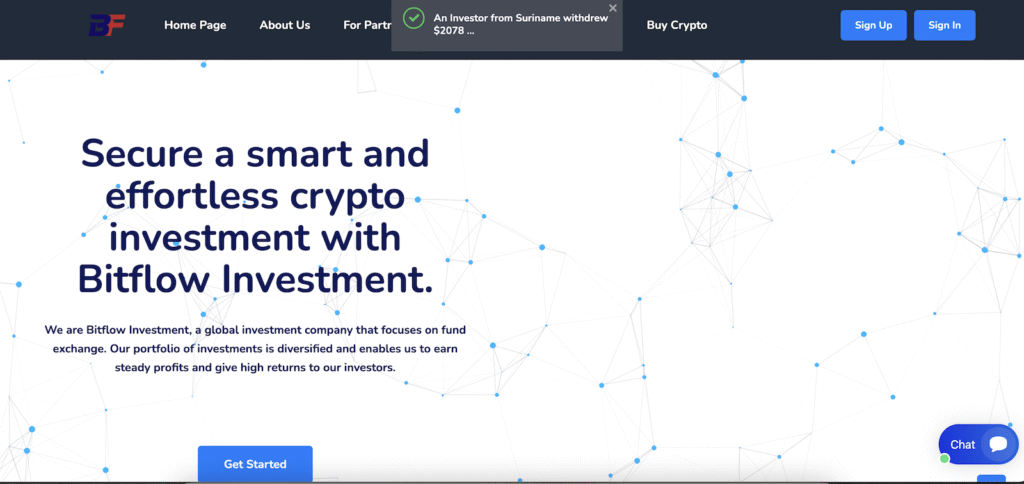

Questionable Business Model

The business model of Bitflow Investment exhibits characteristics commonly associated with high-risk schemes.

- Unrealistic Returns: The platform promises significant returns in short timeframes, a hallmark of Ponzi schemes. Such promises are often unsustainable and indicative of underlying issues.

- Referral Emphasis: A significant focus on recruiting new members suggests a reliance on continuous influxes of capital, rather than genuine investment strategies.

Technical and Security Concerns

Security is paramount in the digital investment space. Bitflow Investment presents several technical red flags:

- Lack of HTTPS: The absence of HTTPS encryption means data transmitted through the site is vulnerable to interception, compromising user security.

- Poor Website Design: A poorly designed website with minimal functionality can indicate a lack of professionalism and potential neglect of user experience and security.

Bitflow Investment: Regulatory and Legal Issues

Operating within legal frameworks is essential for any investment platform. Bitflow Investment’s regulatory standing is dubious:

- No Regulatory Oversight: There is no evidence that Bitflow Investment is registered with any financial regulatory bodies, raising concerns about its legitimacy and the safety of user funds.

- Use of Shell Companies: The platform’s association with entities registered in jurisdictions known for lenient corporate regulations suggests potential attempts to evade scrutiny.

User Experiences and Reviews

User testimonials and reviews provide insight into a platform’s operations. Bitflow Investment has garnered several negative reviews:

- Withdrawal Issues: Multiple users report difficulties in withdrawing funds, a common issue with fraudulent platforms.

- Lack of Support: Complaints about unresponsive customer service further exacerbate concerns about the platform’s reliability.

Conclusion on Bitflow Investment

While the allure of high returns is tempting, the numerous red flags associated with Bitflow Investment cannot be ignored. Potential investors should exercise extreme caution and conduct thorough due diligence before engaging with the platform.

Stay Safe with Scam Insights from Invests.Finance