We are writing this article to draw public attention to considerable red flags surrounding Avexbridges and to urge caution to anyone considering their services. As experts in reviewing financial and legal recovery services, we find it essential to present a balanced yet critical assessment. Our goal is not to defame, but to give a fair, fact-based warning.

- What Avexbridges Claims to Offer

- Why Avexbridges Raises Multiple Serious Questions

- Lack of Transparent Regulation and Verifiable Credentials

- Reviews and “Success Stories” Are Limited and Possibly Biased

- Services Are Vague, Promises Are Broad, Costs Are Hidden

- Pattern Resembles Known Scam-Recovery Schemes

- What Potential Clients Should Demand Before Trusting Avexbridges

- Final Thoughts: Avexbridges Might Offer Hope — But It’s Probably Not Worth the Risk

What Avexbridges Claims to Offer

Avexbridges presents itself as an international investigative and recovery firm specializing in retrieving stolen money or assets from fraudulent investment schemes. On their website, they promise “best-in-class services for individuals defrauded by unregulated investment platforms.” According to their profile, they claim to work with top-level attorneys and offer recovery services for victims of scams like fake binary options and cryptocurrency investment portals.

At first glance, such a service might seem appealing to troubled investors. Many might view Avexbridges as a last resort to reclaim lost funds. However, when we dig deeper into what they actually deliver and what they don’t serious doubts arise.

Why Avexbridges Raises Multiple Serious Questions

Lack of Transparent Regulation and Verifiable Credentials

Unlike a regulated financial recovery or legal firm, Avexbridges offers no verifiable license or oversight information. On public registries there is no clear trace of regulatory oversight tied to their name. For financial-legal recovery, absence of such credentials is a major red flag. Without regulatory or legal oversight there is no guarantee that any entrusted funds or promises of recovery are legitimate.

Additionally, similar services in the online recovery sector often show domain Whois records hidden under privacy shields a common pattern in companies flagged by independent watchdogs. This practice makes it difficult for potential clients to verify who actually runs the firm and where they are located. This opacity is problematic.

Reviews and “Success Stories” Are Limited and Possibly Biased

Avexbridges promotes a handful of glowing reviews, mostly from customers claiming full recovery of funds lost in scams. While positive testimonials might seem reassuring, their small number (just a few) and lack of independent verification raise doubt. It is impossible to confirm whether these represent typical outcomes or cherry-picked successes intended for marketing.

In finance-recovery industries, it is common for firms to highlight a few wins while omitting their failures. Without transparent statistics on success rates how many cases resulted in recovery, how many ended unsuccessfully, average time, cost, possible fees potential clients cannot make an informed decision.

Services Are Vague, Promises Are Broad, Costs Are Hidden

The described services by Avexbridges are broad and ambitious: asset tracing, legal recovery in multiple jurisdictions, liaising with attorneys, complex international fraud investigations. Yet there is little detail on how exactly these services are carried out. There is no public breakdown of procedure, timelines, or contingency plans in case recovery fails.

This kind of vagueness is dangerous. When a firm promises to “recover assets” from fraudulent investments without clear methodology, clients risk paying upfront fees or entrusting sensitive personal and financial information without any guaranteed outcome.

Given that many fraudulent schemes promise high recovery rates, but fail to deliver or vanish once they collect fees this makes Avexbridges’ offer look risky.

Pattern Resembles Known Scam-Recovery Schemes

In the broader landscape of financial fraud recovery, many firms promising miraculous returns and full refunds have been exposed as scams themselves, preying on the desperation of victims. Fake guarantees, undisclosed fees, invisible ownership, and anonymous domains are recurring traits.

A recovery company operating under similar opaque conditions hidden registration details, private domain registration, lack of transparent track record should be approached with extreme caution. Sadly, Avexbridges fits this pattern too well.

What Potential Clients Should Demand Before Trusting Avexbridges

If someone still considers contacting Avexbridges for funds recovery, we advise to demand the following:

- Public evidence of legal/financial licenses or registration in a reputable jurisdiction;

- Clear terms and agreements specifying fees, success conditions, refund or no-win no-fee options;

- List of completed cases with verifiable documentation (court orders, asset recovery records, third-party confirmations);

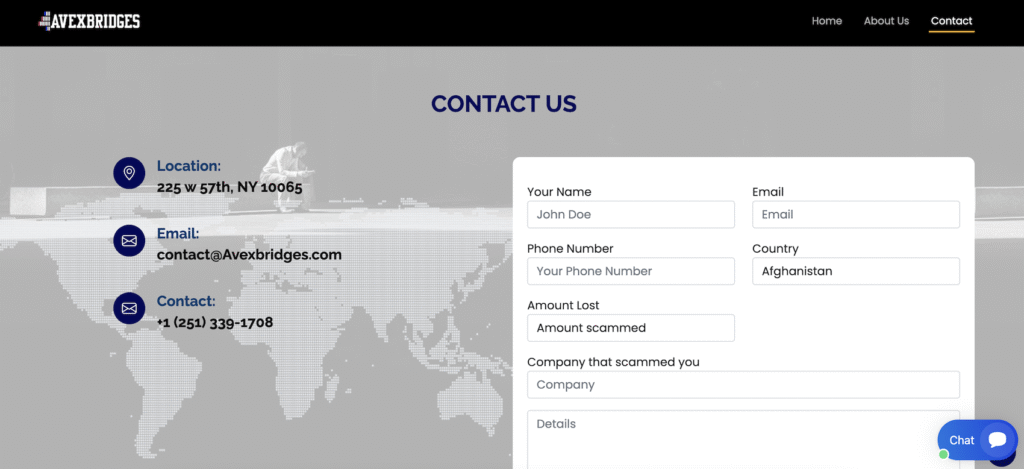

- Transparent contact details physical address, verifiable phone numbers, real-name representatives;

- Written risk disclosure outlining that recovery is uncertain and may fail, with no guarantee.

Absent these, engagement carries a high risk of disappointment, further loss, or even identity/fraud exposure.

Final Thoughts: Avexbridges Might Offer Hope — But It’s Probably Not Worth the Risk

We do not categorically declare every aspect of Avexbridges fraudulent. There is a slim possibility that they represent a legitimate though small-scale recovery outfit with some successes. However, the combination of unverified credentials, limited reviews, vague service description, and lack of transparent processes means that for most potential clients the risks likely outweigh the benefits.

For anyone weary with financial losses and searching for a recovery path, it may be wiser to consult licensed legal firms or established recovery agencies with a public track record rather than entrust hopes to an opaque entity like Avexbridges.